- Australia

- /

- Capital Markets

- /

- ASX:ASX

Did RBA Rate Cut Hopes and Market Surge Just Shift ASX's (ASX:ASX) Investment Narrative?

Reviewed by Simply Wall St

- The Australian sharemarket recently reached a record high, fueled by expectations of an interest rate cut from the Reserve Bank of Australia after a rise in unemployment, with gains led by major banks, property, and technology stocks.

- This investor optimism around potential monetary policy easing has highlighted the sensitivity of rate-driven sectors, drawing renewed attention to the outlook for capital markets operators like ASX.

- We’ll look at how expectations of RBA rate cuts and this surge in rate-sensitive stocks could influence ASX’s investment narrative.

ASX Investment Narrative Recap

To be a shareholder in ASX, you need confidence in its position as Australia’s primary market operator and its ability to benefit from trading volume growth, technology upgrades, and capital market innovation. The recent surge in rate-sensitive stocks, following anticipation of an RBA interest rate cut, may increase short-term trading activity, but it is unlikely to materially change the largest near-term catalyst: the rollout and performance of ASX’s ongoing technology modernization programs. The primary risk remains ongoing regulatory scrutiny, especially regarding pricing policy and compliance.

Among recent announcements, ASX’s disclosure of a new ASIC compliance assessment directly relates to the focus on governance and risk management that investors are watching, particularly as regulatory changes and oversight remain a key source of uncertainty. While this assessment does not alter immediate growth drivers from trading volume boosts, it keeps attention fixed on the potential for further compliance costs or structural reforms, which could affect future profitability or flexibility.

However, investors should also weigh that while optimism is high with rate-driven trading rebounds, the unresolved ASIC investigation means...

Read the full narrative on ASX (it's free!)

ASX's narrative projects A$1.2 billion revenue and A$541.3 million earnings by 2028. This requires a 9.3% yearly revenue decline and an earnings increase of A$54.1 million from A$487.2 million today.

Uncover how ASX's forecasts yield a A$69.40 fair value, a 4% downside to its current price.

Exploring Other Perspectives

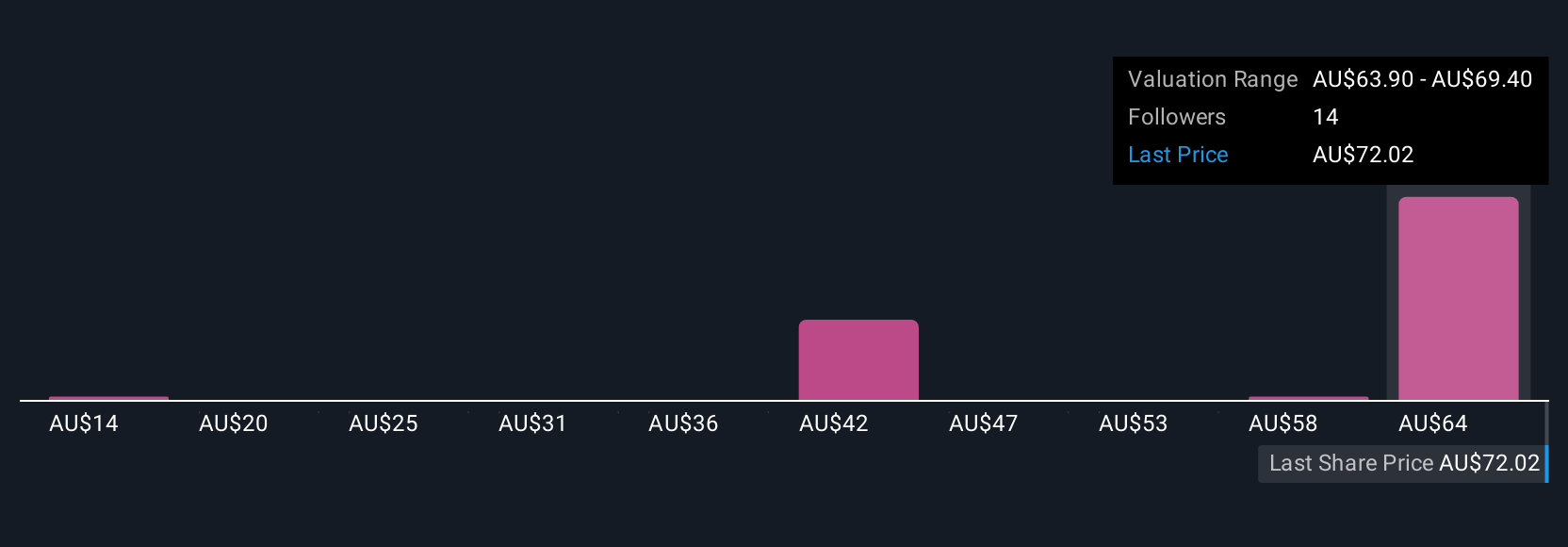

Simply Wall St Community members value ASX between A$14.48 and A$69.40, based on four individual forecasts. With short-term trading volumes in focus, regulatory reviews continue to shape the bigger picture for ASX’s future flexibility. Check out how your outlook compares with other investors’ views.

Build Your Own ASX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASX research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free ASX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASX

ASX

Operates as a multi-asset class and integrated exchange company in Australia and internationally.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives