Does CBA's Indigenous Partnership Reveal a New Chapter in Financial Inclusion and Growth? (ASX:CBA)

Reviewed by Sasha Jovanovic

- Indigenous Business Australia and the Commonwealth Bank recently announced a partnership aimed at improving access to home ownership, business lending, and renewable energy financing for Aboriginal and Torres Strait Islander people.

- This collaboration stands out for its comprehensive approach, offering mentoring, training, and co-funded lending models to help empower Indigenous economic self-determination.

- We’ll explore how this commitment to financial inclusion could shape the bank’s investment narrative and long-term growth opportunities.

Find companies with promising cash flow potential yet trading below their fair value.

Commonwealth Bank of Australia Investment Narrative Recap

Investors in Commonwealth Bank of Australia are often focused on the bank's ability to deliver steady earnings and maintain its leading market position in a competitive and evolving financial services sector. The recent partnership with Indigenous Business Australia underscores CBA’s commitment to financial inclusion, but it is not expected to have a material impact on short-term earnings catalysts or address the core risk of margin pressure from increased competition in digital banking.

Among recent developments, the ongoing digital transformation and investment in technology remains highly relevant as CBA faces intensifying competition from fintechs and digital-first peers. While the partnership may enhance the bank's reputation and support broader inclusion, the key driver for investor returns continues to be CBA’s capacity to defend margins and grow in a market where digital disruption is accelerating.

On the other hand, investors should also be mindful of mounting competition in digital payments and savings, which could …

Read the full narrative on Commonwealth Bank of Australia (it's free!)

Commonwealth Bank of Australia's narrative projects A$31.9 billion revenue and A$11.2 billion earnings by 2028. This requires 4.9% yearly revenue growth and a A$1.1 billion increase in earnings from A$10.1 billion currently.

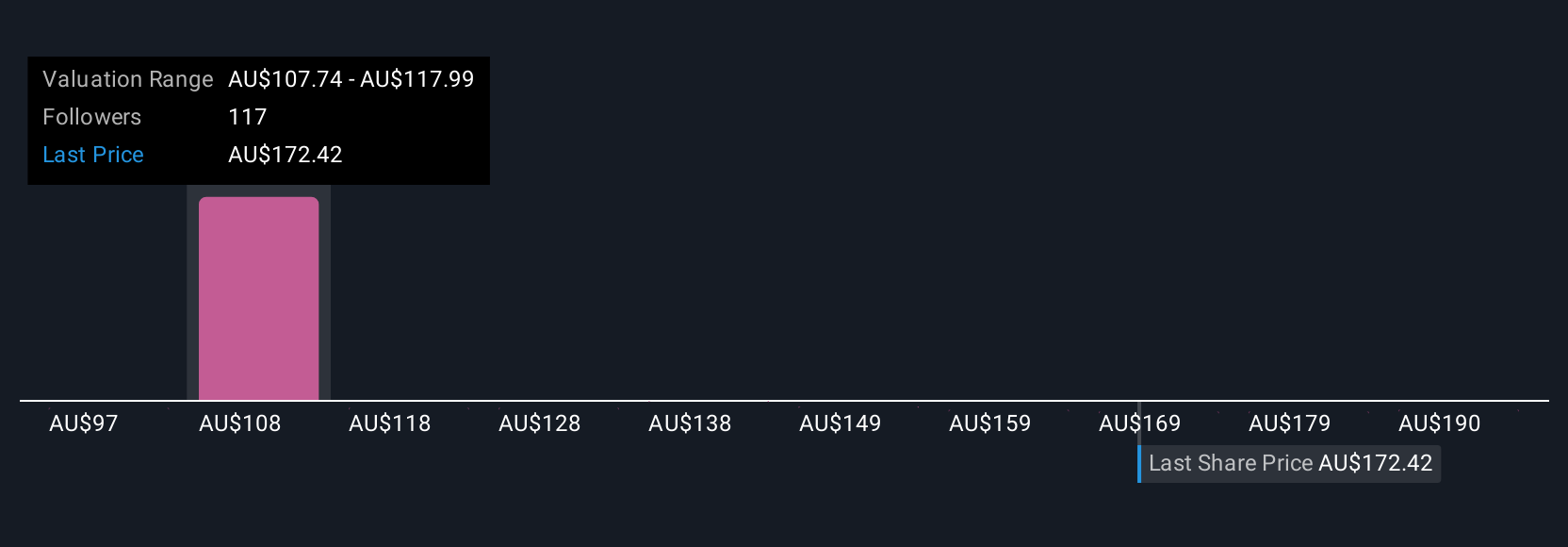

Uncover how Commonwealth Bank of Australia's forecasts yield a A$120.47 fair value, a 29% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate CBA’s fair value between A$100 and A$147.26, with 13 independent views contributing to the debate. This diversity stands alongside ongoing market share battles in digital banking that may further influence CBA’s revenue and earnings outlook, explore the full range of opinions to understand how others are weighing the current opportunities and headwinds.

Explore 13 other fair value estimates on Commonwealth Bank of Australia - why the stock might be worth 41% less than the current price!

Build Your Own Commonwealth Bank of Australia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commonwealth Bank of Australia research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commonwealth Bank of Australia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commonwealth Bank of Australia's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBA

Commonwealth Bank of Australia

Provides retail and commercial banking services in Australia, New Zealand, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives