- Australia

- /

- Hospitality

- /

- ASX:ALL

Aristocrat Leisure (ASX:ALL): Assessing Valuation Following Strong Annual Sales and Profit Growth

Reviewed by Simply Wall St

Aristocrat Leisure (ASX:ALL) revealed its full-year financial results, showing a substantial increase in both sales and net income compared to the previous year. This announcement is drawing fresh attention from investors.

See our latest analysis for Aristocrat Leisure.

Following the upbeat annual earnings, Aristocrat Leisure’s share price has seen a modest lift, up 1.71% in the last trading day, as investors digest stronger sales and profit figures. While the year-to-date share price return is slightly negative, the total shareholder return over the past three and five years, at 77.4% and 106.7% respectively, highlights the company’s impressive long-term wealth creation, despite periods of short-term volatility. Market momentum may be stabilizing as positive sentiment builds around the latest results.

If you're interested in what else is gaining traction, it might be an ideal time to expand your search and uncover fast growing stocks with high insider ownership

With shares trading nearly 16% below the average analyst price target and robust earnings growth reported, it begs the question: is Aristocrat Leisure undervalued, or is the market already factoring in future gains?

Most Popular Narrative: 13.8% Undervalued

Comparing the narrative’s fair value to the latest close, Aristocrat Leisure’s shares still have room to run before reaching the widely followed target price. Here’s a key perspective driving that estimate.

The integration of NeoGames and the establishment of Aristocrat Interactive are expected to drive significant growth, with opportunities in iLottery and iGaming expanding market reach and potentially increasing revenue. The successful sale of Plarium and the strategic review of Big Fish Games may allow Aristocrat to focus more on its core gaming strengths, potentially enhancing future revenue growth and profit margins.

Curious about the logic fueling this fair value? Discover the hot-button financial targets at the heart of this story, including ambitious profit margins, strategic expansion, and a projected earnings jump that has analysts closely watching growth prospects.

Result: Fair Value of $74.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as rising competition and uncertainty in sustaining recent margin gains could quickly alter the positive outlook for Aristocrat Leisure.

Find out about the key risks to this Aristocrat Leisure narrative.

Another View: Is the Market Multiple Sending a Different Signal?

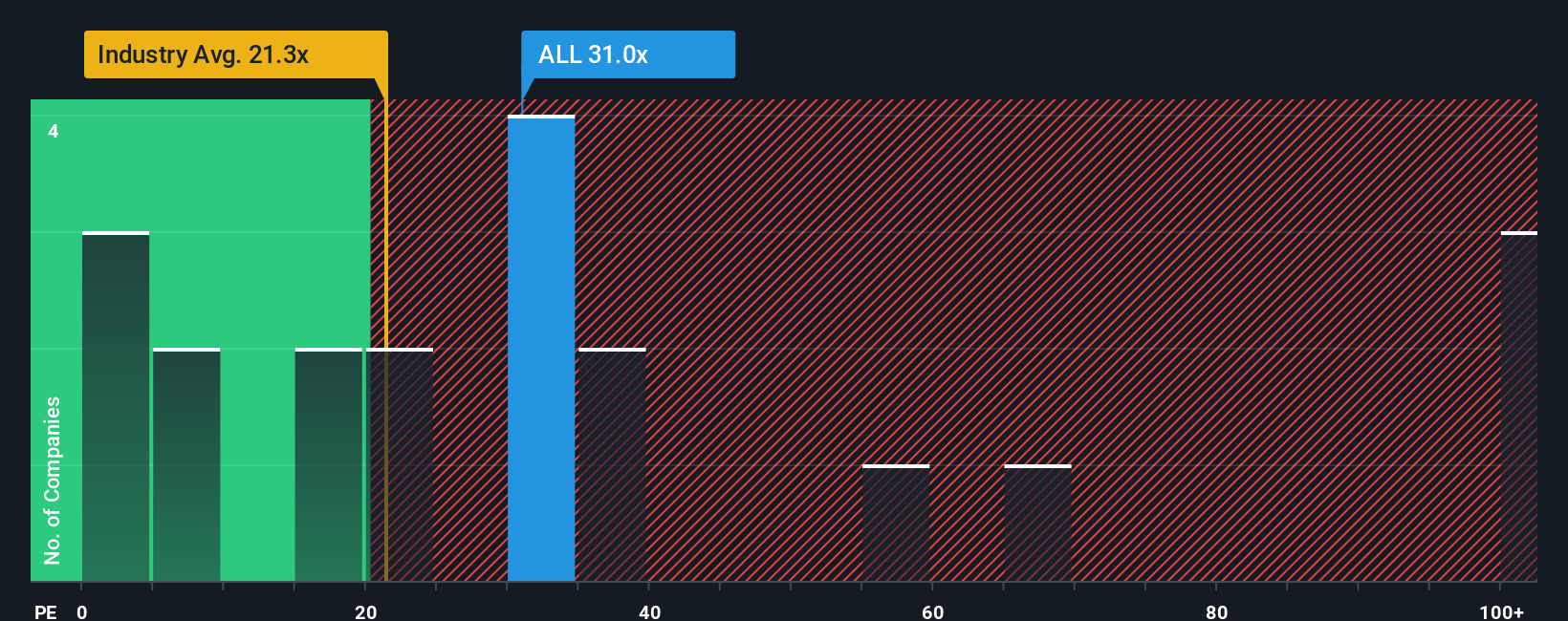

Looking beyond the first valuation method, Aristocrat Leisure's price-to-earnings ratio stands at 34.1x. This is higher than both its peer average of 31.4x and the global industry average of 21.3x. Even when measured against its fair ratio of 34.5x, the gap is narrow. This suggests that shares appear fairly valued but carry less margin for error if market expectations shift. Is this a warning sign, or just a sign of confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aristocrat Leisure Narrative

If you see this differently or want to dive into the details on your own terms, you can shape your own view in just a few minutes, then Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Aristocrat Leisure.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Give yourself the edge by checking out these hand-picked investment angles that could spark your next big move.

- Tap into explosive growth by reviewing these 26 AI penny stocks and find out which companies are revolutionizing entire industries with artificial intelligence.

- Capitalize on market mispricings by evaluating these 872 undervalued stocks based on cash flows, which deliver strong cash flows and the potential for rapid gains.

- Boost your passive income by researching these 15 dividend stocks with yields > 3%, which offer reliable yields above 3% and stable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALL

Aristocrat Leisure

Operates as a gaming content and technology company in Australia and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives