Stock Analysis

- Australia

- /

- Hospitality

- /

- ASX:RFG

Cettire And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.5%, yet it remains up by 19% over the past year, with earnings expected to grow by 12% annually in coming years. In such a dynamic market, identifying stocks with strong financials and growth potential is crucial for investors seeking value. While penny stocks might seem like a term from another era, they still represent opportunities in smaller or newer companies that could offer significant returns when chosen wisely.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$833.14M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$857.79 million.

Operations: The company generates revenue primarily from online retail sales, amounting to A$742.26 million.

Market Cap: A$857.79M

Cettire Limited, with a market cap of A$857.79 million, is an online luxury goods retailer showing potential despite recent challenges. The company reported A$742.26 million in sales for the year ending June 2024, but net income decreased to A$10.47 million from A$15.97 million the previous year, indicating pressure on profit margins which fell from 3.8% to 1.4%. Despite this, Cettire remains debt-free and has strong short-term asset coverage over liabilities. Recent board changes include the appointment of Caroline Elliott as an Independent Non-Executive Director, potentially enhancing governance and strategic direction amidst forecasted revenue growth of 20% year-on-year for early fiscal 2025.

- Navigate through the intricacies of Cettire with our comprehensive balance sheet health report here.

- Evaluate Cettire's prospects by accessing our earnings growth report.

LaserBond (ASX:LBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LaserBond Limited is a surface engineering company in Australia that focuses on improving the performance and durability of machinery components, with a market cap of A$66.82 million.

Operations: The company's revenue is derived from three main segments: Products (A$16.55 million), Services (A$23.39 million), and Technology (A$2.05 million).

Market Cap: A$66.82M

LaserBond Limited, with a market cap of A$66.82 million, operates in surface engineering and has shown mixed financial performance. The company reported A$41.98 million in sales for the year ending June 2024, though net income decreased to A$3.52 million from A$4.76 million previously, reflecting a decline in profit margins from 12.3% to 8.4%. Despite this setback, LaserBond maintains a debt-free status and covers both short- and long-term liabilities with its assets totaling A$22.2M against liabilities of A$22.2M combined, suggesting financial stability amidst shareholder dilution over the past year by 6.3%.

- Dive into the specifics of LaserBond here with our thorough balance sheet health report.

- Understand LaserBond's earnings outlook by examining our growth report.

Retail Food Group (ASX:RFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Retail Food Group Limited is a food and beverage company that manages a multi-brand retail food and beverage franchise in Australia and internationally, with a market cap of A$166.97 million.

Operations: The company's revenue is primarily derived from its Café, Coffee & Bakery segment, which generated A$114.68 million, and its QSR Systems segment, contributing A$17.31 million.

Market Cap: A$166.97M

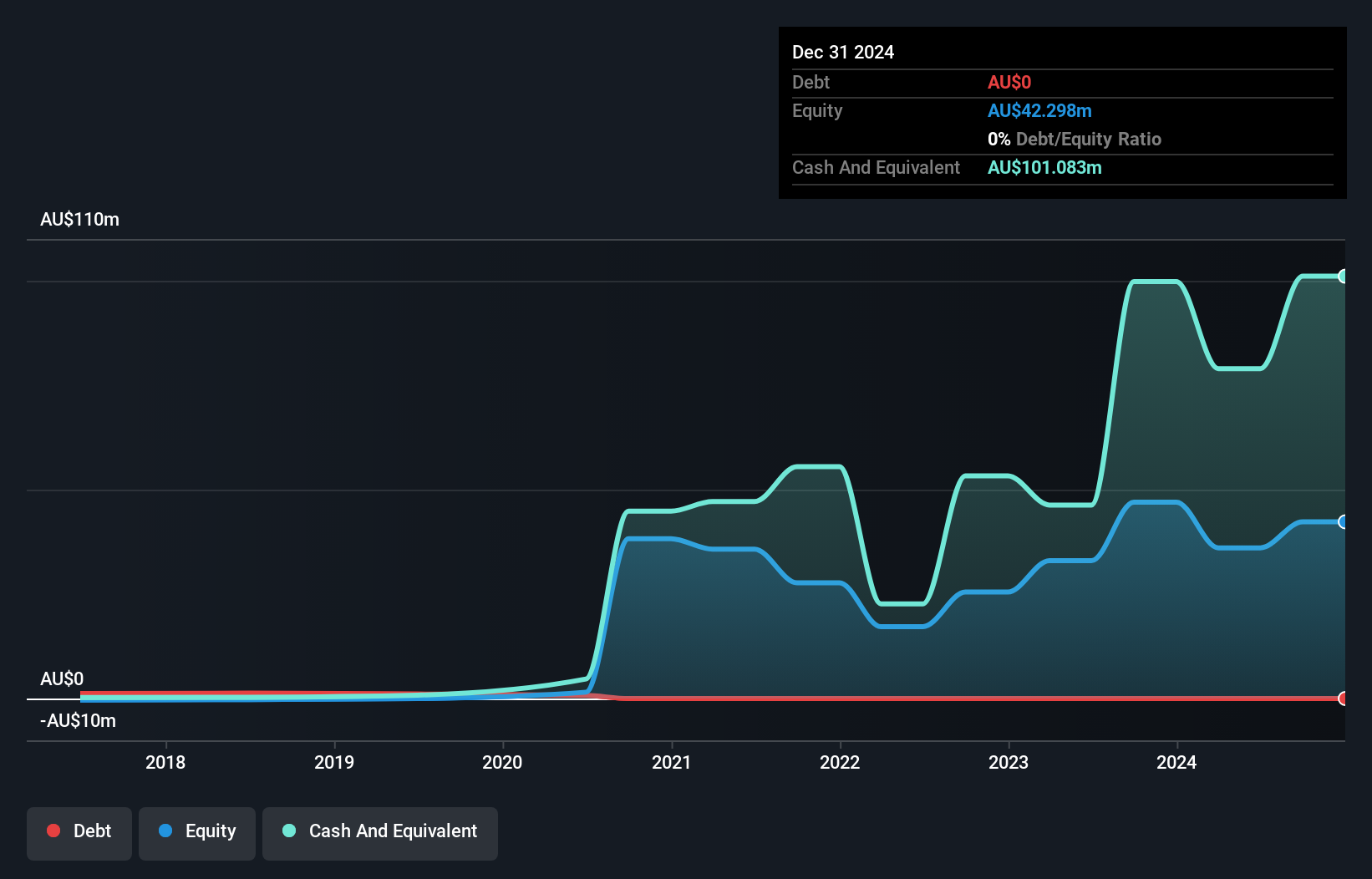

Retail Food Group Limited, with a market cap of A$166.97 million, has transitioned to profitability over the past year, reporting A$125.18 million in sales and a net income of A$5.79 million for the year ending June 2024. The company's Café, Coffee & Bakery segment remains its primary revenue driver at A$114.68 million. Despite positive earnings growth and improved equity from negative five years ago, challenges persist as short-term assets do not cover long-term liabilities (A$107.5M), and interest payments are not well-covered by EBIT (1.1x). Analysts expect continued earnings growth at 22.51% annually without significant shareholder dilution recently noted.

- Click here and access our complete financial health analysis report to understand the dynamics of Retail Food Group.

- Explore Retail Food Group's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1,031 ASX Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RFG

Retail Food Group

A food and beverage company, engages in the management of a multi-brand retail food and beverage franchise in Australia and internationally.