- Australia

- /

- Hospitality

- /

- ASX:ALL

Aristocrat Leisure (ASX:ALL) Is Down 6.7% After Beating Earnings but Facing Interactive Growth Uncertainty

Reviewed by Sasha Jovanovic

- Aristocrat Leisure Limited recently announced full-year earnings for the period ended September 30, 2025, reporting A$6.30 billion in revenue and A$1.64 billion in net income, along with an ordinary final dividend of A$0.49 per share scheduled for December 8, 2025.

- The company exceeded analyst expectations in both sales and profit, yet its shares declined as investors weighed mixed signals from its Interactive division and the outlook for next year.

- We'll examine how positive earnings and dividend growth, alongside persistent questions about the Interactive business, may influence Aristocrat Leisure’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Aristocrat Leisure Investment Narrative Recap

To be a shareholder in Aristocrat Leisure, you need confidence in the company’s ability to grow through innovation, global expansion, and digital gaming while consistently managing risks in its Interactive division. The latest earnings beat and dividend increase may reinforce belief in Aristocrat’s growth strategy, but recent Interactive performance and cautious guidance show the immediate risk is uncertainty around digital growth, which looks material for the short-term outlook.

The recent announcement of a final ordinary dividend of A$0.49 per share, following stronger-than-expected full-year earnings, underscores Aristocrat’s continuing capital return to shareholders. This move aligns with its ongoing emphasis on profitability but comes at a time when shifting investor focus is squarely on the trajectory of digital operations and their ability to support future growth and payout stability. Yet, investors should remember that even positive dividend news does not fully address...

Read the full narrative on Aristocrat Leisure (it's free!)

Aristocrat Leisure's outlook anticipates A$7.3 billion in revenue and A$2.0 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 2.4% and a rise in earnings of A$0.8 billion from current earnings of A$1.2 billion.

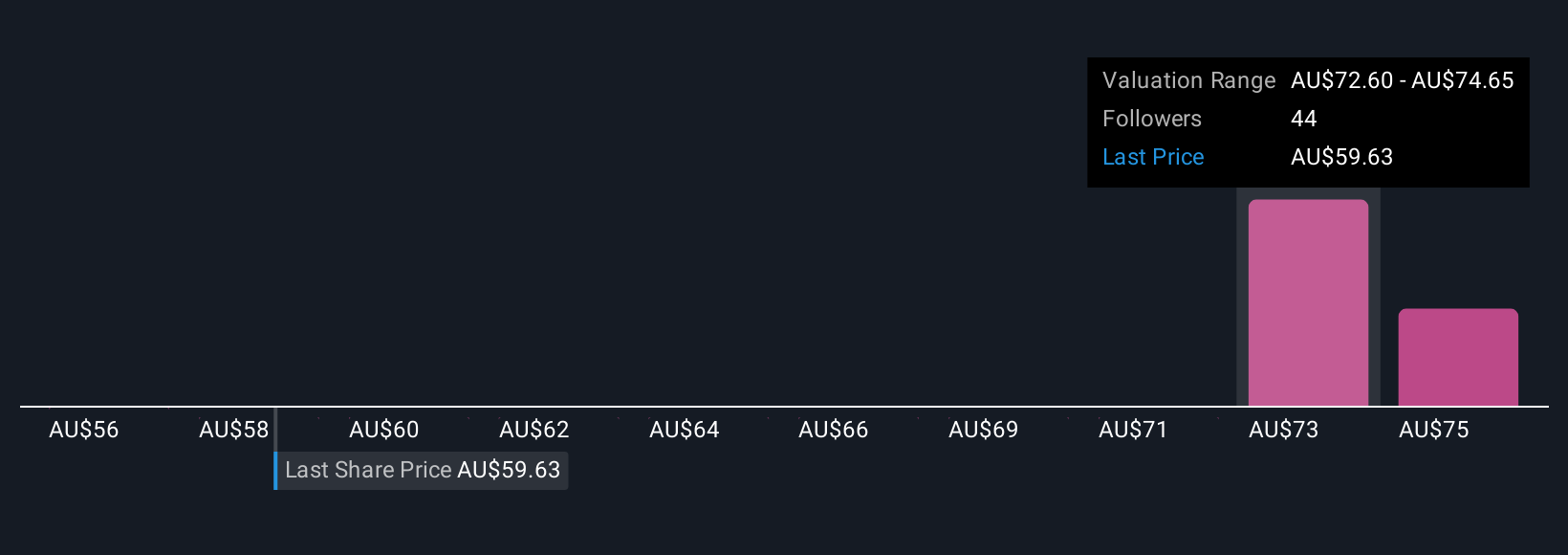

Uncover how Aristocrat Leisure's forecasts yield a A$74.52 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from A$56.22 to A$77.00 per share. These diverging views stand alongside questions about digital segment growth, making it important to weigh differing assumptions on Aristocrat’s next steps.

Explore 5 other fair value estimates on Aristocrat Leisure - why the stock might be worth 6% less than the current price!

Build Your Own Aristocrat Leisure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aristocrat Leisure research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Aristocrat Leisure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aristocrat Leisure's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALL

Aristocrat Leisure

Operates as a gaming content and technology company in Australia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives