- Australia

- /

- Healthtech

- /

- ASX:CGS

Discovering Undiscovered Gems in Australia This December 2025

Reviewed by Simply Wall St

As the Australian market navigates through December, recent disruptions like the ASX announcements outage have highlighted some of the operational challenges facing investors, while fluctuations in sectors such as energy and materials reflect broader economic dynamics. In this environment, identifying promising small-cap stocks requires a keen eye for companies that can demonstrate resilience and growth potential amidst market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Cogstate (ASX:CGS)

Simply Wall St Value Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience solutions company focused on developing, validating, and commercializing digital brain health assessments globally with a market cap of A$418.76 million.

Operations: Cogstate generates revenue primarily from its Clinical Trials segment, which accounts for $50.58 million, while the Healthcare segment contributes $2.51 million.

Cogstate, a neuroscience tech firm known for digital brain health assessments, is carving out growth through its Medidata partnership and AI-driven products. This collaboration is set to broaden Cogstate's reach into new CNS indications and geographies, potentially boosting its contract pipeline. The company's earnings grew 86% last year, surpassing the Healthcare Services industry's 18.5%, with a P/E ratio of 27x below the industry average of 36.2x. Despite being debt-free now compared to a 16.4% debt-to-equity ratio five years ago, it faces challenges like regulatory hurdles and competitive pressures from larger digital health players.

GenusPlus Group (ASX:GNP)

Simply Wall St Value Rating: ★★★★★★

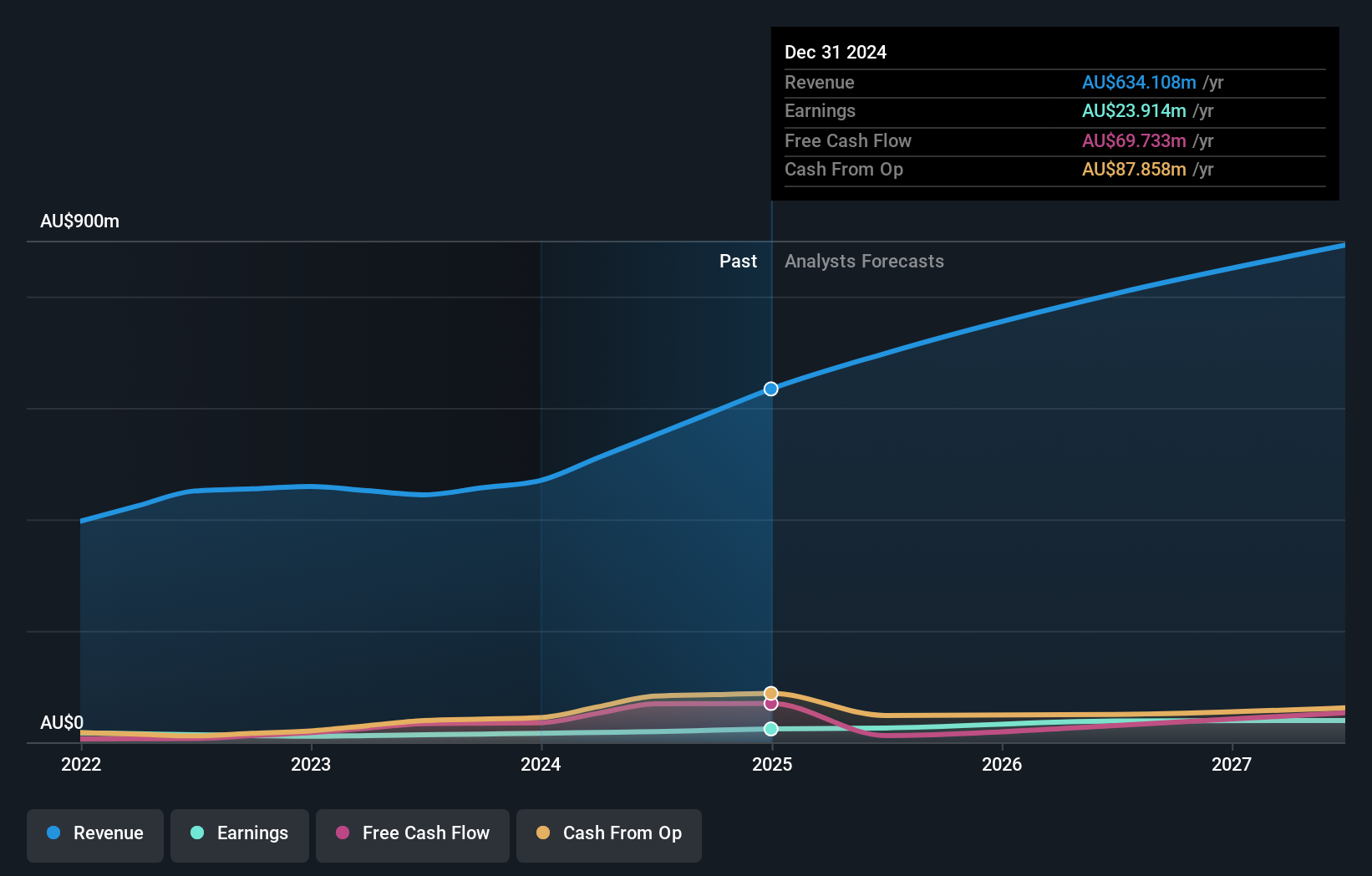

Overview: GenusPlus Group Ltd specializes in the installation, construction, and maintenance of power and communication systems in Australia with a market cap of A$1.15 billion.

Operations: GenusPlus Group Ltd generates revenue primarily from three segments: Infrastructure (A$405.10 million), Energy & Engineering (A$224.06 million), and Services (A$122.11 million).

GenusPlus Group, a nimble player in Australia's energy sector, is poised for growth with its strategic focus on renewable energy and grid upgrades. The company boasts a robust pipeline of diverse projects, reducing geographic risk while venturing into high-margin areas like battery storage systems. Over the past year, earnings surged by 83.6%, outpacing the construction industry's 6.5% growth rate. With more cash than total debt and positive free cash flow reaching A$69 million recently, GenusPlus seems financially sound. The recent addition of Tony Narvaez as a director brings valuable industry expertise to navigate future challenges and opportunities effectively.

Omni Bridgeway (ASX:OBL)

Simply Wall St Value Rating: ★★★★★☆

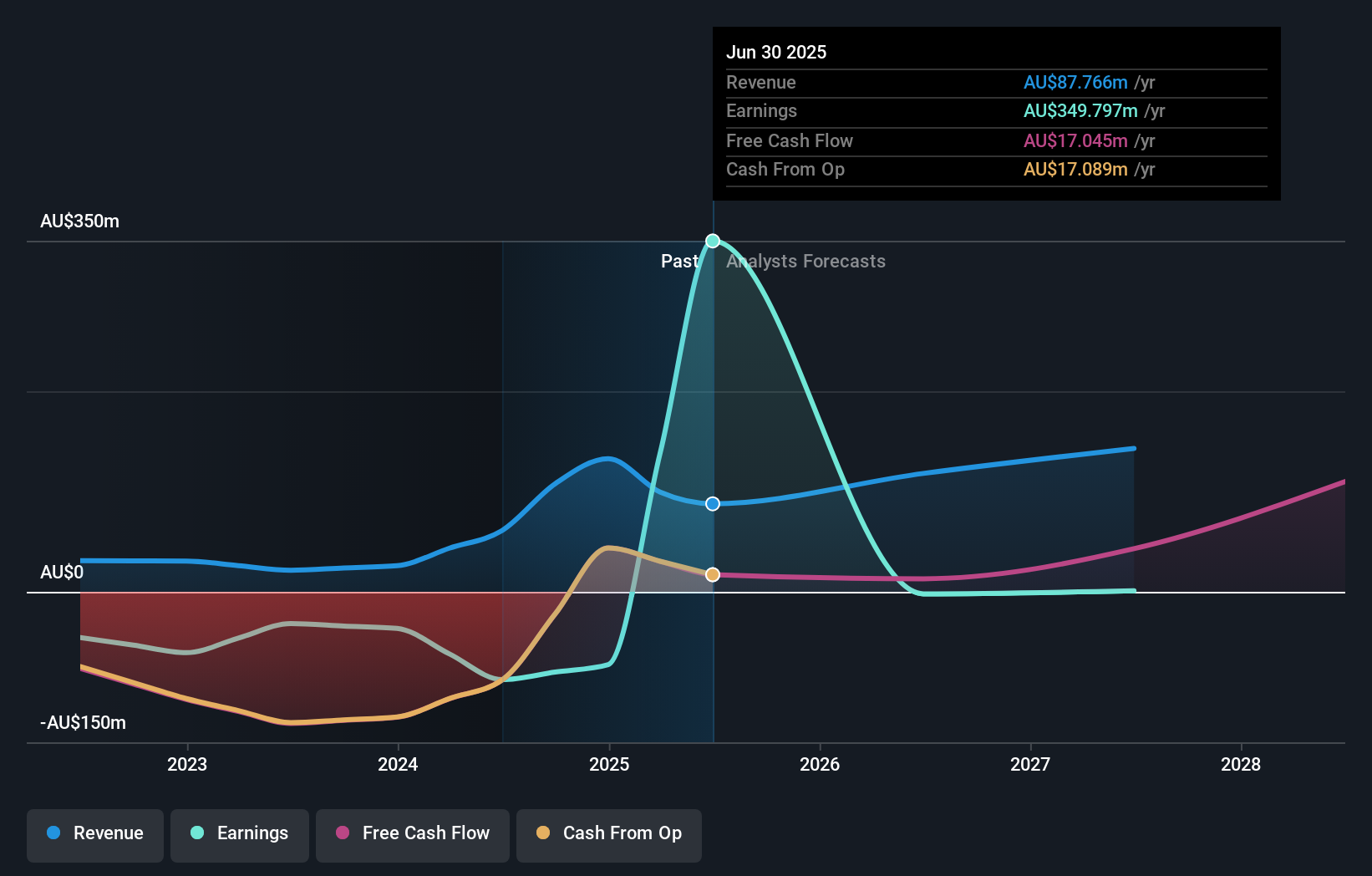

Overview: Omni Bridgeway Limited, along with its subsidiaries, offers dispute and litigation finance services across multiple regions including Australia, the United States, Canada, Latin America, Asia, New Zealand, Europe, the Middle East, and Africa with a market capitalization of A$451.20 million.

Operations: Omni Bridgeway generates revenue primarily from funding and providing services related to legal dispute resolution, amounting to A$87.77 million.

Omni Bridgeway, a notable player in the financial litigation space, has recently turned profitable, boasting a debt to equity ratio reduction from 18.7% to 2.3% over five years. Its price-to-earnings ratio stands at an attractive 1.3x compared to the Australian market's 22x, indicating potential value for investors. Despite earnings forecasted to decline by an average of 148% annually over the next three years, revenue is expected to grow by approximately 24%. The company enjoys high-quality non-cash earnings and more cash than total debt, suggesting financial stability amidst industry challenges.

- Click here to discover the nuances of Omni Bridgeway with our detailed analytical health report.

Gain insights into Omni Bridgeway's historical performance by reviewing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 57 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGS

Cogstate

A neuroscience solutions company, engages in the creation, validation, and commercialization of digital brain health assessments worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026