- United Arab Emirates

- /

- Insurance

- /

- ADX:RAKNIC

Middle Eastern Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have been showing resilience, with most Gulf markets firming up on expectations of a U.S. Federal Reserve rate cut and strong oil prices. In this context, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies that can offer significant value. By focusing on those with solid financials and growth potential, investors may find opportunities in these lower-priced stocks to capitalize on the current market dynamics.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.52 | SAR2.03B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.55 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.84 | TRY1.33B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.45 | AED398.48M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.00 | AED12.76B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.822 | AED502.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.555 | ₪189.94M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market cap of AED683.10 million.

Operations: The company generates revenue from its Motor segment, amounting to AED256.71 million.

Market Cap: AED683.1M

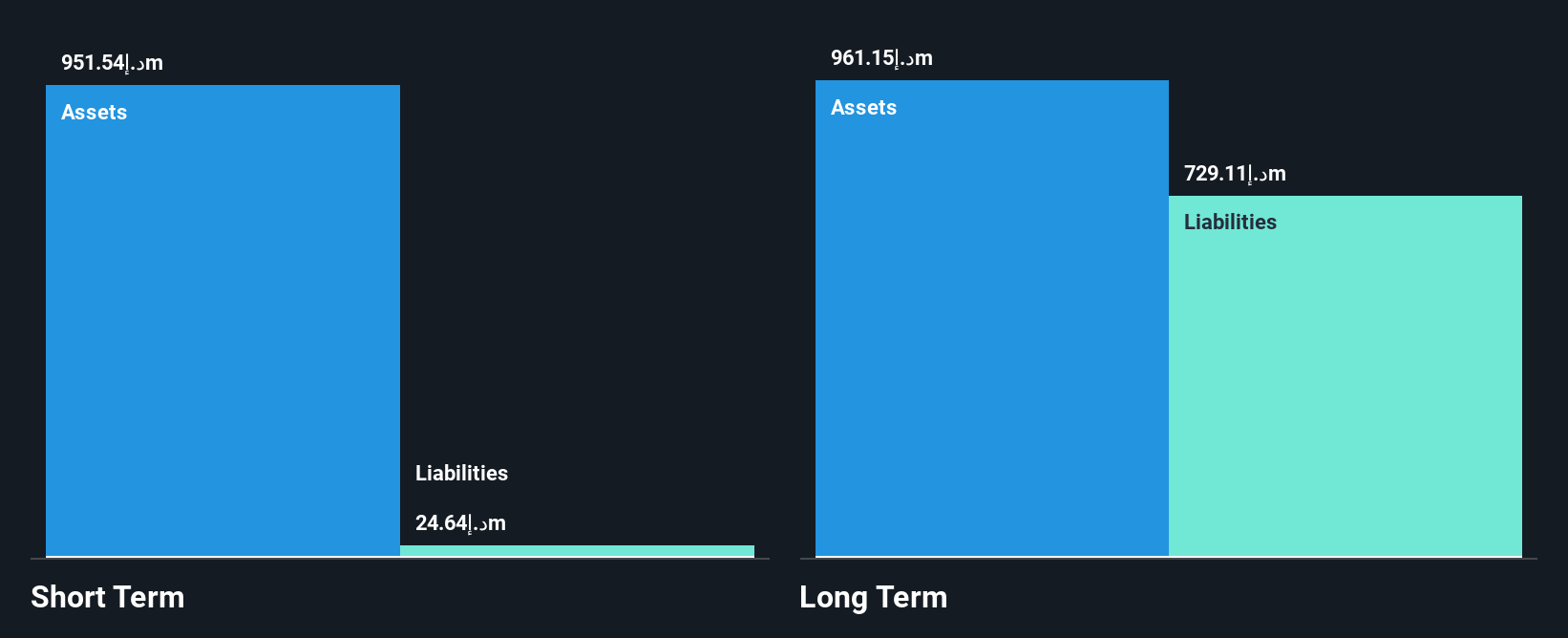

Al Wathba National Insurance Company PJSC, with a market cap of AED683.10 million, has shown significant earnings growth, reporting a net income of AED41.15 million for Q2 2025 compared to a net loss the previous year. The company's earnings growth rate of 134.9% over the past year surpasses industry averages, although this is partly due to large one-off gains impacting results. Despite its low price-to-earnings ratio and stable weekly volatility, AWNIC's share price remains highly volatile short-term. The company maintains strong liquidity with short-term assets exceeding liabilities and has reduced its debt significantly over five years.

- Jump into the full analysis health report here for a deeper understanding of Al Wathba National Insurance Company PJSC.

- Gain insights into Al Wathba National Insurance Company PJSC's past trends and performance with our report on the company's historical track record.

Ras Al Khaimah National Insurance Company P.S.C (ADX:RAKNIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ras Al Khaimah National Insurance Company P.S.C. (ticker: ADX:RAKNIC) operates as an insurance provider offering a range of personal and commercial insurance products, with a market cap of AED400.21 million.

Operations: The company generates revenue through its Life and Health Insurance segment, which accounts for AED173.75 million, and its Motor and General Insurance segment, contributing AED155.44 million.

Market Cap: AED400.21M

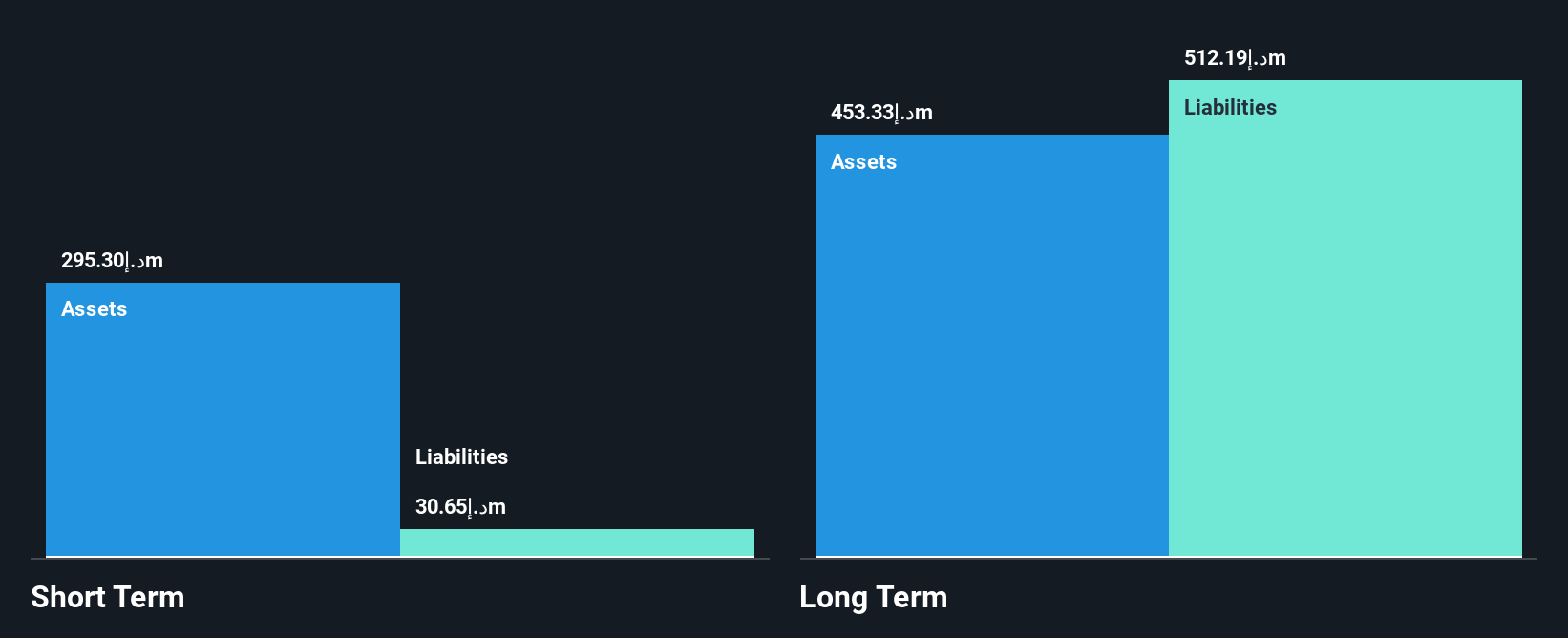

Ras Al Khaimah National Insurance Company P.S.C., with a market cap of AED400.21 million, has demonstrated robust financial performance, achieving a net income of AED13.11 million in Q2 2025 compared to a net loss the previous year. The company's earnings grew by 134.4% over the past year, surpassing industry averages without significant shareholder dilution. Despite having no debt and stable weekly volatility, RAKNIC faces challenges with its short-term assets not covering long-term liabilities (AED512.2M). Its price-to-earnings ratio is favorable at 10.6x against the AE market average of 12.5x, indicating potential value for investors mindful of risks associated with penny stocks.

- Take a closer look at Ras Al Khaimah National Insurance Company P.S.C's potential here in our financial health report.

- Examine Ras Al Khaimah National Insurance Company P.S.C's past performance report to understand how it has performed in prior years.

BioLight Life Sciences (TASE:BOLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioLight Life Sciences Ltd. is an ophthalmic company focused on discovering, developing, and commercializing products for eye conditions, with a market cap of ₪19.39 million.

Operations: There are no reported revenue segments for this company.

Market Cap: ₪19.39M

BioLight Life Sciences Ltd. operates with a market cap of ₪19.39 million and remains pre-revenue, generating less than US$1 million annually. The company is unprofitable, having reported a net loss of ₪6.11 million for the first half of 2025, contrasting with a modest profit in the previous year. Despite being debt-free and possessing short-term assets that cover both short- and long-term liabilities, BioLight faces volatility challenges with its share price fluctuating significantly over recent months. The management team is experienced; however, the company's cash runway is under one year, highlighting liquidity concerns typical for penny stocks in this sector.

- Click to explore a detailed breakdown of our findings in BioLight Life Sciences' financial health report.

- Assess BioLight Life Sciences' previous results with our detailed historical performance reports.

Summing It All Up

- Click through to start exploring the rest of the 77 Middle Eastern Penny Stocks now.

- Contemplating Other Strategies? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:RAKNIC

Ras Al Khaimah National Insurance Company P.S.C

Ras Al Khaimah National Insurance Company P.S.C.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives