- Saudi Arabia

- /

- Food

- /

- SASE:2286

Middle Eastern Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As Gulf markets navigate a landscape marked by economic uncertainty and geopolitical tensions, investors are closely watching the potential impact of U.S. Federal Reserve rate cuts and fluctuating oil prices on regional indices. In this context, dividend stocks can offer a measure of stability and income, making them an attractive consideration for those looking to balance risk in their portfolios amidst the current market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.12% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.13% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.30% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.32% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.34% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.35% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.21% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.47% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.16% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.62% | ★★★★★☆ |

Click here to see the full list of 70 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Emaar Properties PJSC (DFM:EMAAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emaar Properties PJSC is involved in property investment, development, and management both in the United Arab Emirates and internationally, with a market capitalization of AED120.21 billion.

Operations: Emaar Properties PJSC generates revenue through its segments of Real Estate (AED31.41 billion), Leasing, Retail and Related Activities (AED7.36 billion), and Hospitality (AED2.16 billion).

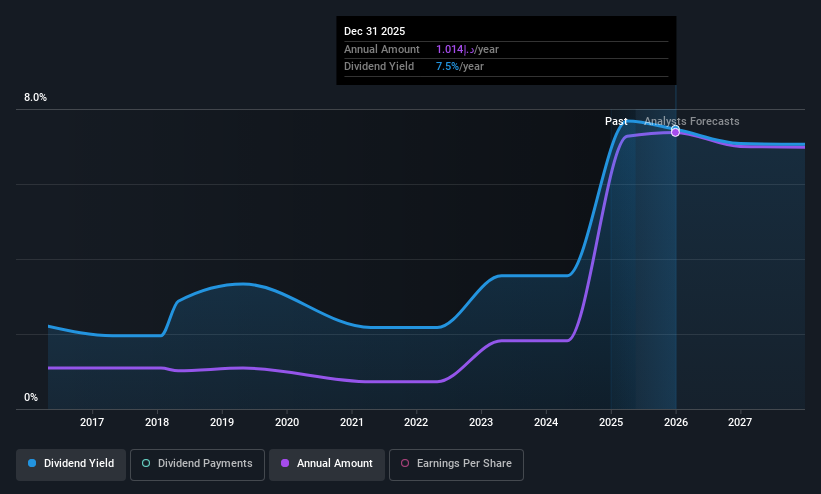

Dividend Yield: 7.4%

Emaar Properties PJSC demonstrates a strong capacity to maintain its dividend payments, with a payout ratio of 57.8% and cash payout ratio of 26.7%, indicating coverage by both earnings and cash flows. Despite its attractive dividend yield of 7.35%, which is among the top in the AE market, Emaar's dividends have been volatile over the past decade. Recent financial results show significant growth in sales and net income, bolstering its position as a competitive dividend stock in the region.

- Delve into the full analysis dividend report here for a deeper understanding of Emaar Properties PJSC.

- Our valuation report here indicates Emaar Properties PJSC may be undervalued.

National General Insurance (P.J.S.C.) (DFM:NGI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National General Insurance Co. (P.J.S.C.) operates in the United Arab Emirates, providing life and general insurance as well as reinsurance services, with a market cap of AED1.01 billion.

Operations: National General Insurance Co. (P.J.S.C.) generates revenue primarily from its insurance segment, with AED894.75 million, and investments contributing AED107.57 million.

Dividend Yield: 7.3%

National General Insurance (P.J.S.C.) offers a compelling dividend yield of 7.32%, ranking in the top 25% within the AE market. The company's payout ratios—56.3% for earnings and 44.2% for cash flows—indicate sustainable dividend coverage, though its dividend history has been volatile over the past decade. Recent earnings show stable performance with net income of AED 85.25 million for six months ending June 2025, reflecting consistent profitability despite slight year-on-year fluctuations.

- Click here to discover the nuances of National General Insurance (P.J.S.C.) with our detailed analytical dividend report.

- Our valuation report unveils the possibility National General Insurance (P.J.S.C.)'s shares may be trading at a premium.

Fourth Milling (SASE:2286)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, focusing on the production, packaging, and sale of flour and its byproducts, as well as animal feed and bran products, with a market cap of SAR2.08 billion.

Operations: Fourth Milling Company's revenue is primarily derived from its food processing segment, which generated SAR637.41 million.

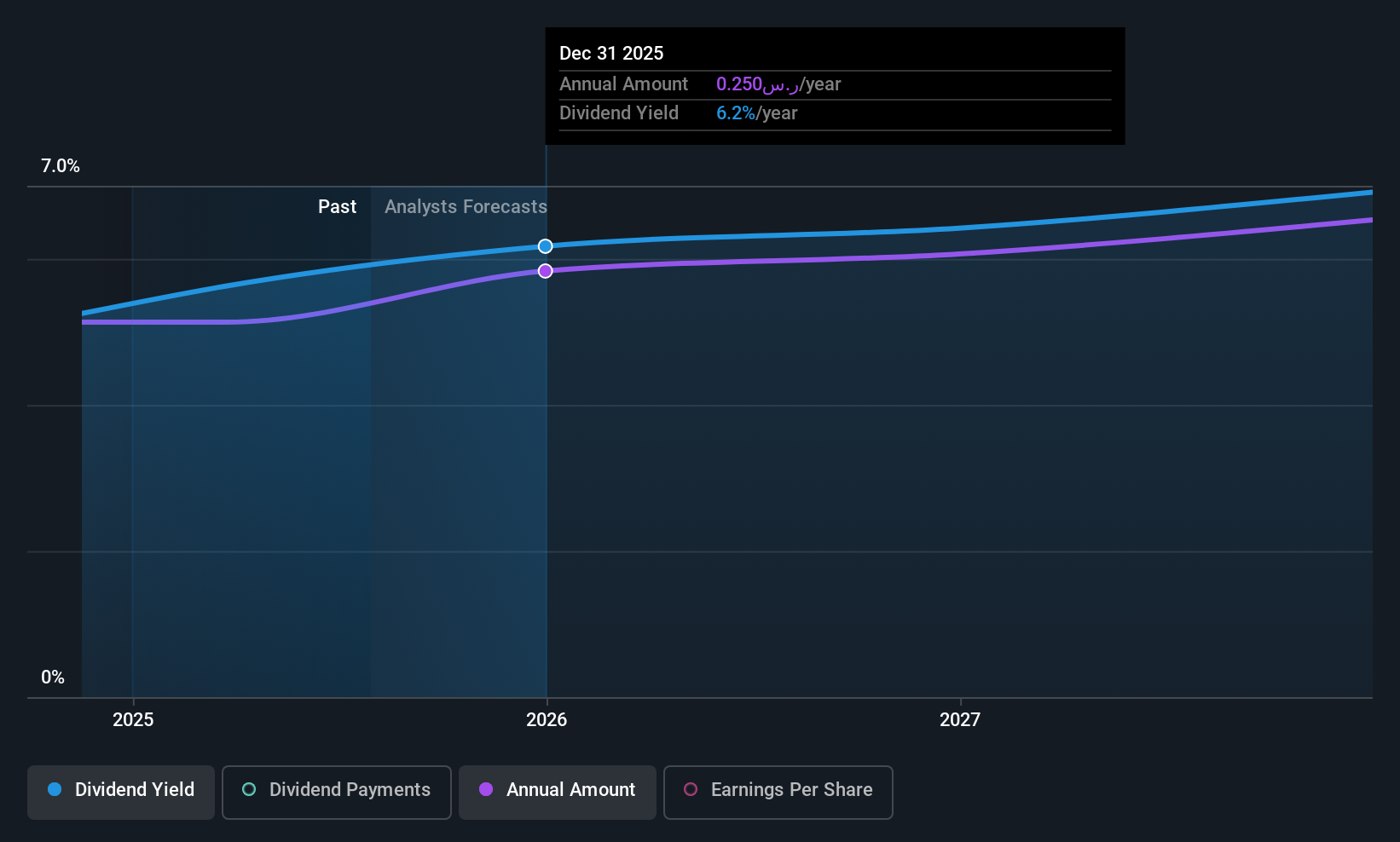

Dividend Yield: 5.7%

Fourth Milling's dividends are backed by a 67.5% payout ratio and a 59.9% cash payout ratio, suggesting sustainability. The recent dividend yield of 5.66% ranks it among the top payers in the SA market. While it's too early to assess dividend growth or stability, earnings grew by 13% last year, supporting future payouts. Recent results show modest sales and net income increases for Q2 and H1 2025, with interim dividends approved at SAR 0.11 per share.

- Unlock comprehensive insights into our analysis of Fourth Milling stock in this dividend report.

- Our valuation report unveils the possibility Fourth Milling's shares may be trading at a discount.

Summing It All Up

- Click here to access our complete index of 70 Top Middle Eastern Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2286

Fourth Milling

Produces of flour, feed, bran, and wheat derivatives in the Kingdom of Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.