- Australia

- /

- Auto Components

- /

- ASX:AOV

Undervalued Small Caps With Insider Activity In Asian Markets September 2025

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's recent interest rate cut, small-cap stocks have demonstrated notable sensitivity and rallied in response, with the Russell 2000 Index seeing a significant gain. In Asia, economic indicators such as China's retail sales and industrial output reveal a broader slowdown, prompting speculation about potential stimulus measures that could impact small-cap companies across the region. In this context, identifying promising small-cap stocks involves examining those with strong fundamentals and potential for growth amidst evolving market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 10.3x | 5.3x | 24.11% | ★★★★★☆ |

| Domino's Pizza Enterprises | NA | 0.6x | 36.96% | ★★★★★☆ |

| East West Banking | 3.3x | 0.8x | 14.31% | ★★★★☆☆ |

| Cettire | NA | 0.3x | 38.24% | ★★★★☆☆ |

| BWP Trust | 10.0x | 13.1x | 13.87% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.79% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.2x | 6.9x | 10.92% | ★★★★☆☆ |

| Southern Cross Electrical Engineering | 17.5x | 0.7x | 28.58% | ★★★☆☆☆ |

| Elders | 21.8x | 0.5x | 45.50% | ★★★☆☆☆ |

| Pizu Group Holdings | 12.5x | 1.2x | 39.53% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

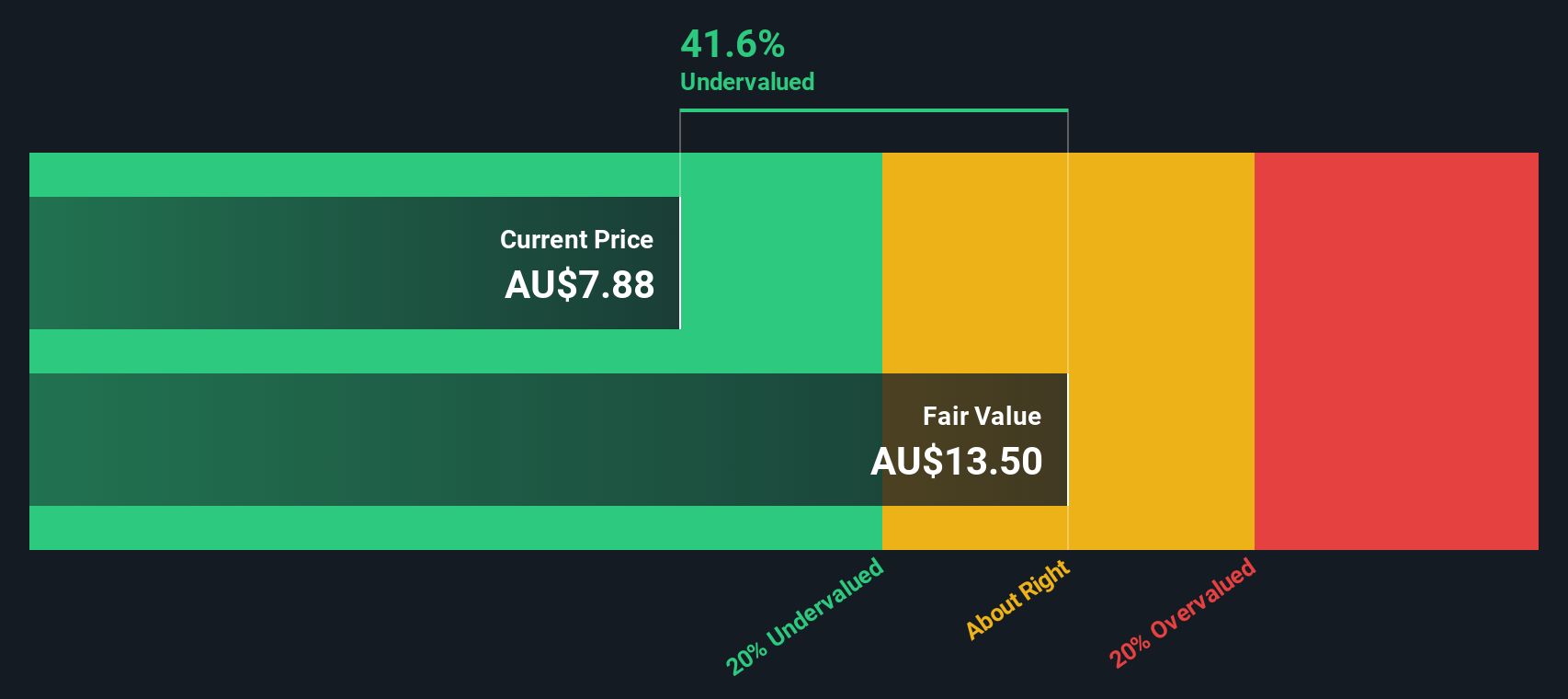

Amotiv (ASX:AOV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amotiv operates in the automotive sector, focusing on powertrain and undercar systems, lighting power and electrical components, as well as 4WD accessories and trailering, with a total market capitalization of A$2.45 billion.

Operations: Amotiv generates revenue primarily from Powertrain & Undercar, Lighting Power & Electrical, and 4WD Accessories & Trailering segments. The gross profit margin has shown fluctuations over the years, reaching 44.74% as of June 2024. Operating expenses are a significant cost component, with sales and marketing being the largest expense within this category.

PE: -11.2x

Amotiv, a small player in Asia's market, displays insider confidence with James Fazzino acquiring 26,363 shares worth A$250,448. Despite a high debt level and reliance on external borrowing, the company forecasts earnings growth of 49.76% annually. Recent buybacks saw 5.1 million shares repurchased for A$48.7 million by mid-2025. However, they reported a net loss of A$106.3 million for fiscal year ending June 2025 against prior year's profit of A$98.8 million, indicating potential challenges ahead despite promising growth projections.

- Unlock comprehensive insights into our analysis of Amotiv stock in this valuation report.

Evaluate Amotiv's historical performance by accessing our past performance report.

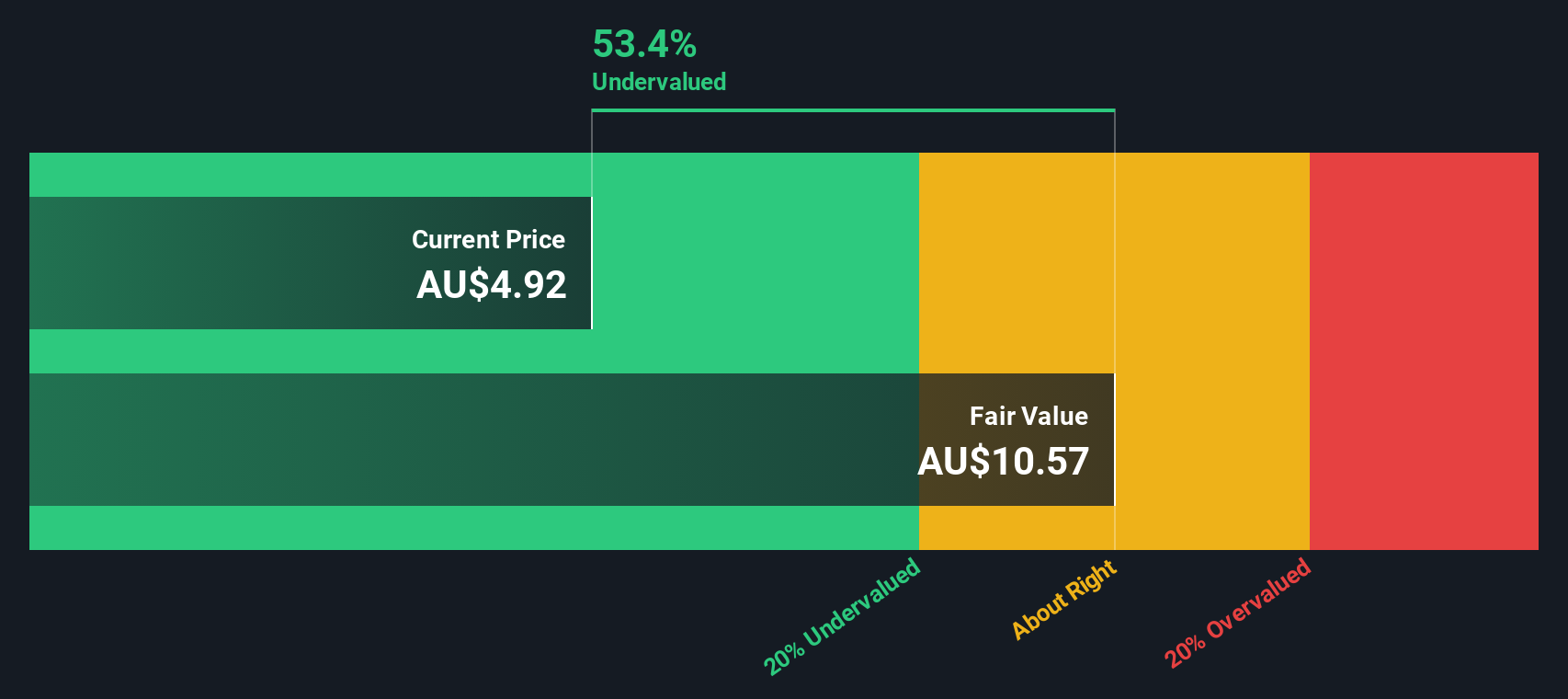

IDP Education (ASX:IEL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: IDP Education is a global leader in international education services, facilitating student placements and English language testing, with a market cap of A$8.24 billion.

Operations: IDP Education's revenue primarily comes from its Educational Services, specifically Education & Training Services, amounting to A$882.20 million. The company has experienced fluctuations in its gross profit margin, peaking at 34.34% in June 2023 and declining to 24.83% by June 2025. Operating expenses have steadily increased over time, with significant allocations towards sales and marketing as well as general and administrative expenses.

PE: 33.8x

IDP Education has seen insider confidence with Paul Rogan purchasing 45,000 shares for A$253,203 between 2024 and 2025. Despite a decline in sales to A$882.2 million from A$1.04 billion last year, earnings are projected to grow by 23.67% annually. The recent appointment of Rogan as a Non-Executive Director may bolster strategic growth initiatives, although the company faces challenges with lower profit margins and reliance on external borrowing for funding.

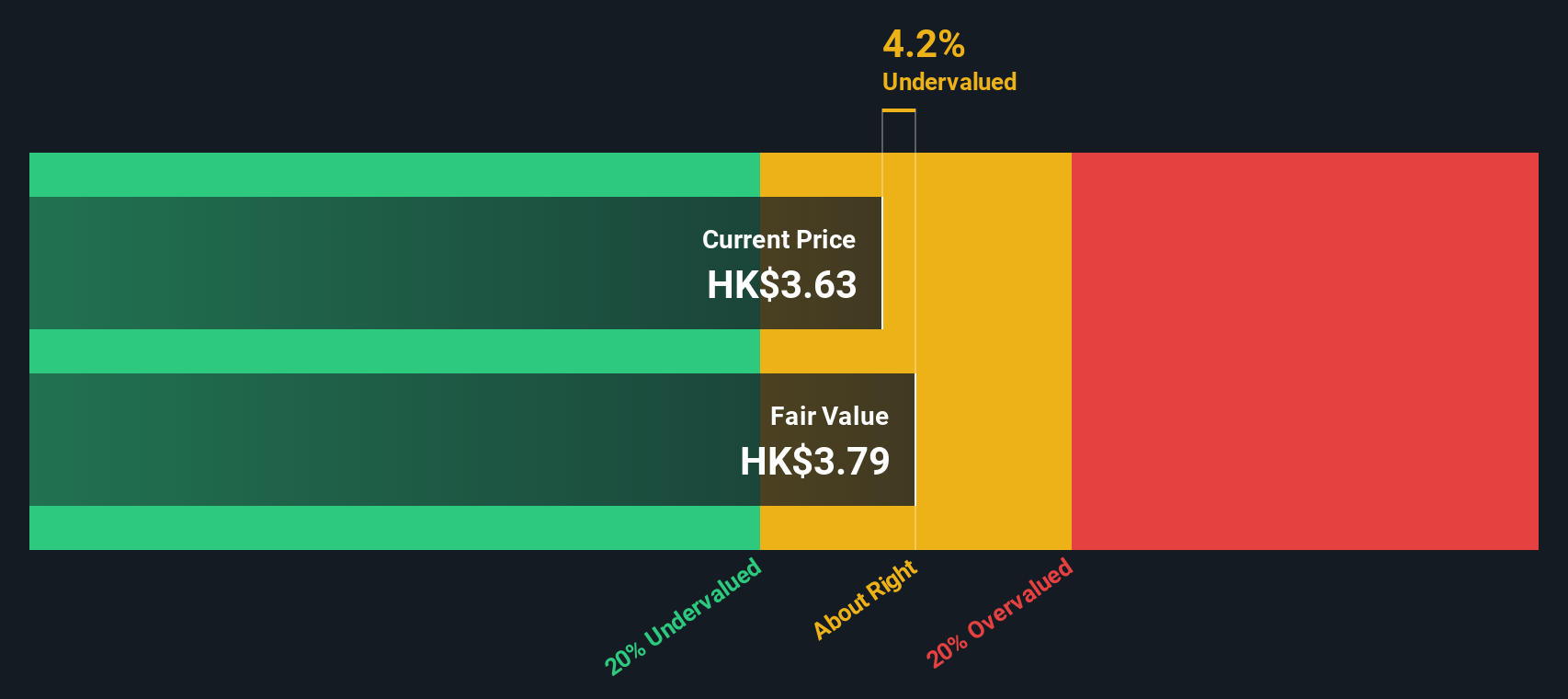

Eagle Nice (International) Holdings (SEHK:2368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Eagle Nice (International) Holdings is a company engaged in the manufacturing and trading of sportswear and apparel, with a market capitalization of approximately HK$1.95 billion.

Operations: The company's revenue streams are primarily derived from the Chinese Mainland, with significant contributions from the USA and Europe. Over recent periods, the gross profit margin has shown a decline from 19.16% in September 2022 to 16.07% in March 2025, indicating changes in cost dynamics or pricing strategies. Operating expenses have consistently been a major component of cost structure, reflecting substantial allocations towards general and administrative expenses.

PE: 9.8x

Eagle Nice (International) Holdings, a notable player in the textile industry, is drawing attention due to its valuation and insider confidence. Executive Vice Chairman Hsiao Ying Chen's purchase of 102,000 shares for HK$405,664 in recent months suggests belief in the company's potential. Despite a dip in profit margins from 6.5% to 4.5% and earnings declining by 3.1% annually over five years, strategic board changes like appointing Mr. Chou Wei-Te may steer future growth amidst external funding challenges.

Taking Advantage

- Embark on your investment journey to our 41 Undervalued Asian Small Caps With Insider Buying selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AOV

Amotiv

Manufactures, imports, distributes, and sells automotive products in Australia, New Zealand, Thailand, rest of Asia, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives