SILEX Laser Uranium Enrichment Commercialization Update Might Change The Case For Investing In Silex Systems (ASX:SLX)

Reviewed by Sasha Jovanovic

- Earlier this week, Silex Systems Limited released a new presentation outlining its ongoing and future plans for the commercialization of its third-generation SILEX laser uranium enrichment technology in collaboration with Global Laser Enrichment.

- This update highlights Silex Systems' ambition to strengthen its position in the nuclear technology sector by advancing innovative enrichment solutions through their partnership.

- We'll now explore how commercialization progress of the SILEX laser enrichment technology could influence Silex Systems' investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Silex Systems' Investment Narrative?

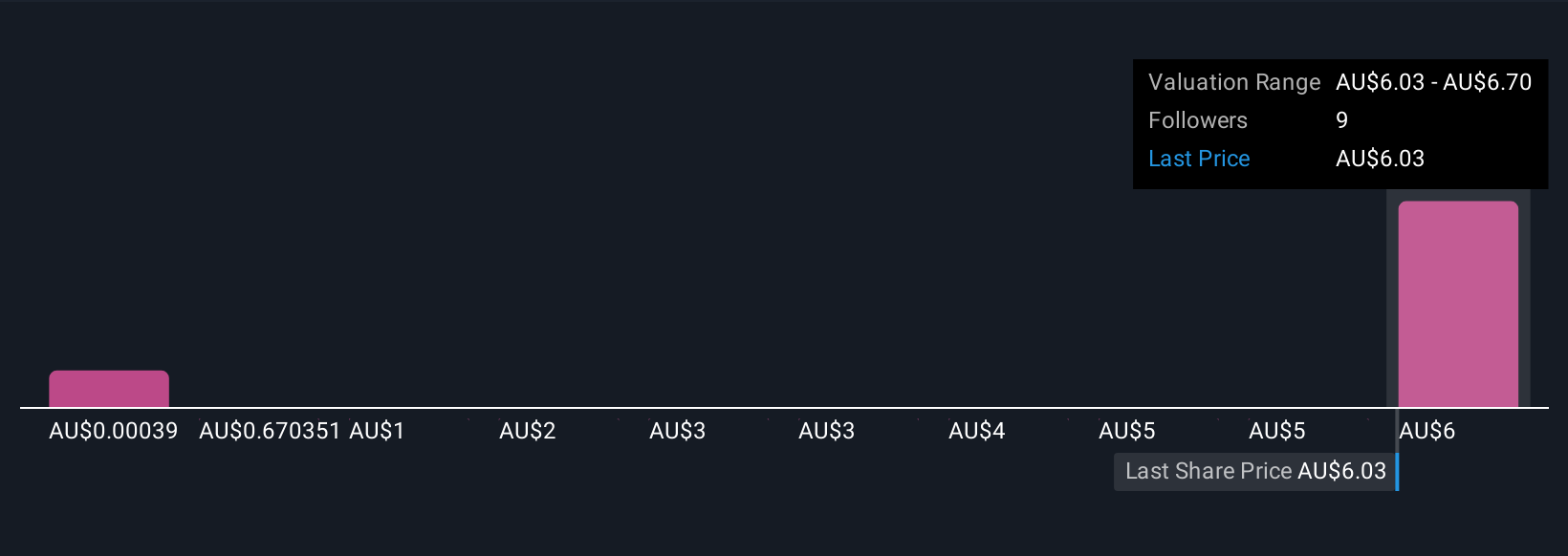

The big picture for Silex Systems hinges on belief in laser-based uranium enrichment as a transformative force in the nuclear technology sector, and the potential for SILEX technology to yield meaningful commercial progress. The recently unveiled presentation sharpens the company's commercialization plans in partnership with Global Laser Enrichment, and may affect what matters most for investors right now: quick execution, capital strength, and a path toward profitability. While the company has ramped up equity offerings to raise over A$170 million in recent months, deepening net losses and continuing absence of dividends highlight ongoing burn and the uncertainty of near-term cash flows. This news likely raises the bar for commercialization milestones as a short-term catalyst, but does not fundamentally ease risk stemming from persistent losses or the high valuation compared to industry peers. The company's ambitious revenue growth targets remain in focus, but the risk around how and when significant commercial contracts will materialize is still top of mind.

But against headline-making growth forecasts, the pace of commercial progress remains a key risk that investors should not ignore. Silex Systems' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on Silex Systems - why the stock might be worth as much as 7% more than the current price!

Build Your Own Silex Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silex Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Silex Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silex Systems' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives