- Australia

- /

- Construction

- /

- ASX:SYL

ASX Stocks Estimated To Be Trading At Discounts Of Up To 44.9%

Reviewed by Simply Wall St

The Australian stock market has faced challenges recently, including an ASX announcements outage that disrupted trading activities and affected several companies. Despite these hurdles, the search for undervalued stocks remains pertinent, as investors look for opportunities to capitalize on potential discounts amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Symal Group (ASX:SYL) | A$2.72 | A$4.67 | 41.7% |

| Superloop (ASX:SLC) | A$2.70 | A$5.36 | 49.6% |

| Smart Parking (ASX:SPZ) | A$1.345 | A$2.26 | 40.6% |

| SenSen Networks (ASX:SNS) | A$0.10 | A$0.19 | 47% |

| Ramelius Resources (ASX:RMS) | A$3.65 | A$7.27 | 49.8% |

| LGI (ASX:LGI) | A$4.27 | A$7.70 | 44.5% |

| Guzman y Gomez (ASX:GYG) | A$23.23 | A$39.38 | 41% |

| Genesis Minerals (ASX:GMD) | A$6.55 | A$13.02 | 49.7% |

| Cromwell Property Group (ASX:CMW) | A$0.47 | A$0.85 | 44.9% |

| Airtasker (ASX:ART) | A$0.34 | A$0.67 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Cromwell Property Group (ASX:CMW)

Overview: Cromwell Property Group (ASX:CMW) is a real estate investment manager with $4.2 billion of assets under management in Australia and New Zealand, and it has a market capitalization of approximately A$1.23 billion.

Operations: The company's revenue segments comprise Co-Investments generating A$19.50 million, an Investment Portfolio contributing A$194 million, and Funds and Asset Management providing A$54.70 million.

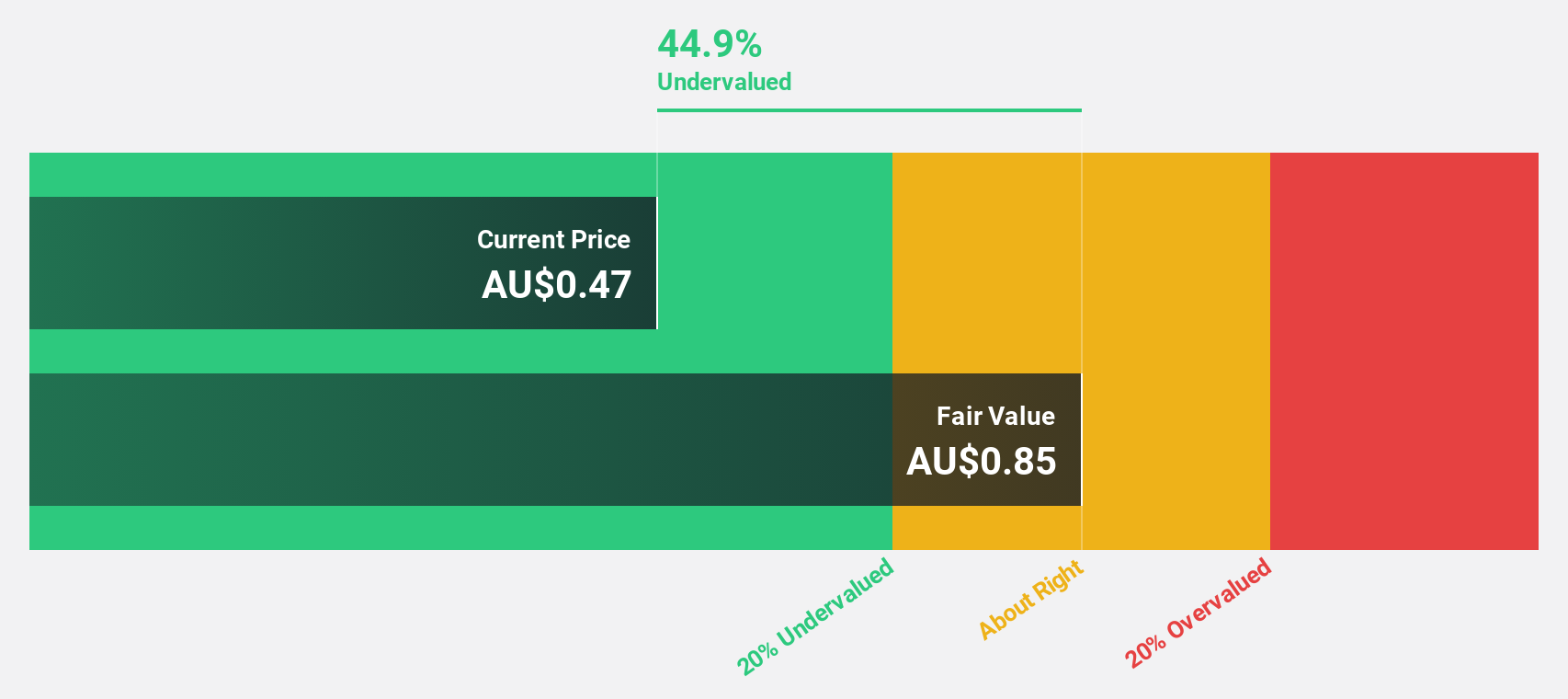

Estimated Discount To Fair Value: 44.9%

Cromwell Property Group trades at A$0.47, significantly below its estimated fair value of A$0.85, suggesting it may be undervalued based on cash flows. Despite a forecasted earnings growth of 29.67% annually and revenue growth exceeding the Australian market average, interest payments are not well covered by earnings, and the dividend yield of 6.38% lacks coverage sustainability. Profitability is anticipated within three years with above-average market growth expectations but a low return on equity forecasted at 7%.

- The analysis detailed in our Cromwell Property Group growth report hints at robust future financial performance.

- Take a closer look at Cromwell Property Group's balance sheet health here in our report.

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited operates in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia with a market capitalization of A$14.80 billion.

Operations: The company's revenue segment is derived entirely from its Rare Earth Operations, amounting to A$556.51 million.

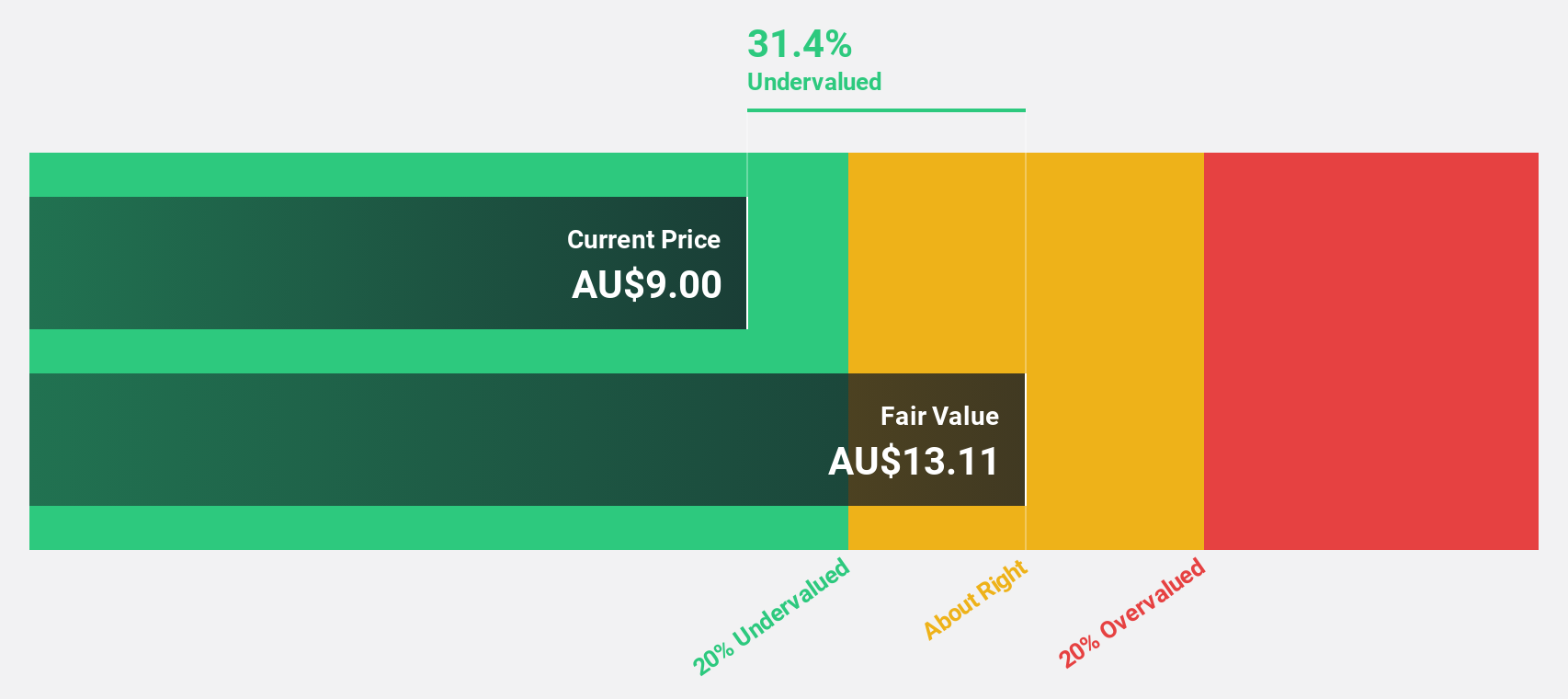

Estimated Discount To Fair Value: 34.7%

Lynas Rare Earths trades at A$14.70, well below its estimated fair value of A$22.53, potentially making it undervalued based on cash flows. The company anticipates robust earnings growth of 46.4% annually, surpassing the Australian market average. However, profit margins have decreased to 1.4% from last year's 18.2%. Recent strategic collaborations with Solidec and Noveon Magnetics aim to enhance Lynas' processing capabilities and supply chain resilience in rare earth production.

- Insights from our recent growth report point to a promising forecast for Lynas Rare Earths' business outlook.

- Get an in-depth perspective on Lynas Rare Earths' balance sheet by reading our health report here.

Symal Group (ASX:SYL)

Overview: Symal Group Limited operates in the civil construction industry in Australia, offering construction contracting, equipment hires, material sales, recycling, and remediation services with a market cap of A$642.36 million.

Operations: The company's revenue segments include A$713.75 million from contracting services and A$183.60 million from plant and equipment.

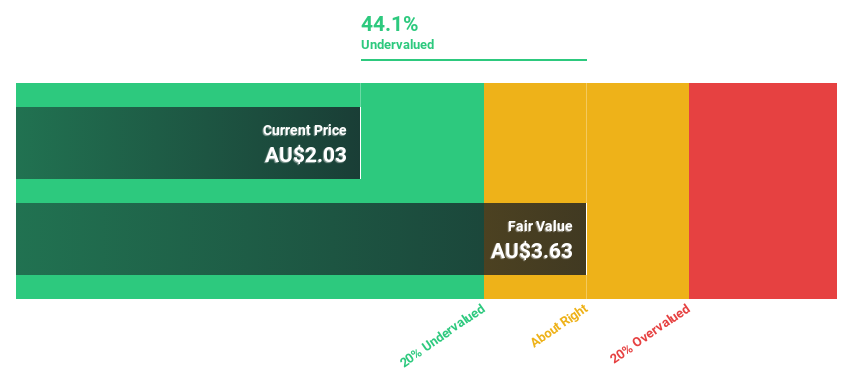

Estimated Discount To Fair Value: 41.7%

Symal Group, trading at A$2.72, is significantly undervalued with an estimated fair value of A$4.67. Despite modest earnings growth forecasts of 13.5% annually, exceeding the Australian market's average, revenue growth remains subdued at 6.2% per year. Recent executive changes include the resignation of CFO Geoff Trumbull, succeeded by interim CFO David Gill to ensure stability during this transition period until a new appointment is made post-February 2026 results release.

- Upon reviewing our latest growth report, Symal Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Symal Group with our detailed financial health report.

Summing It All Up

- Access the full spectrum of 36 Undervalued ASX Stocks Based On Cash Flows by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SYL

Symal Group

Provides construction contracting, equipment hires, material sales, recycling, and remediation services to the civil construction industry in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026