A Fresh Look at Österreichische Post (WBAG:POST) Valuation Following Mixed Q3 and Nine-Month 2025 Results

Reviewed by Simply Wall St

Österreichische Post (WBAG:POST) just released its third quarter and nine-month results for 2025, giving investors plenty to consider. While third quarter net income ticked up, overall sales and profits slipped for the year so far.

See our latest analysis for Österreichische Post.

Investors seem to be weighing Österreichische Post’s mixed earnings, as the stock has quietly built positive momentum. It has posted a strong 11.25% total shareholder return over the past year and a healthy 41.46% return over five years. While the latest results show near-term pressures, the stock’s longer-term performance signals underlying resilience.

If you’re interested in companies with a proven track record and sustained insider conviction, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Given the stock’s recent gains and resilient long-term returns, the key question is whether Österreichische Post shares still offer value for new investors or if the market has already priced in its future growth prospects.

Most Popular Narrative: Fairly Valued

Österreichische Post closed at €30.30, just above the most widely followed narrative's fair value estimate of €29.90. Both figures are closely aligned, fueling debate about what supports this pricing.

Accelerated rollout of automation, self-service branches, and technology upgrades (robotics, order-picking systems, digital channels) is expected to lower operational cost per unit. This increases EBITDA margins and bottom-line earnings over time. The successful turnaround and integration of bank99, along with expanded financial and digital services in the retail network, produces new recurring revenue streams and potential operating leverage, contributing positively to long-term earnings growth and margin expansion.

Want to know what powers this valuation? The real story involves bold profit margin upgrades and forward-looking growth targets you might not expect. Discover which financial levers analysts are betting on and see the numbers that could shift everything.

Result: Fair Value of €29.90 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing mail volumes and persistent labor cost pressures remain key risks. These factors could challenge Österreichische Post’s ability to sustain margin improvements.

Find out about the key risks to this Österreichische Post narrative.

Another View: Multiples Raise Caution

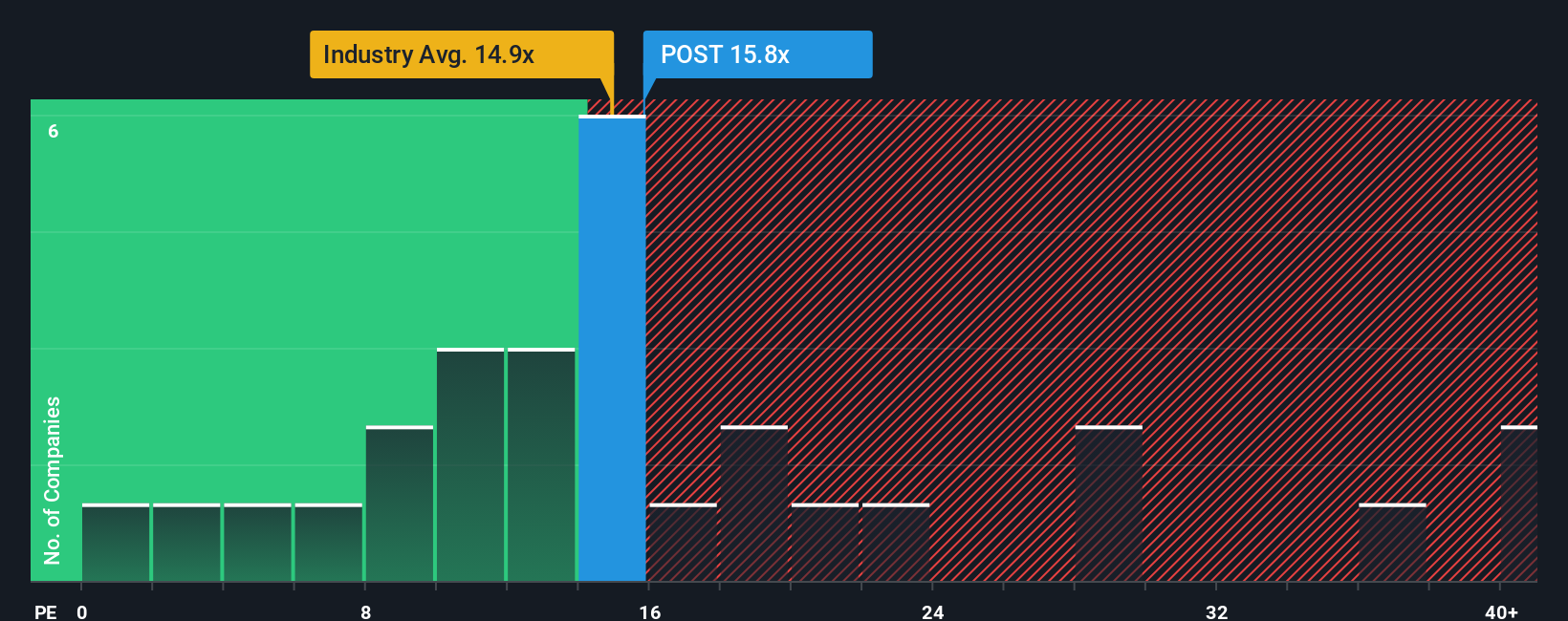

Looking at valuation from a different angle, Österreichische Post’s price is expensive based on its earnings ratio of 15.8x, compared to a lower 14.8x for the European Logistics industry and a much higher peer average of 28.6x. Its fair ratio is estimated at 17.8x, which highlights some room but also points to potential risk if sentiment shifts. Could this premium signal future outperformance, or does it expose shares to a pullback if growth falters?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Österreichische Post for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Österreichische Post Narrative

If these views don't fully align with your own or you enjoy drawing your own conclusions, you can craft a narrative yourself in just a few minutes. Do it your way

A great starting point for your Österreichische Post research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Set yourself up for success by uncovering fresh opportunities beyond Österreichische Post with these tailored stock lists, each one designed to match your ambitions and strategy.

- Capitalize on long-term trends and see which companies are delivering steady income through these 15 dividend stocks with yields > 3% with impressive yields.

- Get ahead of the curve by targeting innovation. Spot the latest breakthroughs and movers among these 27 AI penny stocks transforming the future.

- Fuel your portfolio’s potential by searching for hidden gems and overlooked bargains with these 884 undervalued stocks based on cash flows now making waves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:POST

Österreichische Post

Provides postal and parcel services in Austria, Germany, Southeast and Eastern Europe, Turkey, Azerbaijan, and internationally.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives