- Australia

- /

- Hospitality

- /

- ASX:CKF

Collins Foods (ASX:CKF) Net Margin Falls to 0.8%, Undercutting Bullish Turnaround Narratives

Reviewed by Simply Wall St

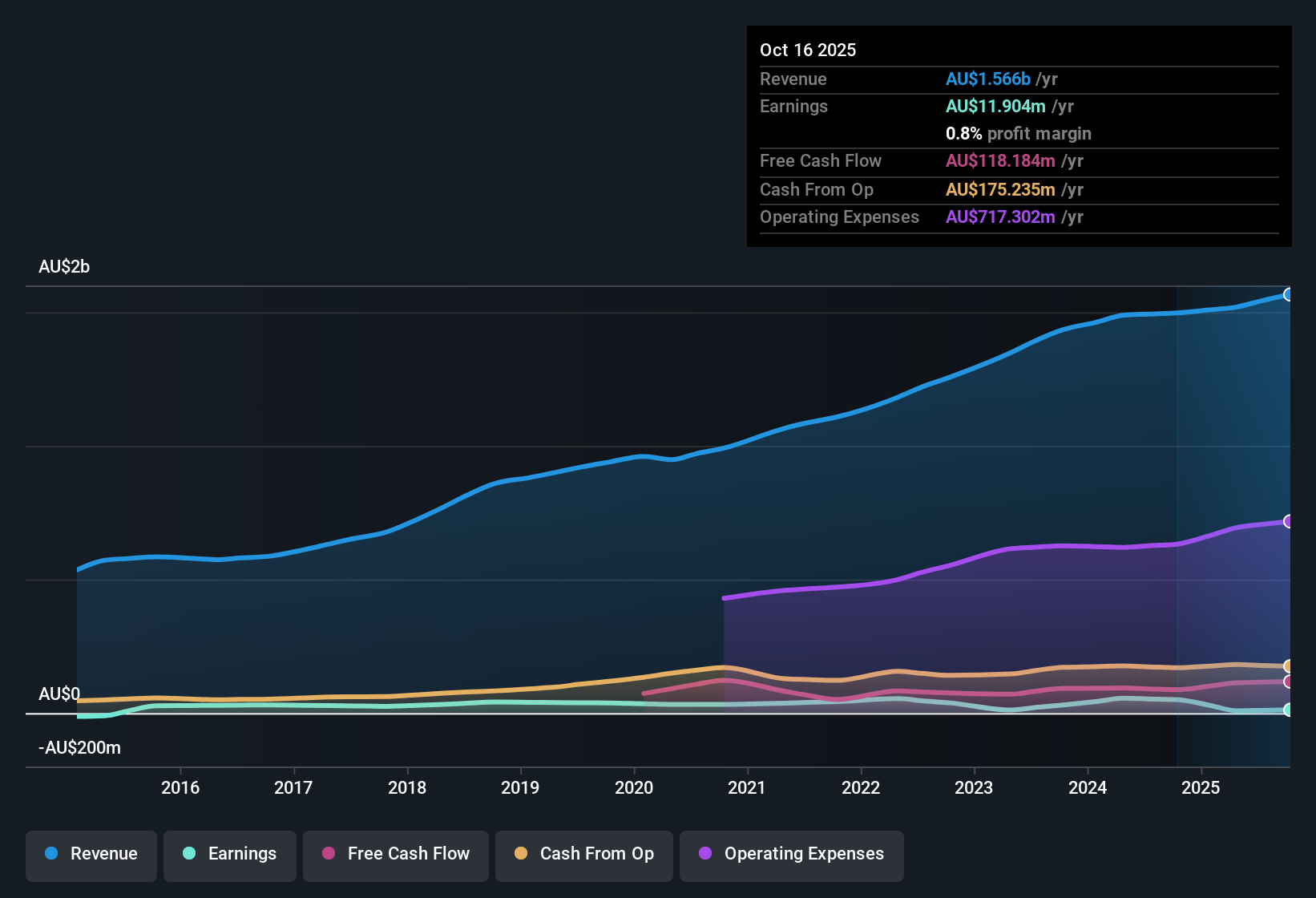

Collins Foods (ASX:CKF) just released its H1 2026 financial results, posting revenue of $815.96 million and a basic EPS of -0.13 AUD, with net income at -$15.29 million. Looking back, the company’s revenue increased from $703.53 million in H1 2025 to $815.96 million this half, while basic EPS declined from 0.20 AUD to -0.13 AUD over the same period. Net margins remain tight, reflecting ongoing pressure on profitability and highlighting a challenging operating environment.

See our full analysis for Collins Foods.Next, we will see how these headline numbers compare to prevailing narratives around Collins Foods and whether the results support the current market story or introduce new considerations.

See what the community is saying about Collins Foods

Net Profit Margin Slides to 0.8%

- Over the last 12 months, Collins Foods' net profit margin dropped to 0.8%, down from 3.3% a year earlier. This reflects shrinking profitability even as annual revenue passed $1.5 billion AUD.

- Analysts' consensus view highlights that persistent cost pressures and weak same-store sales in Europe are dragging down margins.

- Cost inflation, particularly on labor and energy, is eroding bottom line gains despite high-quality underlying earnings.

- The consensus expects margin pressures to persist at least through FY26. This suggests that any meaningful margin recovery will take time.

- Want to see how this margin squeeze shapes the broader market perspective? Tap into the full consensus narrative for Collins Foods. 📊 Read the full Collins Foods Consensus Narrative.

Trading 37% Below DCF Fair Value

- The current share price of $11.20 AUD sits about 37% below the DCF fair value estimate of $17.91 AUD. This suggests valuation appeal despite operational challenges.

- Analysts' consensus narrative points out that while high present PE multiples (111x) appear expensive, expectations of robust 30% annual earnings growth over the next few years underpin the notion of a possible turnaround.

- Consensus forecasts call for EPS to climb from $0.10 AUD now to $0.71 AUD by around 2028, which could justify a transition to a lower, more industry-normalized PE ratio.

- However, the relatively small gap between the analyst price target ($12.11 AUD) and the current price argues that most of the recovery optimism is already priced in. As a result, future surprises may matter more than historical declines.

Revenue Growth Lags Market, But Forecast Rebound in EPS

- Revenue is expected to grow at a rate of 5.8% per year, just shy of the broader Australian market's 6%. EPS is forecast to accelerate at 30.1%, compared with the market's lower pace.

- Consensus view underscores this mismatch as both a risk and an opportunity.

- Disappointing growth in some regions (Europe) could continue to weigh on near-term sentiment. Meanwhile, successful execution of new store rollouts and digital initiatives might unlock higher profits in the future.

- The situation requires balancing short-term shocks with the potential to capture longer-term earnings momentum if efficiency and growth initiatives deliver as planned.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Collins Foods on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another angle on these results? Take a few minutes to put your own spin on the story and share your insights. Do it your way.

A great starting point for your Collins Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Collins Foods is under pressure from shrinking profit margins and cost inflation, with recent earnings highlighting ongoing challenges to consistent, stable growth.

If you want to focus on companies delivering more predictable performance year after year, use our stable growth stocks screener (2082 results) to cut through the volatility and find steadier alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CKF

Collins Foods

Engages in the operation, management, and administration of restaurants in Australia and Europe.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026