- Australia

- /

- Capital Markets

- /

- ASX:BFG

Undiscovered Gems With Strong Potential In Australia August 2025

Reviewed by Simply Wall St

As the Australian market reaches new heights with the ASX200 hitting an all-time intra-day high of 8,827 points, investors are keenly observing sectors like Materials and Energy which have shown robust performance. In this dynamic environment, identifying undiscovered gems requires a focus on small-cap stocks that demonstrate resilience and potential for growth amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Bell Financial Group (ASX:BFG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to a diverse clientele across Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur with a market capitalization of A$410.55 million.

Operations: Bell Financial Group generates revenue primarily from broking (A$173.47 million), followed by products & services (A$51.01 million) and technology & platforms (A$29.89 million). The company's net profit margin reflects its financial efficiency in converting revenue into profit after accounting for costs and expenses.

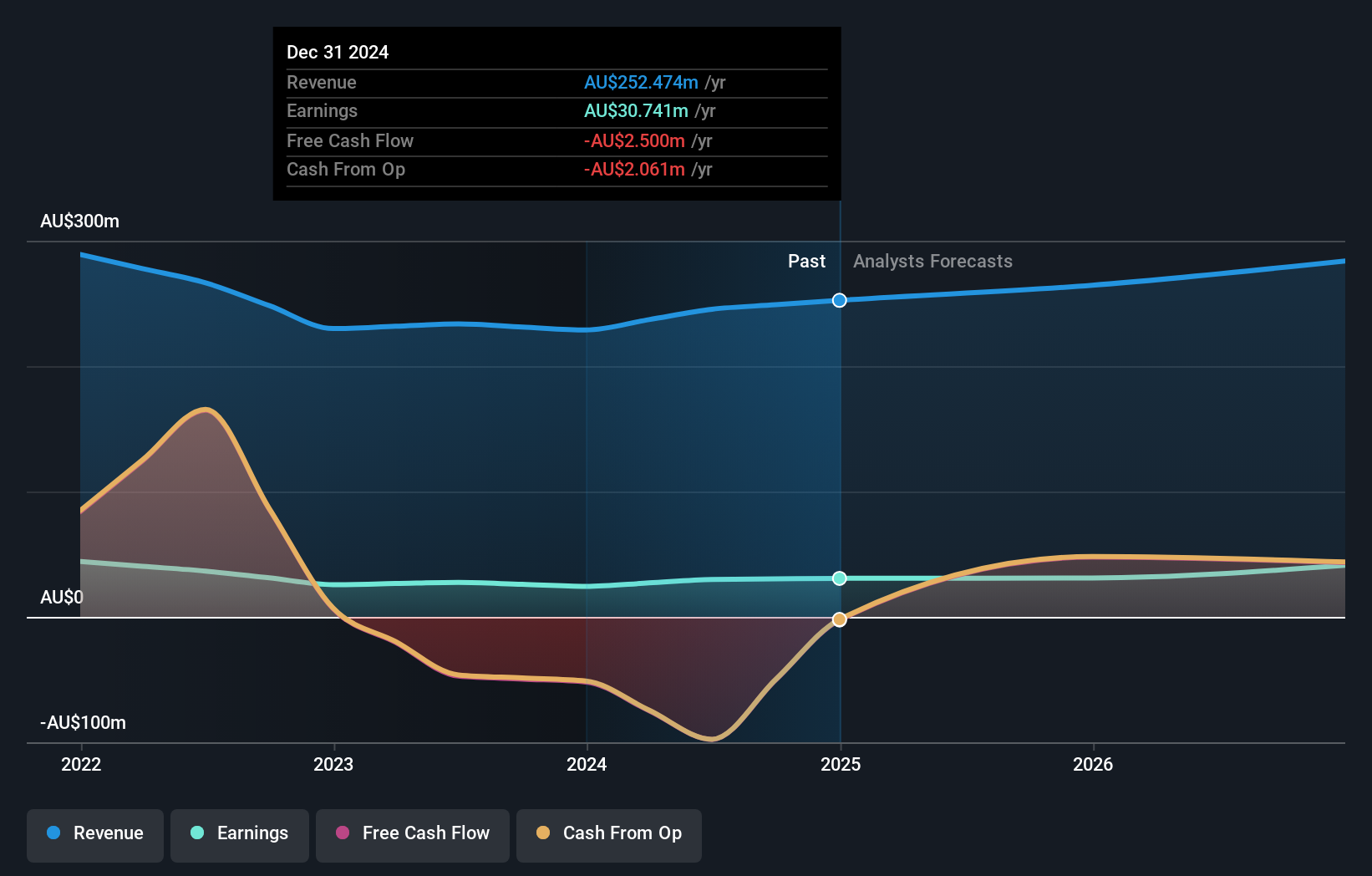

Bell Financial Group, a nimble player in Australia's financial sector, showcases promising aspects with its earnings growing by 26% over the past year, surpassing the Capital Markets industry growth of 23%. The company trades at a value 10.7% below its estimated fair value and has successfully reduced its debt to equity ratio from 83.9% to 17.7% over five years. Despite not being free cash flow positive recently, BFG's high level of non-cash earnings indicates robust underlying operations. With Nick Hamilton stepping in as CFO, bringing extensive experience from McMillan Shakespeare and Credit Suisse, strategic leadership appears well-positioned for future growth.

- Dive into the specifics of Bell Financial Group here with our thorough health report.

Assess Bell Financial Group's past performance with our detailed historical performance reports.

Helia Group (ASX:HLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Helia Group Limited, along with its subsidiaries, operates in the loan mortgage insurance sector primarily in Australia, with a market capitalization of approximately A$1.40 billion.

Operations: Helia Group generates revenue primarily from its loan mortgage insurance business, amounting to A$504.73 million.

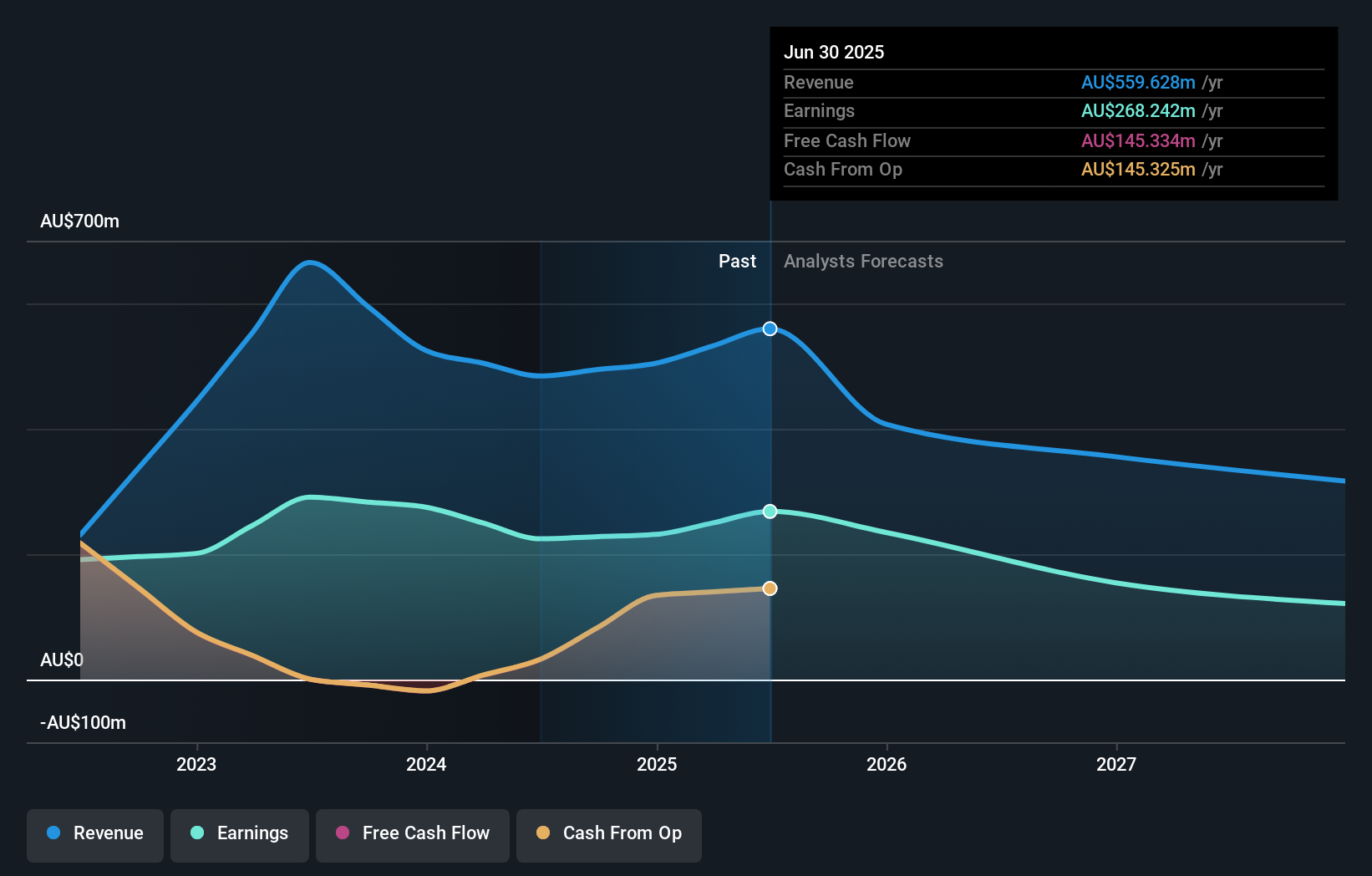

Helia Group, a notable entity in Australia's loan mortgage insurance scene, is navigating through potential headwinds. Analysts highlight challenges from government schemes like the Home Guarantee Scheme and lender self-insurance that could cap growth in gross written premiums. With unemployment potentially increasing claims, net profit margins might shrink from 45.9% to 33.9%. Despite these hurdles, Helia's strong financial footing and high customer satisfaction are noteworthy positives. The company trades at A$5.04 per share but with an analyst target of A$3.52, reflecting caution over projected earnings decline to A$103 million by July 2028 from today's A$231 million.

Metals X (ASX:MLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of A$531.83 million.

Operations: Metals X Limited generates revenue primarily from its 50% stake in the Renison Tin Operation, which contributed A$218.82 million.

Metals X, a smaller player in the Australian mining sector, has shown impressive earnings growth of 601.7% over the past year, significantly outpacing the industry's 14.3%. This surge was partly due to a one-off gain of A$20.2M in its recent financials. The company trades at 7.8% below its estimated fair value and has effectively reduced its debt-to-equity ratio from 47.7% to just 0.1% over five years, highlighting strong financial management. While earnings are expected to decline by an average of 27.1% annually for the next three years, Metals X remains profitable with positive free cash flow and sufficient interest coverage.

- Click here to discover the nuances of Metals X with our detailed analytical health report.

Examine Metals X's past performance report to understand how it has performed in the past.

Where To Now?

- Delve into our full catalog of 49 ASX Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BFG

Bell Financial Group

Engages in the provision of full-service broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients in Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives