- Australia

- /

- Capital Markets

- /

- ASX:MQG

What Macquarie Group (ASX:MQG)'s Rising Half-Year Profits and Net Interest Income Mean For Shareholders

Reviewed by Sasha Jovanovic

- On November 6, 2025, Macquarie Group Limited announced half-year results for the period ended September 30, reporting net interest income of A$2.07 billion and net income of A$1.66 billion, both increases from the previous year.

- Additionally, the company’s basic and diluted earnings per share from continuing operations rose year-over-year, signaling some improvement in profitability for shareholders.

- We’ll explore how Macquarie’s growth in net interest income shapes the current investment narrative and forward-looking analyst expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Macquarie Group Investment Narrative Recap

To be a Macquarie Group shareholder today, you need to believe in the company’s ability to generate steady earnings growth despite a complex competitive environment and fluctuating market conditions. The latest earnings announcement confirms a year-over-year increase in both net interest income and net income, but this improvement is not enough to fully offset concerns over margin pressure in the Banking and Financial Services segment, which remains the most important short-term catalyst and risk for the business.

Among recent developments, the proposed sale of Macquarie’s $2.5 billion Paraway Pastoral Company stands out, highlighting the company’s ongoing portfolio reshaping. This move is aligned with efforts to strengthen core business segments, which could influence both future earnings resilience and the balance between growth and risk in the near term.

Yet, against this backdrop, investors should also consider how increased margin pressure from competition in financial services might play out if...

Read the full narrative on Macquarie Group (it's free!)

Macquarie Group is projected to reach A$20.2 billion in revenue and A$4.9 billion in earnings by 2028. This outlook assumes annual revenue growth of 5.3% and an increase in earnings of A$1.3 billion from the current level of A$3.6 billion.

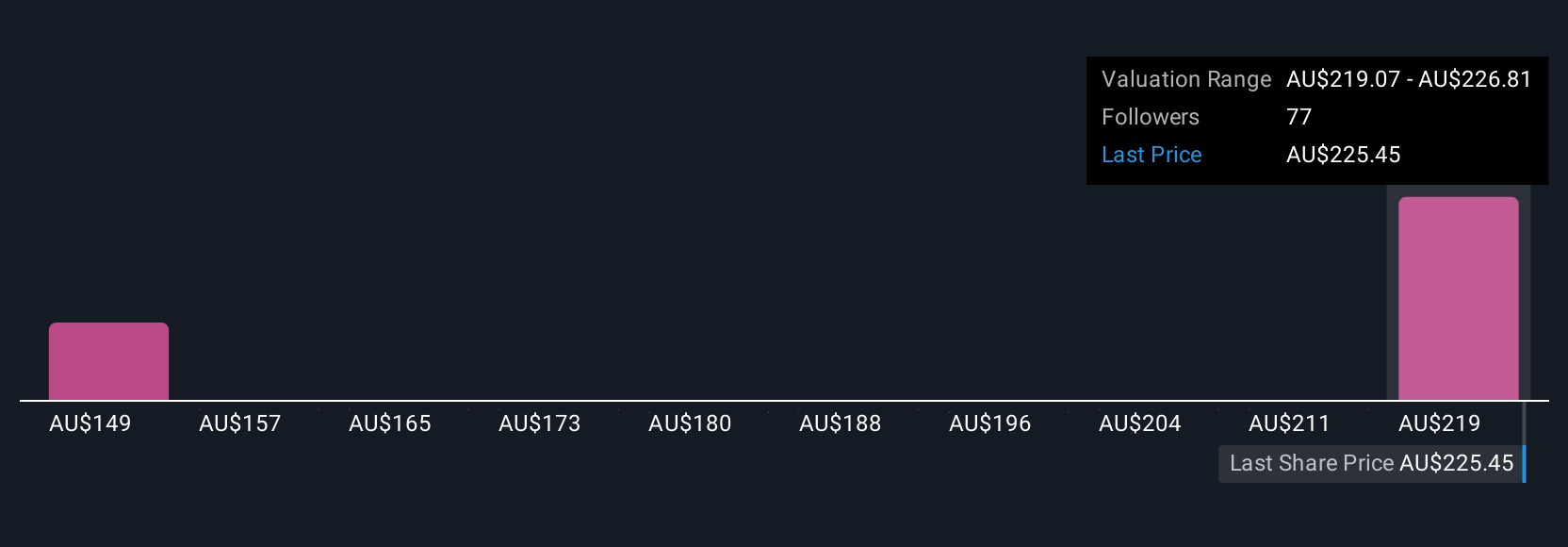

Uncover how Macquarie Group's forecasts yield a A$223.80 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 8 different fair value estimates for Macquarie, ranging from A$143.93 to A$223.80. With market participants split, ongoing margin pressure in core banking remains a key influence on future results, underscoring the importance of examining diverse viewpoints.

Explore 8 other fair value estimates on Macquarie Group - why the stock might be worth 34% less than the current price!

Build Your Own Macquarie Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macquarie Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macquarie Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macquarie Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives