- Australia

- /

- Hospitality

- /

- ASX:WEB

After Leaping 25% Web Travel Group Limited (ASX:WEB) Shares Are Not Flying Under The Radar

Web Travel Group Limited (ASX:WEB) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.5% isn't as impressive.

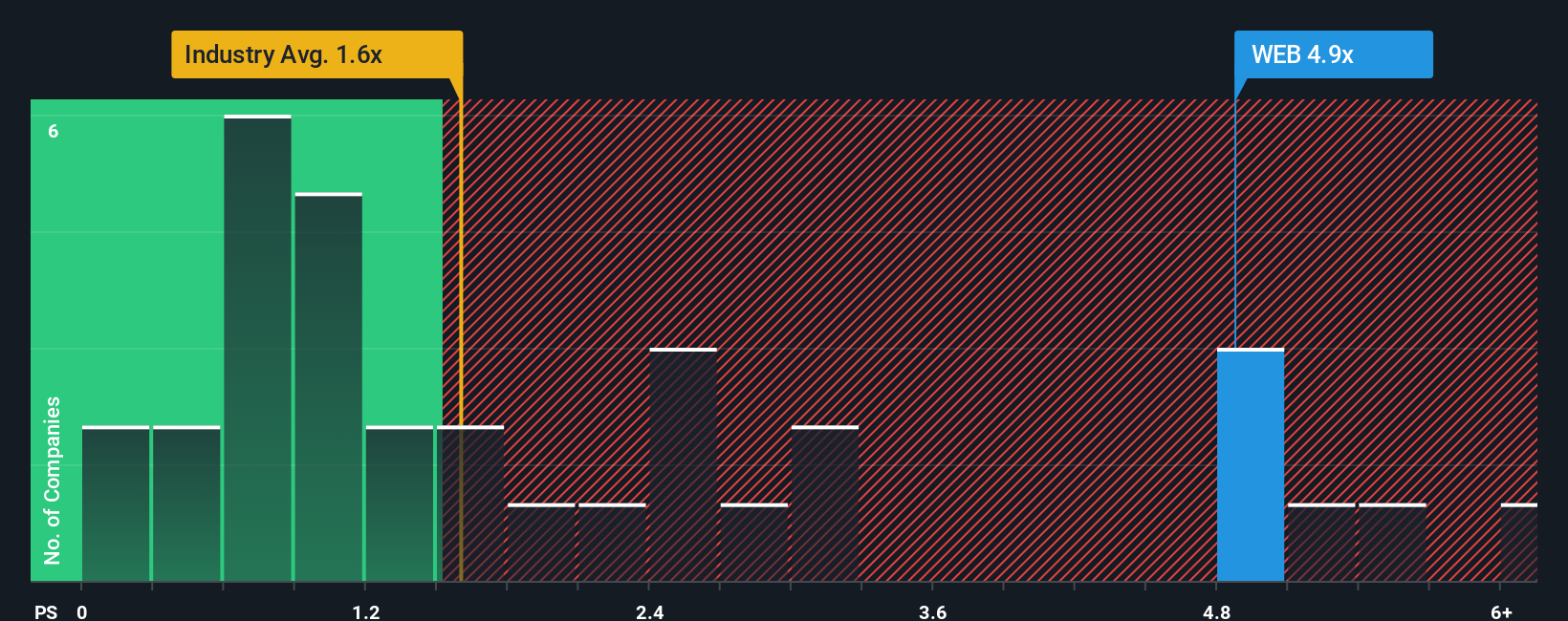

After such a large jump in price, you could be forgiven for thinking Web Travel Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.9x, considering almost half the companies in Australia's Hospitality industry have P/S ratios below 1.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Web Travel Group

How Has Web Travel Group Performed Recently?

Recent times have been pleasing for Web Travel Group as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Web Travel Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Web Travel Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an excellent 40% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 14% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.5% per year, which is noticeably less attractive.

In light of this, it's understandable that Web Travel Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Web Travel Group's P/S Mean For Investors?

The strong share price surge has lead to Web Travel Group's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Web Travel Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Web Travel Group you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, the United Arab Emirates, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026