- Australia

- /

- Metals and Mining

- /

- ASX:IPX

Top ASX Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

In the last week, the Australian market has been flat, though it is up 10% over the past year with earnings forecast to grow by 12% annually. In this context, identifying growth companies with high insider ownership can be particularly appealing as it often indicates strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 102.6% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17.5% | 61.8% |

| AVA Risk Group (ASX:AVA) | 15.5% | 118.8% |

| Acrux (ASX:ACR) | 14.6% | 129.6% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 69.2% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 77.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited (ASX:FLT) provides travel retailing services for both leisure and corporate sectors across various regions globally, with a market cap of A$4.74 billion.

Operations: Flight Centre Travel Group Limited generates revenue primarily from its leisure segment (A$1.35 billion) and corporate segment (A$1.11 billion).

Insider Ownership: 13.5%

Flight Centre Travel Group demonstrates solid growth potential with high insider ownership. Its earnings are forecast to grow at 19.7% annually, outpacing the Australian market's 12.1%. Recent results show a significant increase in net income from A$47 million to A$139 million year-on-year. The company is actively seeking acquisitions to double its Cruise & Touring sales, leveraging strong cash reserves and existing brands delivering over 25% growth in this segment annually.

- Take a closer look at Flight Centre Travel Group's potential here in our earnings growth report.

- Our valuation report here indicates Flight Centre Travel Group may be overvalued.

IperionX (ASX:IPX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited focuses on the exploration and development of mineral properties in the United States, with a market cap of A$694.18 million.

Operations: IperionX Limited generates its revenue from the exploration and development of mineral properties in the United States.

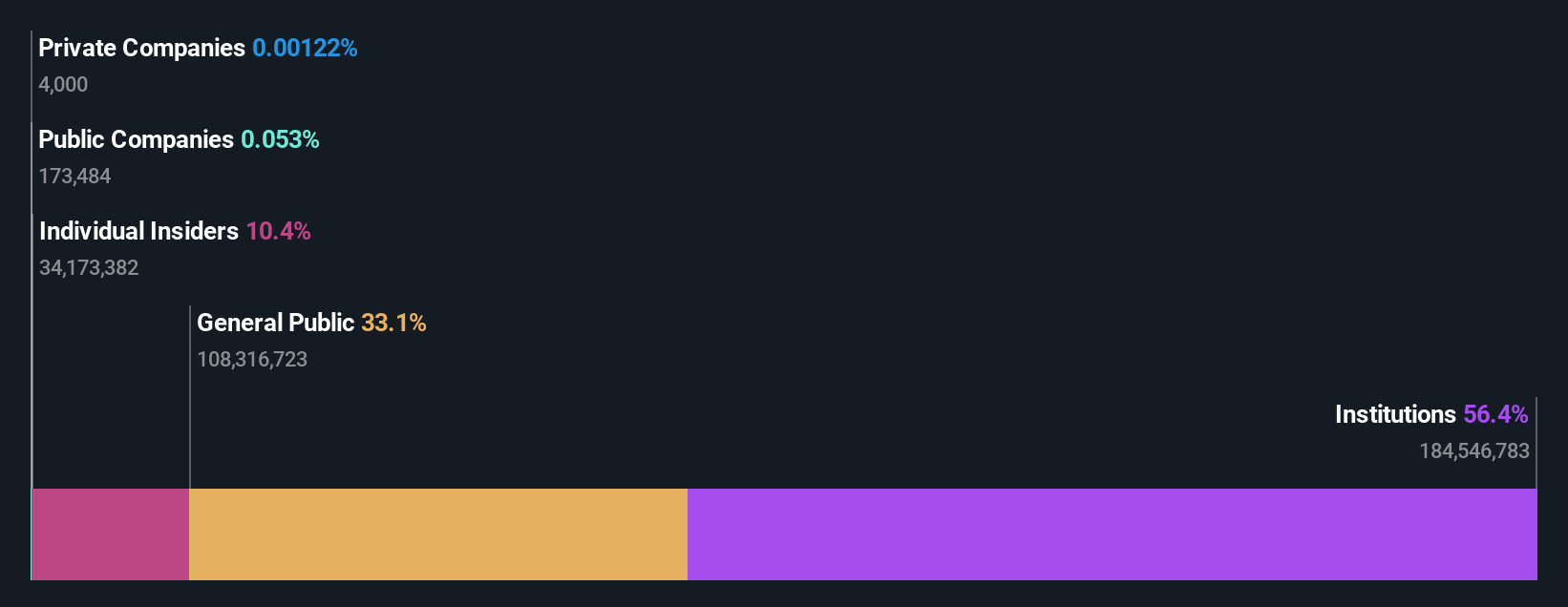

Insider Ownership: 16.8%

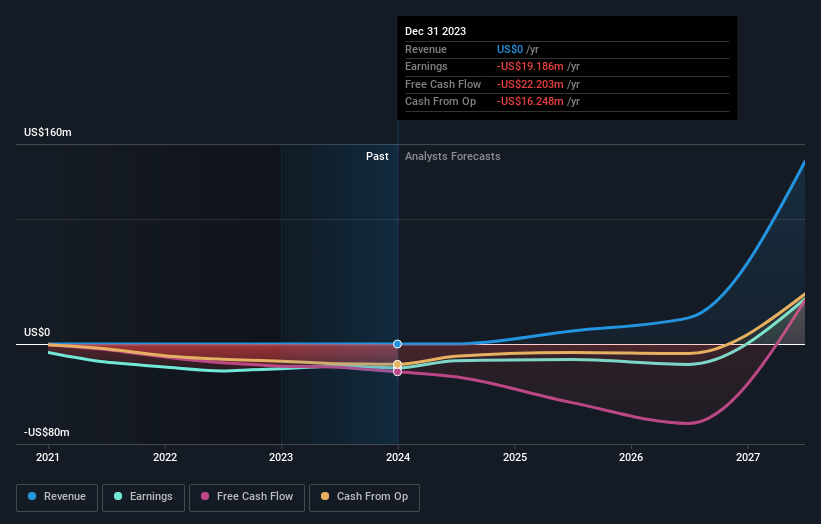

IperionX showcases significant growth potential with high insider ownership. The company recently achieved a major milestone by commissioning its HAMRTM furnace, boosting titanium production capacity substantially. IperionX's revenue is forecast to grow at 73.5% annually, outpacing the Australian market's 5.2%. Insiders have been buying more shares in the past three months, indicating confidence in future prospects. Additionally, IperionX is expected to become profitable within three years and has partnered with Aperam Recycling for sustainable titanium solutions.

- Navigate through the intricacies of IperionX with our comprehensive analyst estimates report here.

- The analysis detailed in our IperionX valuation report hints at an inflated share price compared to its estimated value.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.55 billion.

Operations: The company's revenue segments include Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Technology One demonstrates solid growth potential with substantial insider ownership. The company forecasts annual earnings growth of 14.79% and revenue growth of 11.5%, both outpacing the Australian market averages. Recent executive changes include the appointment of Paul Robson as an independent Non-Executive Director, bringing extensive SaaS experience from Adobe, which could drive strategic transformation and operational efficiency. Despite no significant recent insider trading activity, Technology One's consistent profit increase by 13.1% last year underscores its robust financial health.

- Click to explore a detailed breakdown of our findings in Technology One's earnings growth report.

- Our valuation report unveils the possibility Technology One's shares may be trading at a premium.

Taking Advantage

- Click here to access our complete index of 93 Fast Growing ASX Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPX

IperionX

Engages in exploration and development of its mineral properties in the United States.

High growth potential with excellent balance sheet.