- Israel

- /

- Semiconductors

- /

- TASE:ARTS

Middle Eastern Penny Stocks: 3 Picks With Market Caps Under US$70M

Reviewed by Simply Wall St

With UAE stock markets edging higher on rising oil prices and hopes for a U.S. Federal Reserve rate cut, the Middle East market is experiencing a wave of cautious optimism. Penny stocks, though often considered niche investments, can offer unique growth opportunities by focusing on smaller or newer companies with strong financial health. This article highlights three such penny stocks from the Middle East that combine balance sheet resilience with potential for impressive returns.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.044 | ₪218.24M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.45 | AED14.58B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.793 | AED2.25B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.703 | ₪212.18M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

We'll examine a selection from our screener results.

Sharjah Insurance Company P.S.C (ADX:SICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Insurance Company P.S.C. provides general, property, non-property, and life insurance products in the United Arab Emirates and internationally, with a market cap of AED225 million.

Operations: The company generates revenue primarily from underwriting activities, including AED7.24 million from fire insurance, AED0.72 million from marine insurance, and AED1.60 million from other types of underwriting.

Market Cap: AED225M

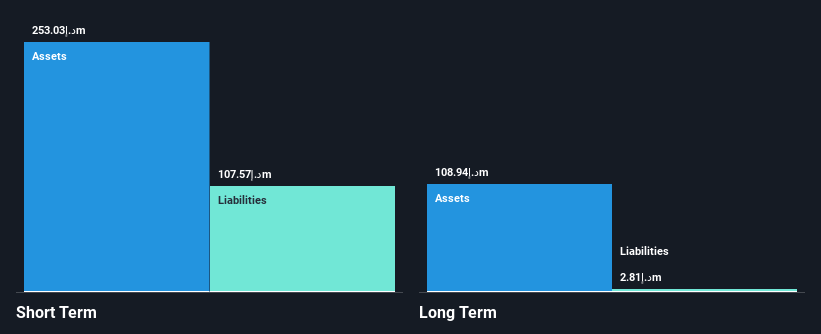

Sharjah Insurance Company P.S.C. has demonstrated significant earnings growth, with a recent increase of 4002.5% over the past year, surpassing industry averages. The company is debt-free and maintains strong financial health, with short-term assets of AED265.5 million exceeding both short- and long-term liabilities. Its Price-To-Earnings ratio of 4.6x suggests it may be undervalued compared to the AE market average. Recent earnings reports highlight a substantial rise in net income for Q3 2025 to AED17.49 million from AED3.8 million a year ago, reflecting improved profitability and operational efficiency despite its low Return on Equity at 16.7%.

- Click here to discover the nuances of Sharjah Insurance Company P.S.C with our detailed analytical financial health report.

- Assess Sharjah Insurance Company P.S.C's previous results with our detailed historical performance reports.

Airtouch Solar (TASE:ARTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtouch Solar Ltd offers autonomous water-free robotic cleaning solutions for solar panels and has a market cap of ₪18.13 million.

Operations: The company's revenue primarily comes from its Industrial Automation & Controls segment, generating ₪44.24 million.

Market Cap: ₪18.13M

Airtouch Solar Ltd, with a market cap of ₪18.13 million, offers promising autonomous water-free robotic cleaning solutions for solar panels. Despite its unprofitability and negative Return on Equity (-29.2%), the company has shown financial improvement by reducing losses at 1.6% annually over five years and maintaining a stable cash runway exceeding three years based on current free cash flow. While the share price remains highly volatile, Airtouch Solar's experienced management team (average tenure of 2.8 years) and board (4.6 years) provide stability, with short-term assets significantly covering both short- and long-term liabilities.

- Get an in-depth perspective on Airtouch Solar's performance by reading our balance sheet health report here.

- Gain insights into Airtouch Solar's historical outcomes by reviewing our past performance report.

Avrot Industries (TASE:AVRT)

Simply Wall St Financial Health Rating: ★★★★★★

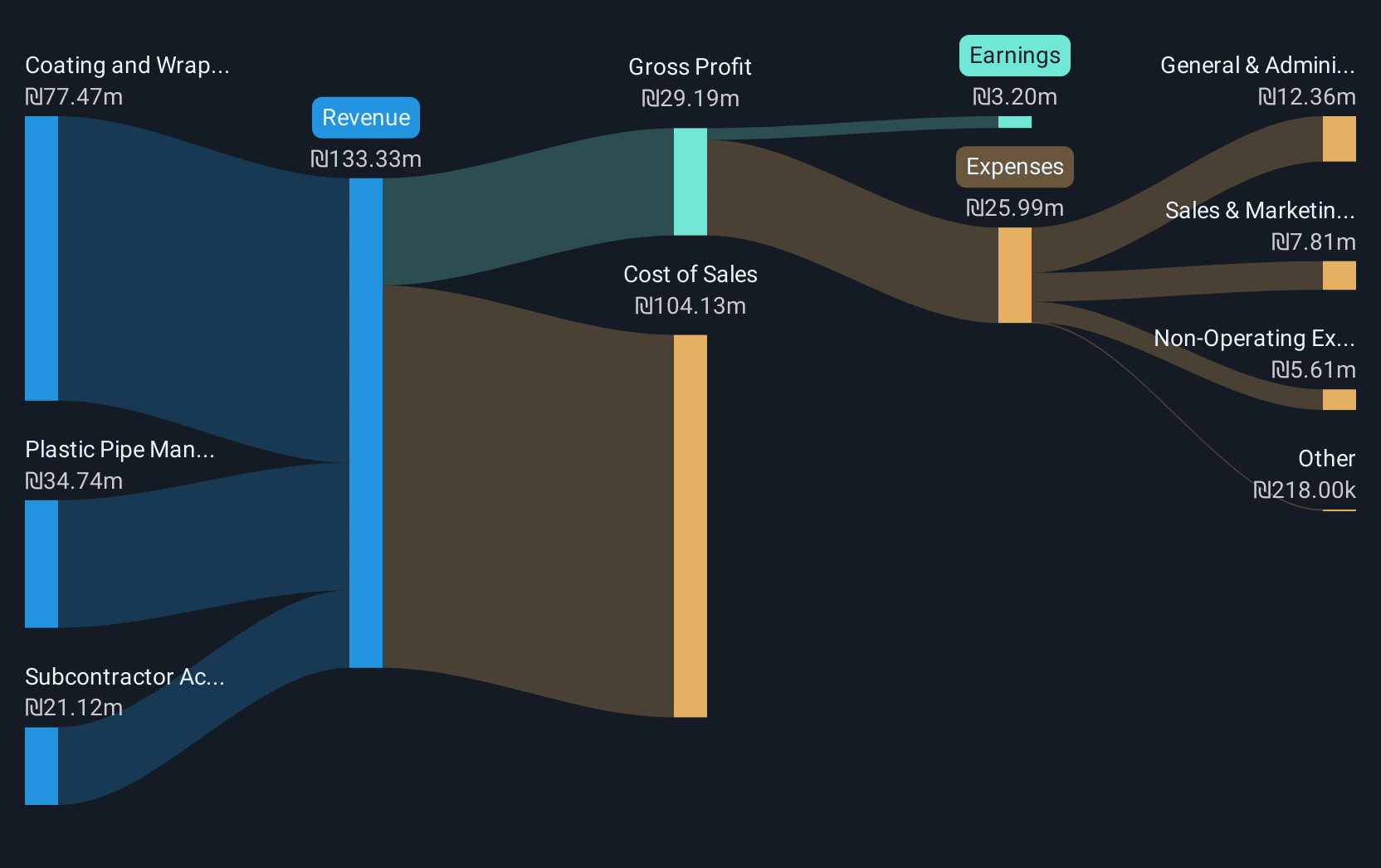

Overview: Avrot Industries Ltd specializes in the lining and coating of steel pipes in Israel, with a market cap of ₪186.30 million.

Operations: Avrot's revenue is primarily derived from coating and wrapping of steel pipes (₪77.47 million), followed by plastic pipe manufacturing (₪34.74 million) and subcontractor activity in water and sewage infrastructure (₪21.12 million).

Market Cap: ₪186.3M

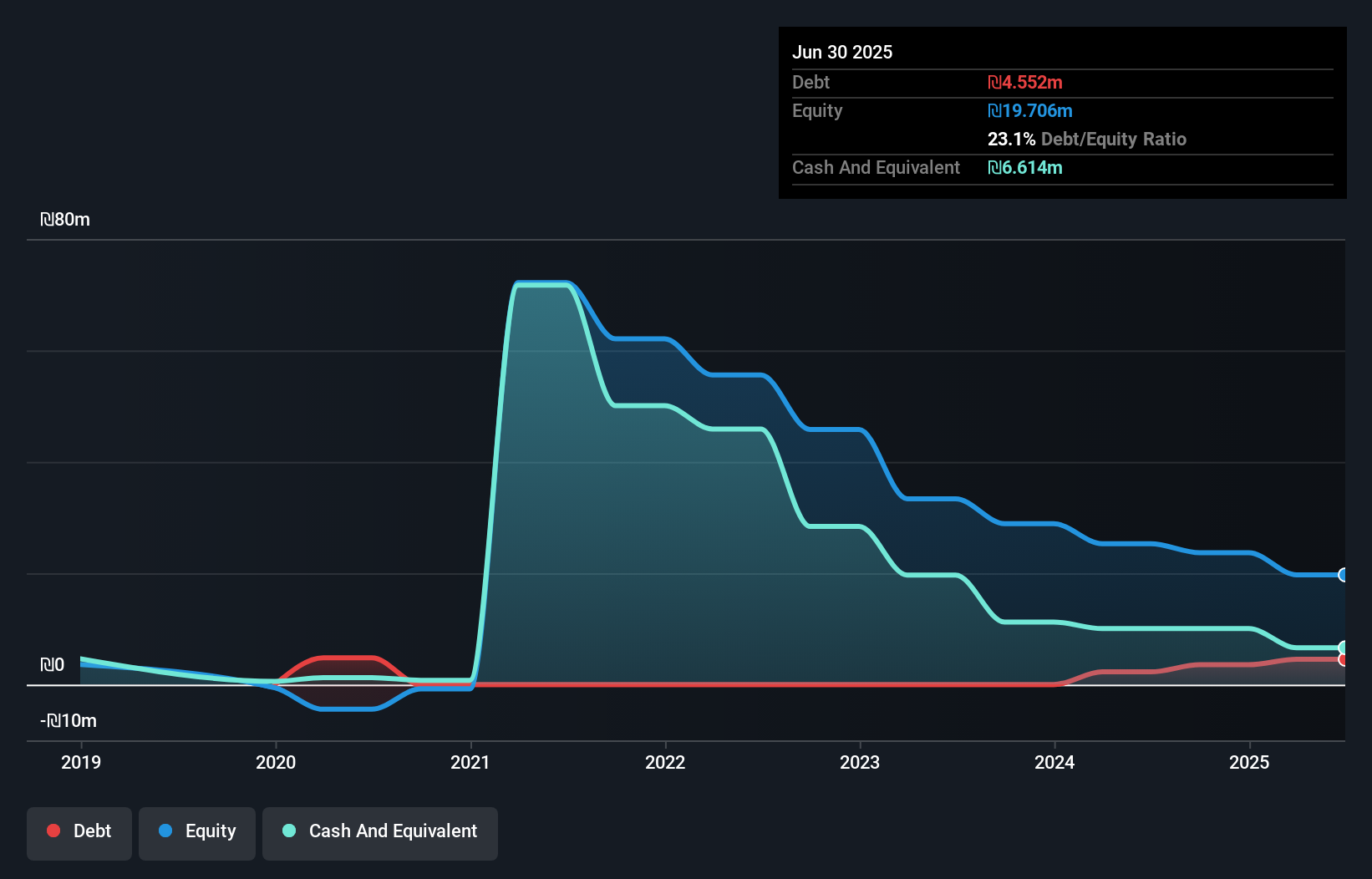

Avrot Industries Ltd, with a market cap of ₪186.30 million, has achieved profitability this year, marking a significant turnaround with high-quality earnings and a satisfactory net debt to equity ratio of 2.3%. The company’s short-term assets (₪109.9M) comfortably cover both short- and long-term liabilities. Despite its low Return on Equity at 3%, Avrot's financial health is bolstered by well-covered interest payments (5.6x EBIT coverage) and reduced debt levels over five years from 109.6% to 9.7%. However, share price volatility remains high compared to most Israeli stocks despite recent improvements.

- Jump into the full analysis health report here for a deeper understanding of Avrot Industries.

- Learn about Avrot Industries' historical performance here.

Taking Advantage

- Explore the 78 names from our Middle Eastern Penny Stocks screener here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ARTS

Airtouch Solar

Provides autonomous water-free robotic cleaning solutions for solar panels.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026