- Australia

- /

- Aerospace & Defense

- /

- ASX:ASB

Austal (ASX:ASB) Valuation in Focus Following Strong 2025 Earnings Growth

Reviewed by Simply Wall St

For anyone watching Austal (ASX:ASB), the latest earnings announcement is hard to ignore. The company just reported a leap in both sales and net income for the full year, outpacing last year’s numbers by a wide margin. When a company posts this kind of growth after years of steady expansion, it tends to get investors asking whether there’s more upside ahead, or if the news has made the stock a crowded trade.

The market has certainly noticed the news. Austal’s share price has climbed 21% in the past month alone, contributing to a broader rally that has gathered pace this year. This is not just a near-term bounce; the stock is now up 357% over the past three years, an impressive result as the company continues to post double-digit growth in both revenue and profit. The leadership shuffle, with founder John Rothwell stepping back this quarter, is another factor investors are considering as they assess what’s next for the business.

With the stock surging after these results, the real question now is whether Austal is getting ahead of itself or if there is still value left on the table for investors willing to look beyond the headlines.

Most Popular Narrative: 15.1% Overvalued

The most widely followed narrative views Austal shares as trading at a premium to fair value, with the current market price outpacing calculated fundamentals by over 15%.

Substantial investments and expansion in U.S. and Australian shipyard capacity, along with the near-record A$13.1 billion order book and major new agreements (for example, Strategic Shipbuilding Agreement and AUKUS initiatives), position Austal to capitalize on multi-year increases in defense spending and global naval modernization. This directly underpins sustained revenue growth and improved capacity utilization in the medium to long term.

Curious about what could make Austal's valuation outstrip reality? The analysts behind this narrative are banking on ambitious growth projections and fortress-like order books. What quantitative assumptions are fueling these bold expectations? Uncover the numbers shaping this overvalued call.

Result: Fair Value of $7.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, any unexpected government budget cuts or trouble shifting from legacy to new programs could quickly challenge this optimistic story for Austal.

Find out about the key risks to this Austal narrative.Another View: Multiple-Based Valuation Differs

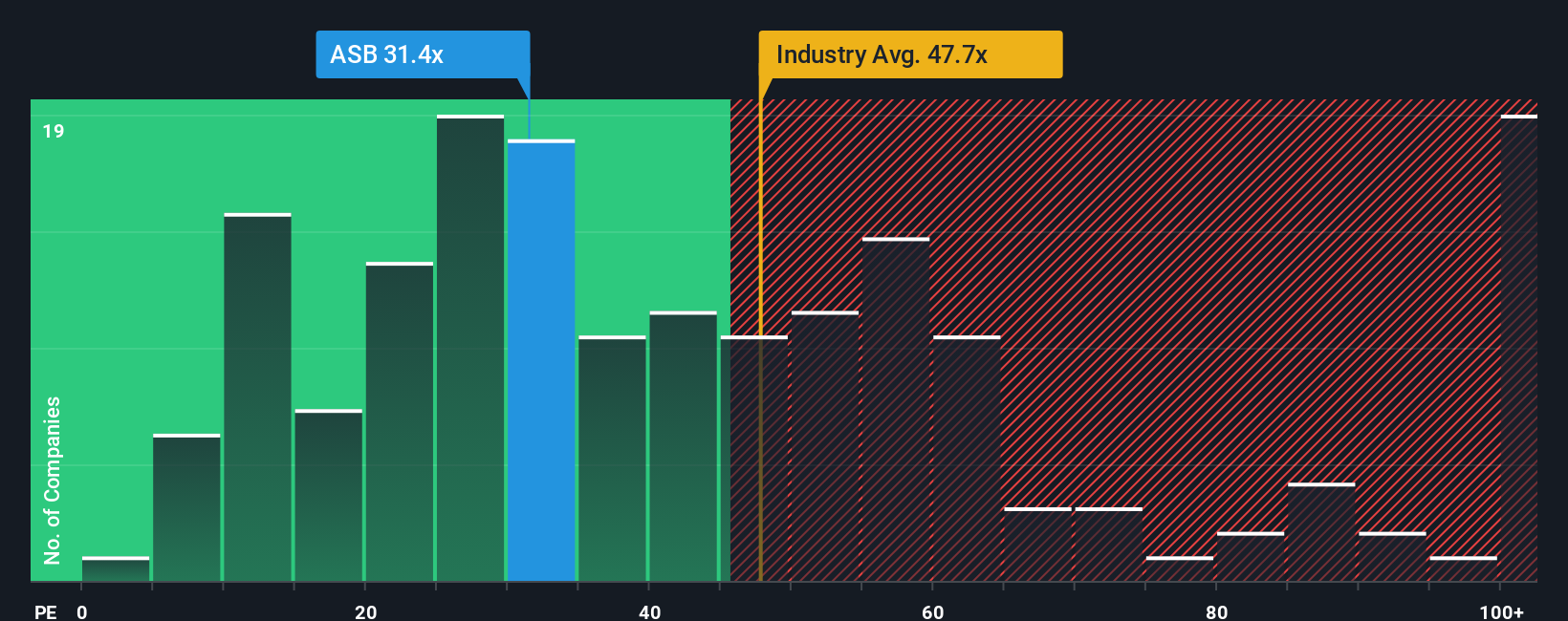

While analysts argue Austal is trading above its fair value, one common valuation yardstick actually paints a different picture. Based on its price-to-earnings ratio compared to industry peers, Austal appears to offer better value than many competitors. Could the market be missing something, or does this method ignore risks lurking below the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Austal to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Austal Narrative

If you want to test these ideas for yourself or approach the data from a different angle, crafting your own narrative takes just a few minutes. Do it your way.

A great starting point for your Austal research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. The right tools can help you spot unique companies before everyone else does. Level up your portfolio by using these curated screens:

- Capitalize on undervalued gems by tapping into undervalued stocks based on cash flows for stocks with strong fundamentals trading at attractive price points.

- Supercharge your returns as you uncover AI penny stocks powering the next wave of artificial intelligence breakthroughs and real-world solutions.

- Collect reliable income and build long-term wealth by targeting dividend stocks with yields > 3% backed by consistent, inflation-beating yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:ASB

Austal

Engages in the design, manufacture, and support of vessels for commercial and defense customers in the United States, Australia, Europe, Asia, and South America.

Flawless balance sheet and good value.

Market Insights

Community Narratives