- Australia

- /

- Capital Markets

- /

- ASX:EQT

Exploring 3 Australian Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As the Australian market navigates a mixed landscape, with the XJO starting strong yet still trailing its recent highs, investors are closely watching sectors like materials and real estate for signs of momentum. In this dynamic environment, identifying undiscovered gems involves looking for companies that can capitalize on sectoral shifts and emerging trends, offering potential growth opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Rand Mining | NA | 10.19% | 2.74% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

EQT Holdings (ASX:EQT)

Simply Wall St Value Rating: ★★★★★☆

Overview: EQT Holdings Limited, with a market cap of A$706.78 million, operates in Australia offering philanthropic, trustee, and investment services through its subsidiaries.

Operations: EQT Holdings generates revenue primarily from its Trustee & Wealth Services segment, contributing A$102.18 million, and Corporate & Superannuation Trustee Services, adding A$79.99 million.

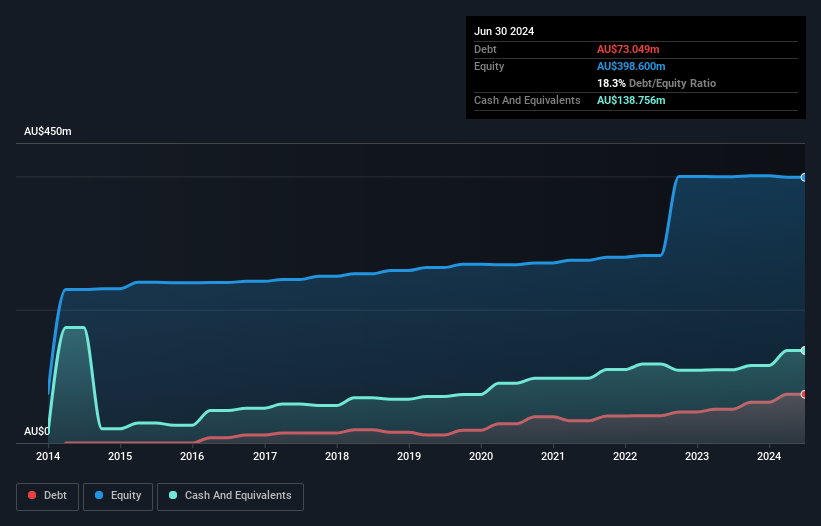

EQT Holdings, a nimble player in the Australian financial services sector, is making waves with its impressive 19.7% earnings growth over the past year, outpacing the industry's 5.9%. With more cash than total debt and a robust EBIT covering interest payments by 10.8 times, EQT's financial health appears sound. The company’s price-to-earnings ratio of 20.6x is attractive compared to the industry average of 22.7x, indicating potential value for investors. However, recent regulatory inquiries and increased debt levels from 10.8% to 20.5% over five years could pose challenges despite promising prospects in digital transformation and corporate trustee demand driving efficiency gains.

Fiducian Group (ASX:FID)

Simply Wall St Value Rating: ★★★★★★

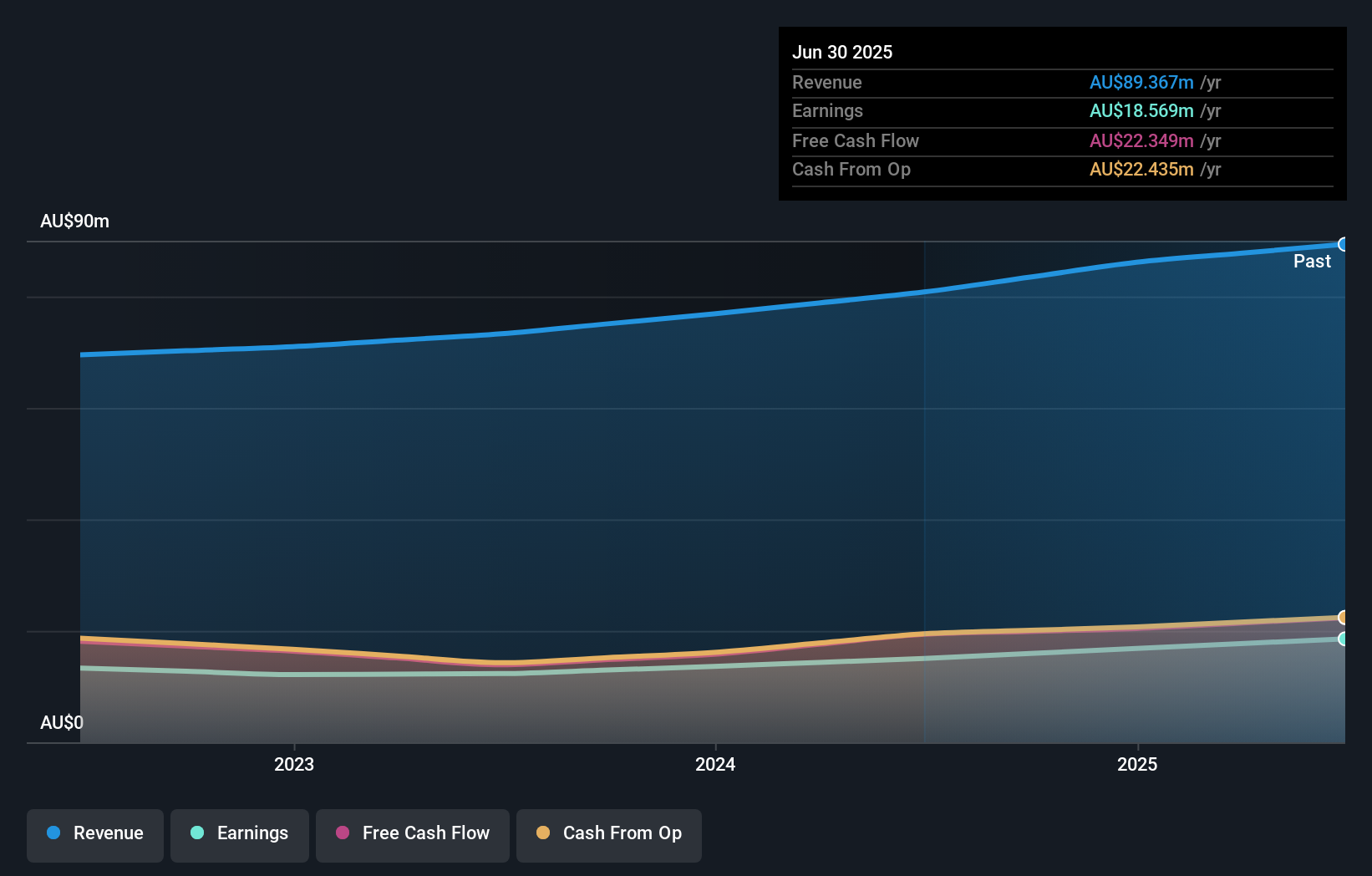

Overview: Fiducian Group Ltd operates in the financial services sector in Australia, with a market capitalization of A$407.22 million.

Operations: Fiducian Group Ltd generates revenue primarily from four segments: Financial Planning (A$29.66 million), Funds Management (A$25.59 million), Corporate Services (A$17.67 million), and Platform Administration (A$16.45 million). The company's net profit margin is a key indicator of its financial efficiency, reflecting the proportion of revenue that translates into profit after all expenses are accounted for.

Fiducian Group, a nimble player in the financial sector, showcases impressive earnings growth of 23.5% over the past year, outpacing its industry peers. The company boasts high-quality earnings and remains debt-free for five years, highlighting prudent financial management. Its price-to-earnings ratio of 21.9x is lower than the industry average of 22.7x, suggesting potential value for investors. Recent announcements include a fully franked dividend increase to A$0.247 per share and net income rising to A$18.57 million from A$15.04 million last year, reflecting robust operational performance and shareholder-friendly policies with consistent dividends.

- Take a closer look at Fiducian Group's potential here in our health report.

Review our historical performance report to gain insights into Fiducian Group's's past performance.

Peet (ASX:PPC)

Simply Wall St Value Rating: ★★★★☆☆

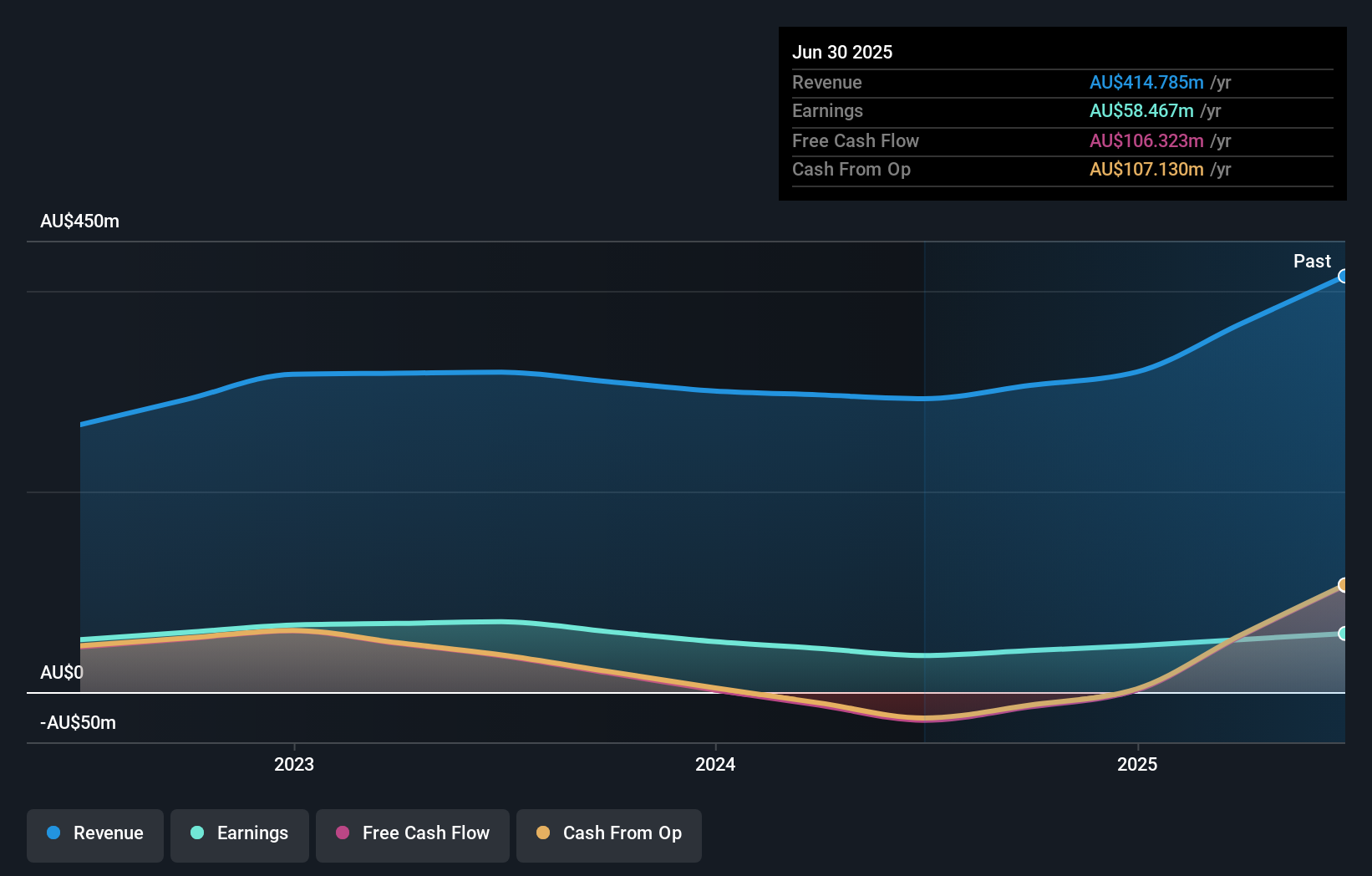

Overview: Peet Limited is an Australian company that focuses on acquiring, developing, and marketing residential land, with a market capitalization of A$842.69 million.

Operations: Peet generates revenue primarily from Company Owned Projects (A$313.24 million), with additional contributions from Funds Management (A$56.39 million) and Joint Arrangements (A$51.88 million).

Peet, a noteworthy player in the Australian real estate sector, has demonstrated robust financial performance with earnings surging by 60% over the past year. This growth outpaces the industry average of 40.9%, reflecting Peet's strategic prowess and market positioning. The company is trading at an attractive valuation, estimated to be 84.5% below its fair value, making it a potential opportunity for investors seeking undervalued assets. Despite a high net debt to equity ratio of 45.8%, Peet's interest payments are well covered by EBIT at 10.7 times coverage, indicating sound financial management amidst ongoing strategic evaluations led by Goldman Sachs to optimize future growth prospects.

- Dive into the specifics of Peet here with our thorough health report.

Understand Peet's track record by examining our Past report.

Make It Happen

- Dive into all 52 of the ASX Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EQT

EQT Holdings

Provides philanthropic, trustee, and investment services in Australia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026