- Australia

- /

- Construction

- /

- ASX:TEA

Director’s Increased Stake Via DRP Might Change The Case For Investing In Tasmea (ASX:TEA)

Reviewed by Sasha Jovanovic

- Tasmea Ltd. recently announced that director Stephen Elliott Young has increased his holdings in the company by acquiring additional ordinary shares through a Dividend Reinvestment Plan.

- This move highlights a closer alignment between company leadership and shareholders, often viewed as a sign of executive confidence in future prospects.

- We’ll explore how director participation in the Dividend Reinvestment Plan influences Tasmea’s investment narrative and perceived board commitment.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Tasmea's Investment Narrative?

Being a Tasmea shareholder means trusting in the company’s ability to sustain and build on strong recent growth, maintain quality earnings, and execute on its ambitious targets for fiscal 2026. The company’s robust revenue and net income increases, improving margins, and disciplined capital management have drawn attention, but the stock’s higher price-to-earnings ratio and substantial debt remain clear headwinds. The recent acquisition of shares by director Stephen Elliott Young through the Dividend Reinvestment Plan reinforces the perception of leadership alignment with shareholders, though by itself, this move does not materially shift the company’s key short-term catalysts, which rest on delivering on guidance and effectively deploying capital from recent equity raises. Risks tied to the company’s debt levels and slowing forecasted earnings growth compared to the broader market still stand out and merit careful monitoring. Potential impacts from debt levels remain important for investors to consider.

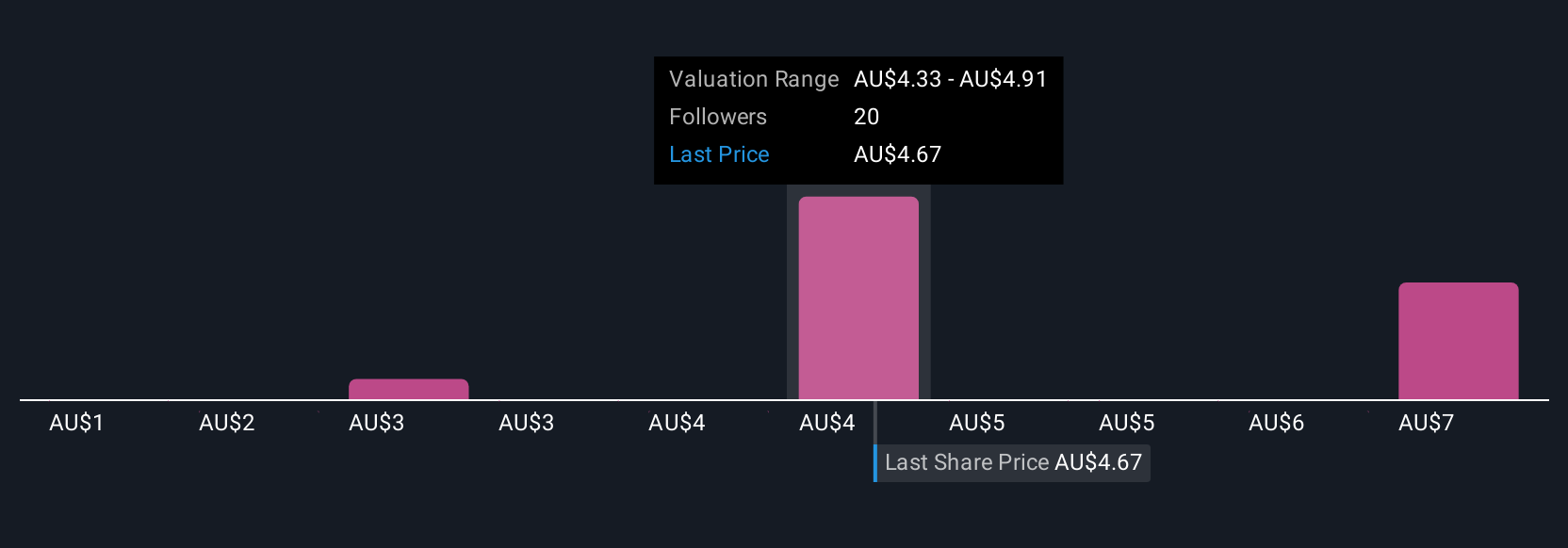

Tasmea's shares have been on the rise but are still potentially undervalued by 21%. Find out what it's worth.Exploring Other Perspectives

Explore 9 other fair value estimates on Tasmea - why the stock might be worth 41% less than the current price!

Build Your Own Tasmea Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tasmea research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tasmea research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tasmea's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tasmea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TEA

Tasmea

Provides shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives