- Singapore

- /

- Consumer Finance

- /

- SGX:T6I

Insider Action On Undervalued Asian Small Caps For April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China continue to escalate, impacting global markets, Asian small-cap stocks have been navigating a complex environment marked by volatility and cautious investor sentiment. Despite these challenges, opportunities may arise for discerning investors who focus on companies with strong fundamentals and potential for growth in this dynamic region.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.6x | 1.1x | 40.77% | ★★★★★★ |

| New Hope | 5.5x | 1.6x | 48.98% | ★★★★★☆ |

| Atturra | 26.4x | 1.1x | 42.17% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 41.56% | ★★★★★☆ |

| Dicker Data | 19.0x | 0.7x | -35.59% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 41.49% | ★★★★☆☆ |

| PWR Holdings | 36.3x | 5.0x | 21.25% | ★★★☆☆☆ |

| Hansen Technologies | 298.5x | 2.9x | 22.20% | ★★★☆☆☆ |

| WAM Strategic Value | 9.2x | 5.3x | 1.71% | ★★★☆☆☆ |

| Integral Diagnostics | 147.7x | 1.7x | 44.24% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

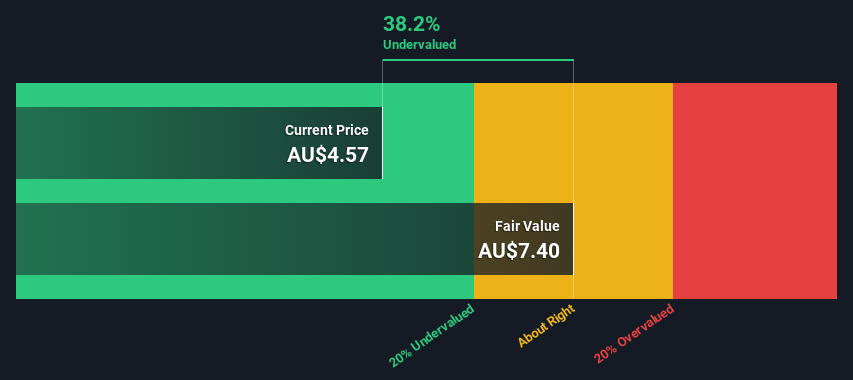

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMC Capital is a company engaged in real estate operations, with a market cap of A$1.58 billion.

Operations: The company's revenue primarily stems from real estate activities, with a significant portion of its income influenced by segment adjustments. Over time, the gross profit margin has reached 100%, indicating that revenue equals gross profit due to the absence of reported cost of goods sold (COGS). Operating expenses have consistently increased, reflecting a focus on managing non-operating expenses effectively. The net income margin has shown significant improvement, reaching 112.27% in recent periods.

PE: 8.9x

HMC Capital, a small company in Asia, is drawing attention due to its interest in acquiring Healthscope Limited, aiming to protect rents for its HealthCo REIT. Despite higher-risk funding from external borrowing, the company reported significant earnings growth with net income reaching A$166.9 million for the half-year ended December 2024. Insider confidence is evident from recent share purchases within the last year. The company's revenue is forecasted to grow annually by 12.29%, suggesting potential future opportunities despite current challenges.

- Delve into the full analysis valuation report here for a deeper understanding of HMC Capital.

Understand HMC Capital's track record by examining our Past report.

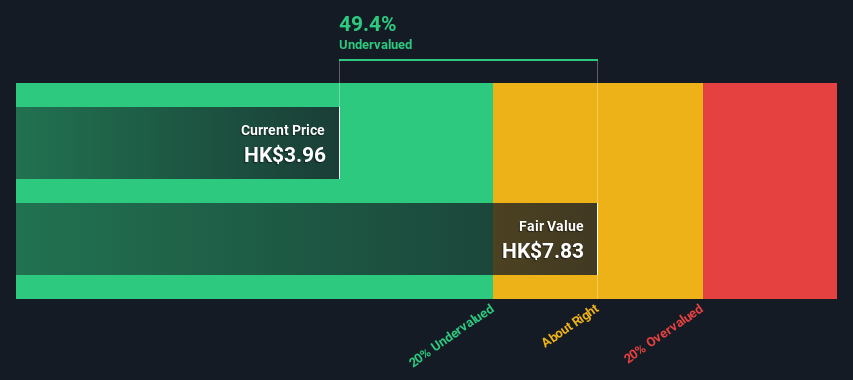

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★★★☆

Overview: China XLX Fertiliser is a company engaged in the production and sale of chemical fertilizers and related products, with a focus on urea, methanol, and compound fertilizers, holding a market capitalization of CN¥7.57 billion.

Operations: The company's revenue streams are primarily driven by Urea, Compound Fertiliser, and Methanol. Gross profit margin reached a peak of 24.49% in mid-2021 but experienced fluctuations, settling at 16.99% by the end of 2024. Operating expenses consistently impact profitability with significant contributions from sales and marketing as well as general and administrative expenses.

PE: 3.8x

China XLX Fertiliser, a smaller player in the Asian market, recently announced a final dividend of RMB 0.26 per share for 2024. Despite sales dipping slightly to CNY 23.1 billion from CNY 23.5 billion, net income rose to CNY 1.46 billion from CNY 1.19 billion, indicating improved profitability with basic earnings per share increasing to CNY 1.20 from CNY 0.97 year-on-year. Insider confidence is evident as Qingjin Zhang purchased an additional 270,000 shares in March for approximately US$1 million, reflecting potential optimism about future growth despite high debt levels and reliance on external borrowing for funding.

- Click to explore a detailed breakdown of our findings in China XLX Fertiliser's valuation report.

Explore historical data to track China XLX Fertiliser's performance over time in our Past section.

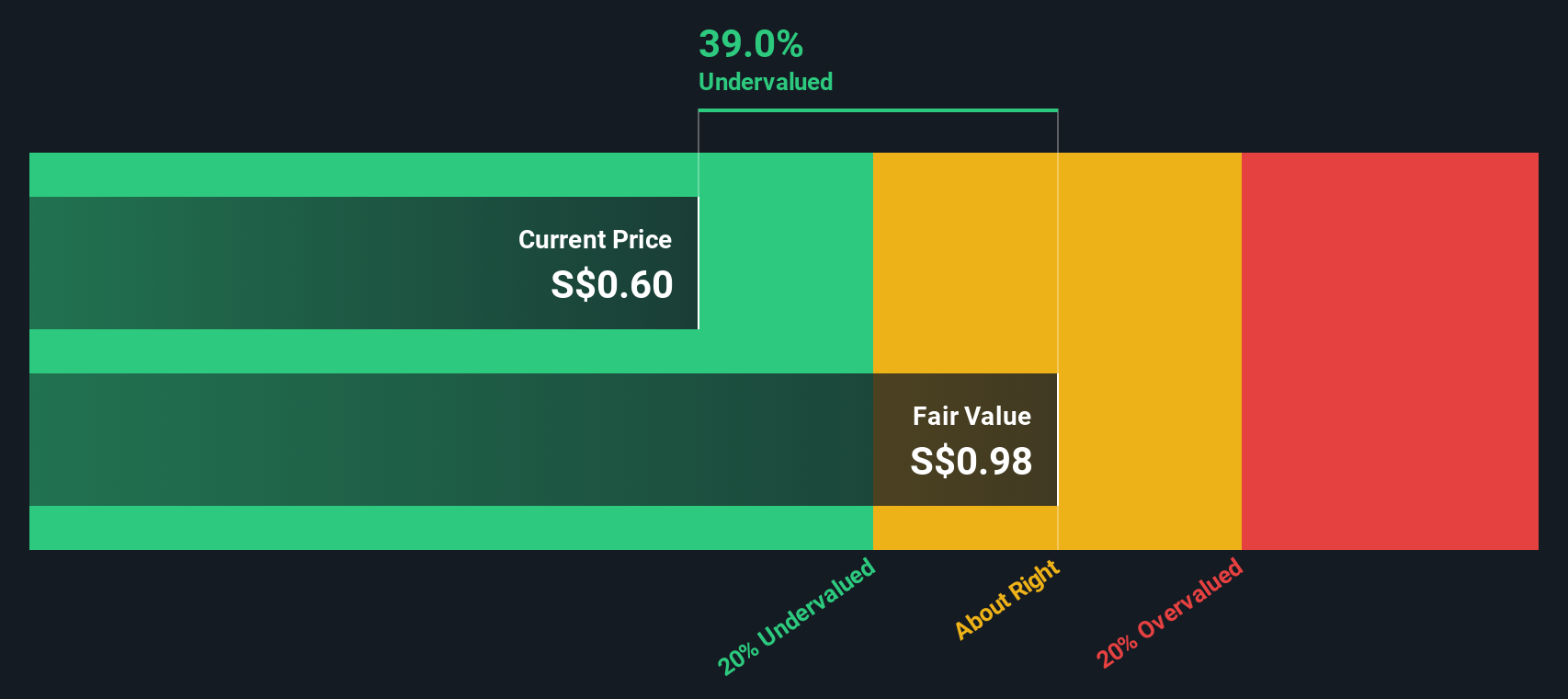

ValueMax Group (SGX:T6I)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ValueMax Group operates in pawnbroking, moneylending, and the retail and trading of jewellery and gold, with a market capitalization of approximately SGD 0.48 billion.

Operations: The company generates revenue primarily from retail and trading of jewellery and gold, alongside pawnbroking and moneylending services. The gross profit margin has shown a notable trend, increasing from 6.65% in mid-2014 to 28.45% by the end of 2024. Operating expenses have been a consistent component of the cost structure, with general and administrative expenses being significant contributors.

PE: 5.5x

ValueMax Group, a small company in Asia, shows potential as an undervalued investment. Despite relying on external borrowing, their financial position is stable with operating cash flow covering debt. Recent earnings indicate growth with sales reaching S$456 million and net income at S$82.83 million for 2024, up from the previous year. Insider confidence is evident as they increased their holdings over the past six months. The announced dividend of S$0.0268 per share further highlights shareholder value focus amidst rising earnings per share figures.

- Dive into the specifics of ValueMax Group here with our thorough valuation report.

Gain insights into ValueMax Group's past trends and performance with our Past report.

Next Steps

- Click this link to deep-dive into the 65 companies within our Undervalued Asian Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:T6I

ValueMax Group

An investment holding company, engages in the pawnbroking, moneylending, jewelry and watches retailing, and gold trading businesses primarily in Singapore.

Solid track record, good value and pays a dividend.

Market Insights

Community Narratives