- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Woolworths Group (ASX:WOW): Valuation in Focus After Quarterly Sales Growth Spurs Share Price Recovery

Reviewed by Simply Wall St

Woolworths Group (ASX:WOW) recently released its first-quarter sales results, reporting group sales of $18,483 million, up from $18,004 million a year earlier. This steady growth can catch the attention of investors.

See our latest analysis for Woolworths Group.

Following the company’s stronger first-quarter sales announcement, Woolworths Group’s share price has rebounded by 7.5% over the past month after a tough run earlier in the year. However, its 1-year total shareholder return of -2.1% suggests the broader picture still shows muted momentum. Long-term gains remain modest.

If you’re looking for the next market mover, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares now recovering and some valuation metrics suggesting the stock still trades below analyst price targets, the key question becomes: is Woolworths Group undervalued at current levels, or is the market already factoring in its future prospects?

Most Popular Narrative: 7.6% Undervalued

At yesterday’s close, Woolworths Group’s shares were trading below the most popular narrative’s fair value estimate. This setup signals an intriguing disconnect and puts a spotlight on forward growth drivers.

The ongoing investment and upgrades in Woolworths' supply chain automation and distribution centers are expected to drive significant operational efficiencies and margin improvement over the next few years. As dual running and commissioning costs roll off and new facilities like Moorebank and Auburn CFCs deliver returns, this is likely to support higher future EBIT and ROIC.

What is really propelling this valuation? All eyes are on big automation bets and a digital retail expansion plan that is set to redefine margins and earnings. The full narrative reveals which underestimated financial levers underpin the price target. Explore the bold assumptions smart money is following. Are they too bullish, or about to be proven right? Dive in for the numbers behind the optimism.

Result: Fair Value of $30.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in discretionary retail and fierce price competition could still challenge Woolworths Group’s margin recovery and longer term growth story.

Find out about the key risks to this Woolworths Group narrative.

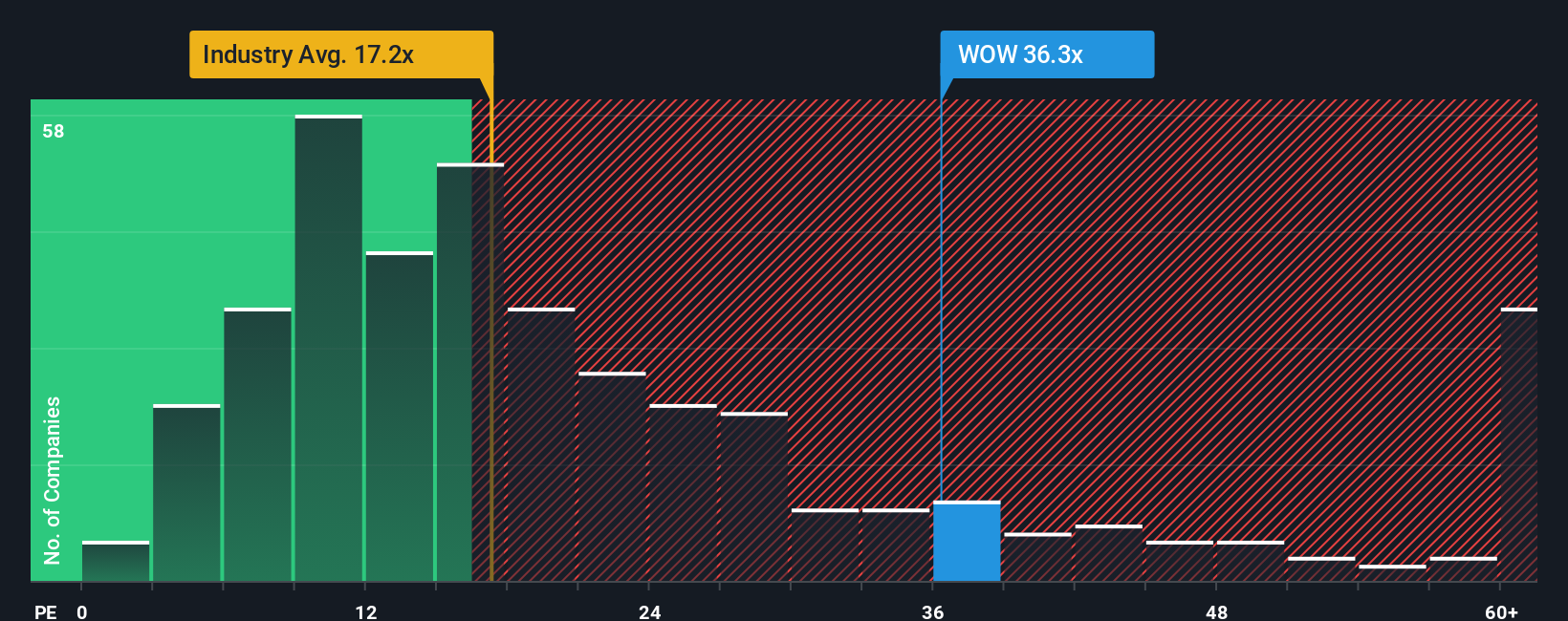

Another View: Market Multiples Raise Questions

While analysts see upside using future growth estimates, the latest price-to-earnings ratio tells a different story. Woolworths shares trade at 35.7 times earnings, which is much steeper than both the global industry average of 17.5 and its peers at 22.7. Even compared to the fair ratio of 30.9, the premium is clear. This gap suggests investors expect a strong turnaround, but it could also mean the shares carry higher risk if growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woolworths Group Narrative

If you want to challenge the consensus or dive deeper into the data yourself, you can quickly craft your own Woolworths Group outlook and set your narrative in just a few minutes. Do it your way

A great starting point for your Woolworths Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself the edge by tapping into unique and overlooked opportunities outside the mainstream. The Simply Wall Street Screener highlights fresh stocks that could transform your portfolio and help you spot the next big winner. Don’t let these possibilities pass you by.

- Tap into exceptional income streams by checking out these 20 dividend stocks with yields > 3%, which consistently offer attractive yields above 3%.

- Accelerate your growth journey and seize the upside from emerging technologies by targeting these 25 AI penny stocks, companies set to benefit from artificial intelligence innovation.

- Strengthen your portfolio with value opportunities by zeroing in on these 836 undervalued stocks based on cash flows, stocks trading below their fair value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WOW

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives