- Australia

- /

- Construction

- /

- ASX:MND

Why Monadelphous Group (ASX:MND) Is Up 13.1% After Upgraded Guidance and New Contract Wins

Reviewed by Sasha Jovanovic

- Monadelphous Group recently updated its FY26 revenue forecast, projecting 20–25% growth over the prior year and announcing over A$570 million in newly secured contracts since the start of the current financial year.

- The acquisition of Kerman Contracting is expected to enhance Monadelphous’s service capabilities and enable the company to expand into new markets as part of its ongoing growth strategy.

- We'll explore how Monadelphous's strong pipeline of new contracts and higher revenue projections could influence its investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Monadelphous Group Investment Narrative Recap

To be a Monadelphous Group shareholder, you need to believe that contract momentum, revenue growth, and business diversification will outweigh near-term sector risks. The updated FY26 revenue forecast and newly secured contracts are positive catalysts, yet the biggest short-term concern remains skilled labor shortages, which threaten to put pressure on margins if wage costs continue to rise. The new guidance is encouraging, but it does not fully alleviate this operating risk.

Among recent announcements, the acquisition of Kerman Contracting stands out as particularly relevant. This move directly supports Monadelphous’s ambition to broaden its service offering and enter new market segments, ideally strengthening its pipeline and increasing resilience amid shifting customer spending trends. This aligns closely with the company’s stated growth strategy at this critical juncture.

However, while these catalysts are promising, investors should still keep a close eye on the ongoing risk that ...

Read the full narrative on Monadelphous Group (it's free!)

Monadelphous Group's outlook anticipates A$2.6 billion in revenue and A$98.7 million in earnings by 2028. This reflects a 6.4% annual revenue growth rate and an increase of A$15 million in earnings from the current A$83.7 million level.

Uncover how Monadelphous Group's forecasts yield a A$21.82 fair value, a 15% downside to its current price.

Exploring Other Perspectives

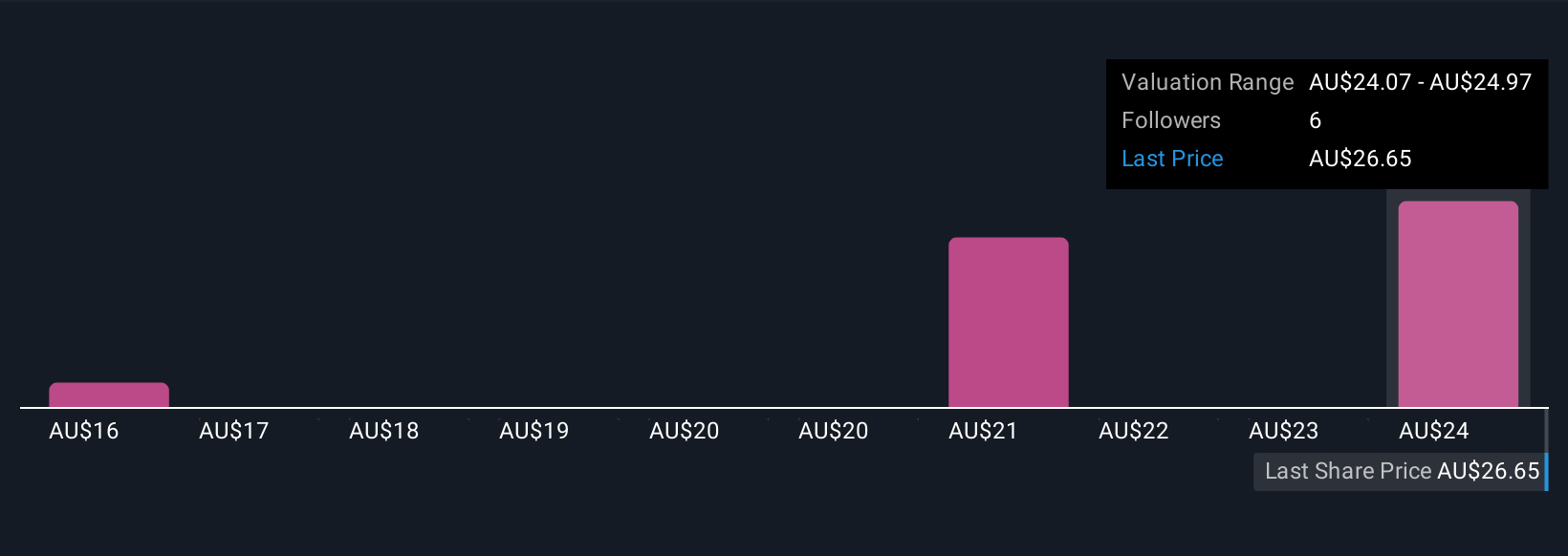

Simply Wall St Community members have valued Monadelphous from as low as A$15.95 to A$24.91, across three independent valuations. While expansion and new contracts drive optimism, persistent labor shortages could still challenge future profitability, so consider a range of views as you assess the outlook.

Explore 3 other fair value estimates on Monadelphous Group - why the stock might be worth as much as A$24.91!

Build Your Own Monadelphous Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monadelphous Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Monadelphous Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monadelphous Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MND

Monadelphous Group

An engineering group, provides construction, maintenance, and industrial services to resources, energy, and infrastructure sectors in Australia, China, Mongolia, Papua New Guinea, China, Vietnam, the Philippines, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives