- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

Why DroneShield (ASX:DRO) Is Down 33.8% After Executive Share Sales and Contract Clarification

Reviewed by Sasha Jovanovic

- Earlier this week, DroneShield disclosed that its CEO, chairman, and a director sold a significant number of shares, following clarification that a previously announced A$7.6 million contract win was not new business but a reissue.

- This combination of insider selling and contract withdrawal sparked widespread investor attention and raised questions about executive confidence and the transparency of the company's sales pipeline.

- We'll explore how this wave of insider share sales and contract reclassification could influence investor perceptions of DroneShield's longer-term outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DroneShield Investment Narrative Recap

To be a DroneShield shareholder, you would need conviction in surging demand for counter-drone technology, the company’s global expansion and a robust contract pipeline, despite heavy dependence on large government deals. The recent wave of director share sales following a contract reclassification drew sharp scrutiny, but these events do not appear to affect the near-term catalyst of executing and landing sizeable defense contracts; instead, they sharpen focus on the risk of confidence and pipeline transparency.

One relevant recent announcement is the withdrawal and clarification of an A$7.6 million contract, which was not new business but a regulatory update reissue. This, when coupled with insider selling, puts a spotlight on the reliability and visibility of DroneShield’s reported backlog, vital for investors who see recurring government deals as the primary short-term growth engine.

In contrast, what could catch investors off guard is…

Read the full narrative on DroneShield (it's free!)

DroneShield's narrative projects A$359.8 million revenue and A$96.1 million earnings by 2028. This requires 49.7% yearly revenue growth and an A$90.5 million increase in earnings from the current A$5.6 million.

Uncover how DroneShield's forecasts yield a A$5.15 fair value, a 129% upside to its current price.

Exploring Other Perspectives

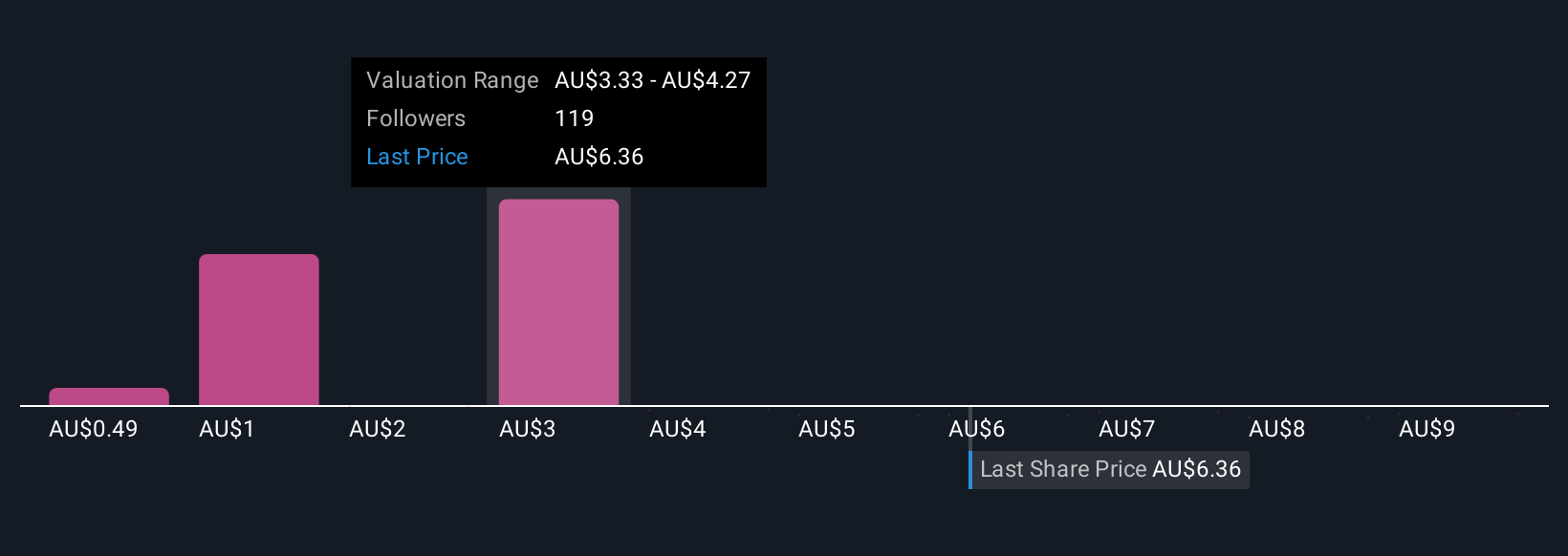

The Simply Wall St Community offered 44 individual fair value estimates for DroneShield, ranging from as low as A$0.50 to nearly A$9.90. While execution of large contracts remains critical, the wide spectrum of these views underscores just how much opinions can differ ahead of the next earnings report.

Explore 44 other fair value estimates on DroneShield - why the stock might be worth less than half the current price!

Build Your Own DroneShield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DroneShield research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DroneShield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DroneShield's overall financial health at a glance.

No Opportunity In DroneShield?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives