- Australia

- /

- Capital Markets

- /

- ASX:MFF

Is MFF Capital Investments’ (ASX:MFF) Rising NTA a Testament to Its Long-Term Investment Discipline?

Reviewed by Sasha Jovanovic

- MFF Capital Investments Limited recently reported an increase in its weekly Net Tangible Assets (NTA) per share to A$5.297 as of November 7, 2025 and announced a change of address for its registered office and principal administrative office in Sydney.

- This NTA update highlights the company's focus on maintaining a stable financial position with a measured net cash allocation, reflecting its ongoing commitment to long-term capital growth.

- We’ll look at how the firm’s stronger NTA underscores MFF Capital’s core investment story and signals management discipline for investors.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is MFF Capital Investments' Investment Narrative?

To be a shareholder in MFF Capital Investments, the core belief is in disciplined global portfolio management with an emphasis on long-term, tangible capital growth, an approach supported by a rising NTA per share and prudent cash positioning. The latest NTA increase, alongside a stable net cash allocation of 7.7%, reinforces management’s commitment to financial stability and investment flexibility, rather than offering a short-term catalyst. The address change is neutral for the business and does not affect near-term operations or major risks; investor focus instead will likely remain on leadership changes and board renewal, given a largely seasoned but relatively static board. Earnings and revenue dipped recently, which may amplify concerns around management transition and whether recent executive appointments will translate to improved growth. The main risk continues to be execution by a newly tenured management team. However, board renewal, and how quickly management’s experience translates to growth, is something investors should watch closely.

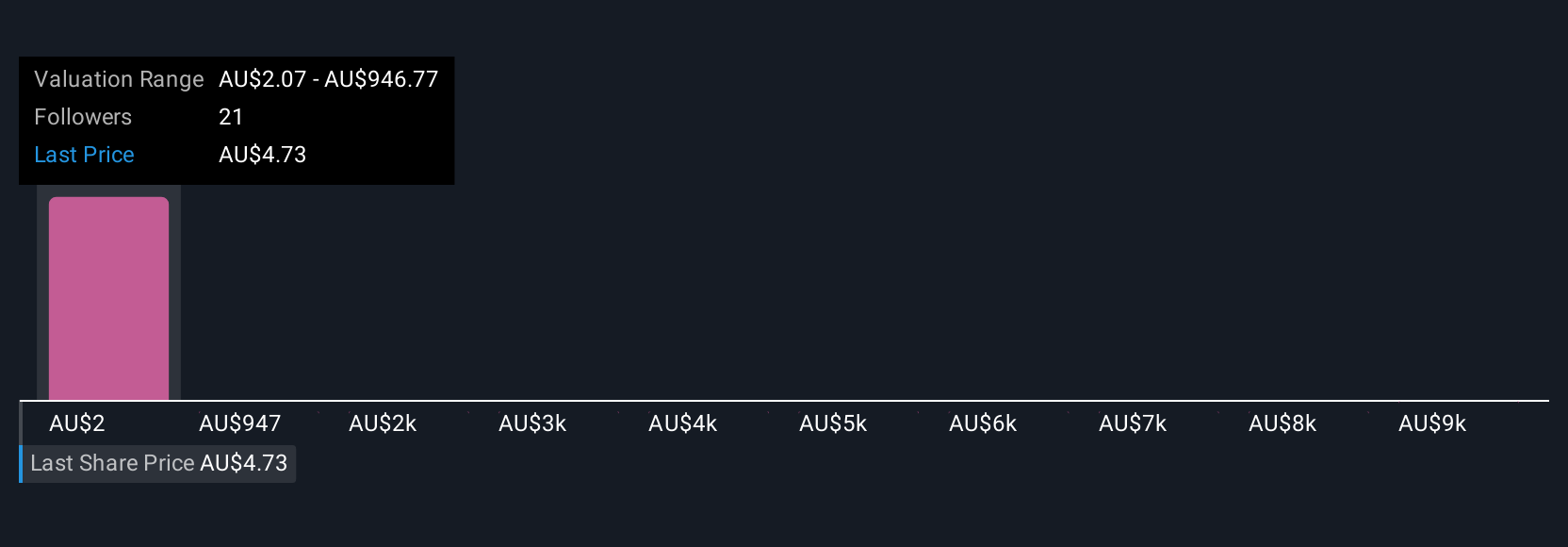

MFF Capital Investments' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 9 other fair value estimates on MFF Capital Investments - why the stock might be a potential multi-bagger!

Build Your Own MFF Capital Investments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MFF Capital Investments research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free MFF Capital Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MFF Capital Investments' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives