As most Gulf markets experience a dip due to weak oil prices, investors are increasingly focused on finding stable income sources in the region. In this context, dividend stocks can offer an attractive option for those seeking reliable returns amid market volatility.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.58% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.61% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.14% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.22% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.09% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.94% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.20% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.63% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.68% | ★★★★★☆ |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | 6.06% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Emirates Insurance Company P.J.S.C (ADX:EIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Insurance Company P.J.S.C. operates in the general insurance and reinsurance sectors across the United Arab Emirates, the United States, and Europe, with a market capitalization of AED1.10 billion.

Operations: Emirates Insurance Company P.J.S.C. generates revenue primarily from underwriting, which accounts for AED2.36 billion, and investments, contributing AED88.37 million.

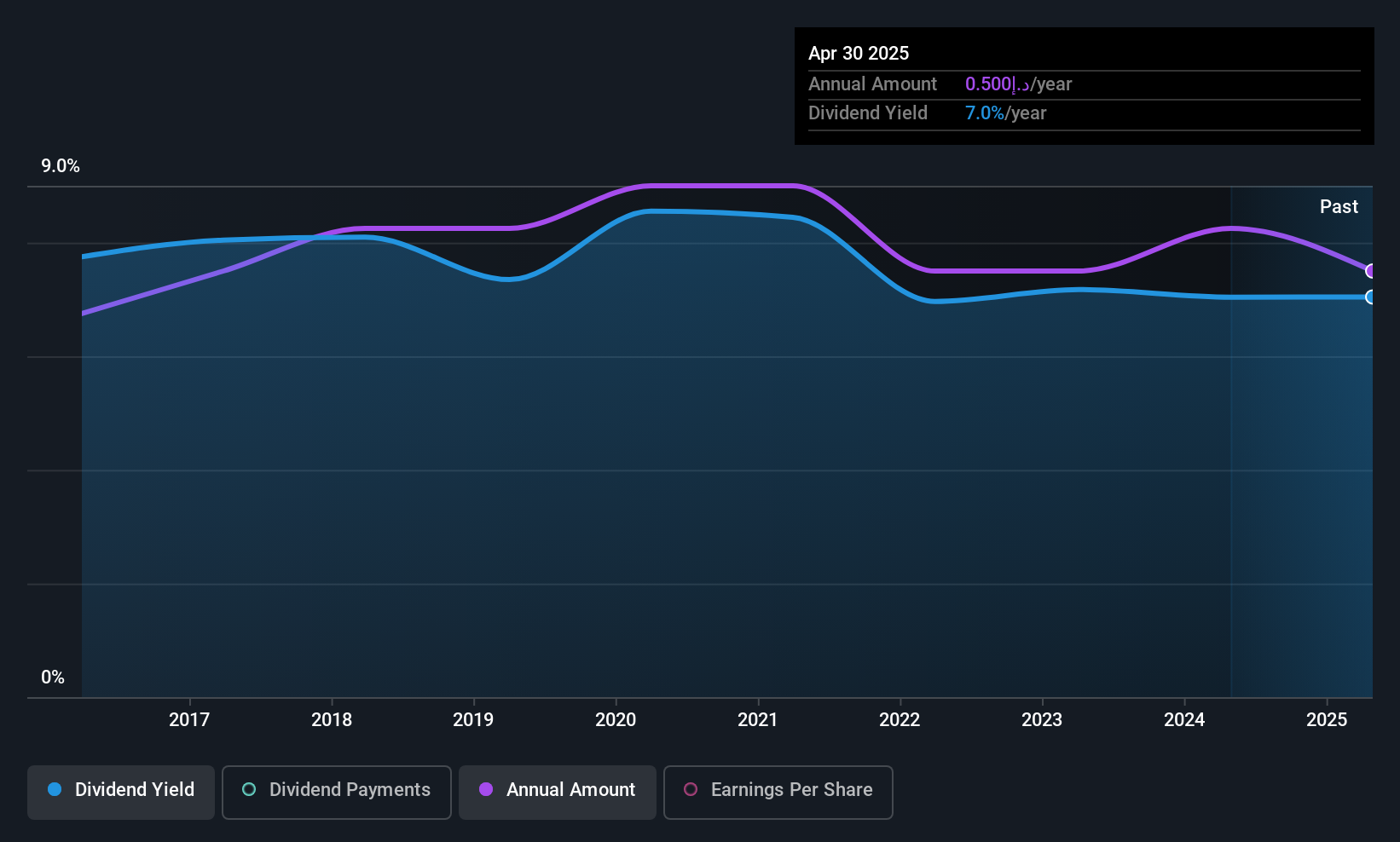

Dividend Yield: 6.8%

Emirates Insurance Company P.J.S.C. offers a dividend yield of 6.85%, placing it in the top 25% of AE market payers, yet its dividends are not well covered by cash flows, with a high cash payout ratio of 188.4%. Despite stable dividends over the past decade, their reliability is questionable due to inconsistent growth and volatility. Recent earnings reports show improved net income and EPS compared to last year, indicating potential financial stability improvements.

- Get an in-depth perspective on Emirates Insurance Company P.J.S.C's performance by reading our dividend report here.

- The analysis detailed in our Emirates Insurance Company P.J.S.C valuation report hints at an inflated share price compared to its estimated value.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is engaged in the production and sale of plastic pipes, spare parts, and various profiles and plastic goods both in Turkey and internationally, with a market cap of TRY14.58 billion.

Operations: Ege Profil Ticaret ve Sanayi Anonim Sirketi generates revenue through the sale of plastic pipes, spare parts, and various profiles and plastic goods.

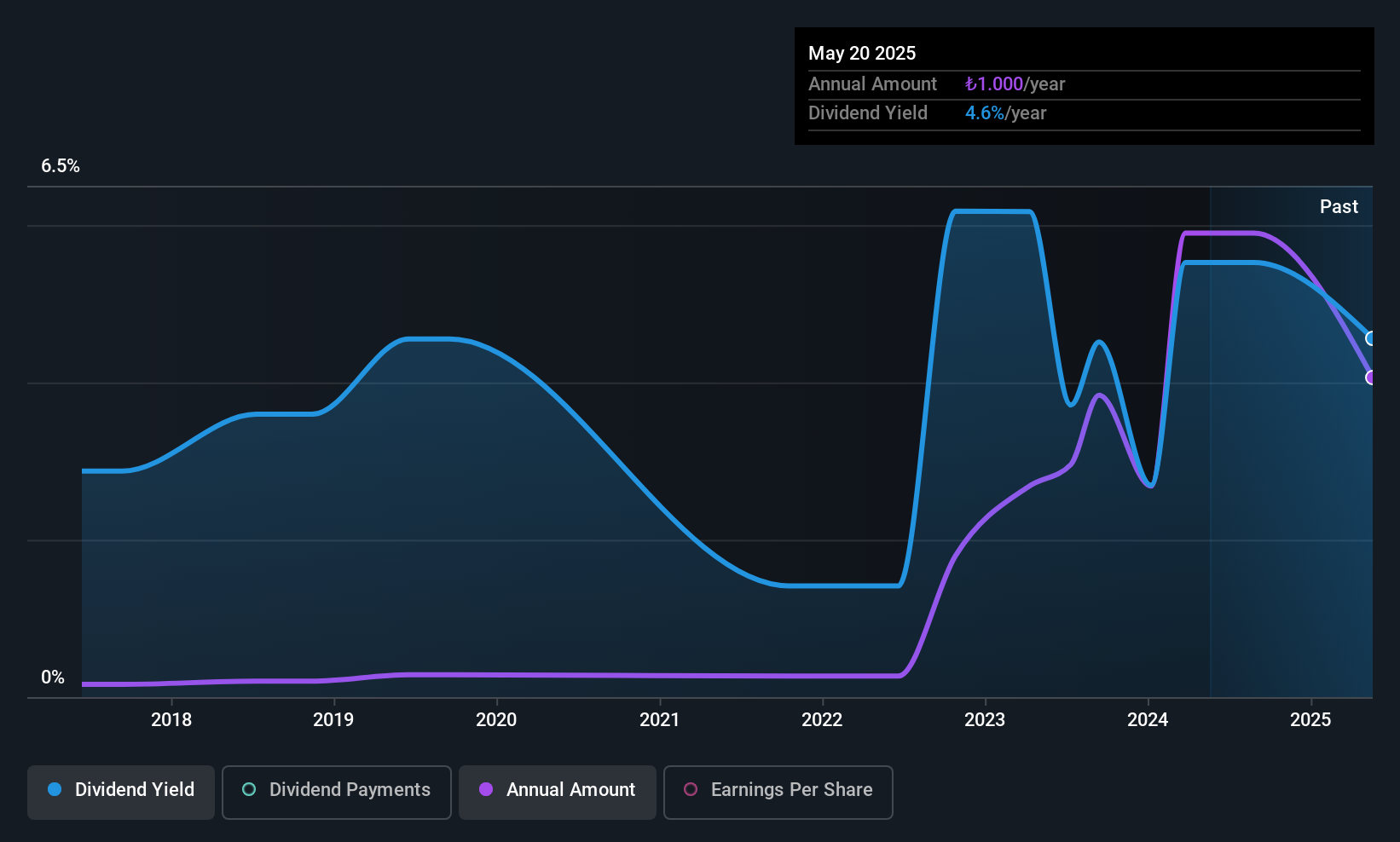

Dividend Yield: 3.7%

Ege Profil Ticaret ve Sanayi Anonim Sirketi offers a dividend yield of 3.74%, ranking in the top 25% of TR market payers. Despite earnings and cash flows covering dividends with payout ratios of 40.9% and 28.8% respectively, the company's dividend history is less reliable, showing volatility over its nine-year payment period. Recent earnings reports reveal a decline in sales and net income for both the second quarter and first half of 2025 compared to last year.

- Take a closer look at Ege Profil Ticaret ve Sanayi Anonim Sirketi's potential here in our dividend report.

- Our valuation report here indicates Ege Profil Ticaret ve Sanayi Anonim Sirketi may be overvalued.

Turkiye Garanti Bankasi (IBSE:GARAN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market cap of TRY613.20 billion.

Operations: Turkiye Garanti Bankasi A.S. generates revenue through its segments, with Retail Banking contributing TRY177.10 billion and Corporate Banking adding TRY167.70 billion, while Investment Banking reported a negative revenue of TRY190.75 billion.

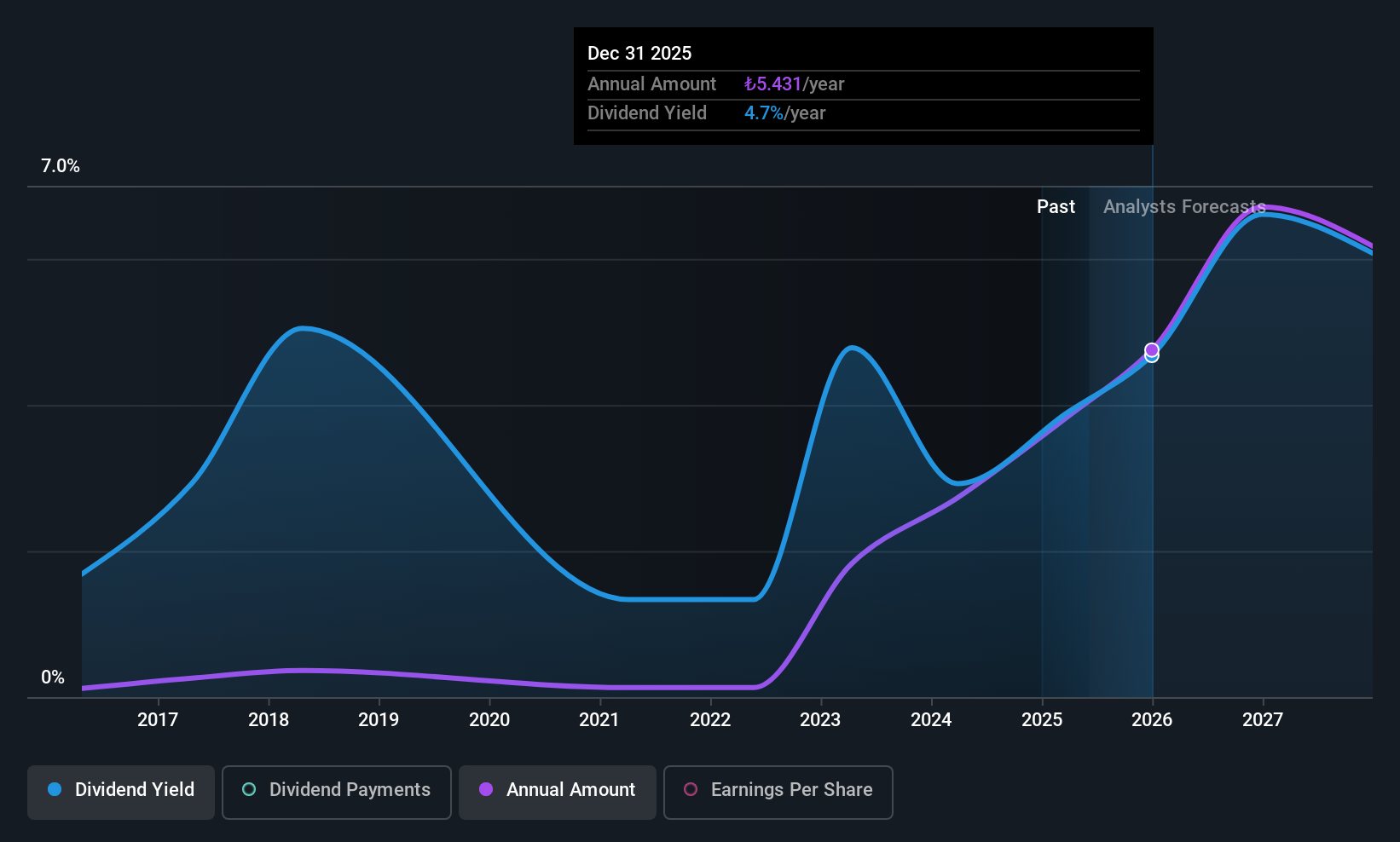

Dividend Yield: 3%

Turkiye Garanti Bankasi's dividend yield of 3.01% is slightly below the top 25% in the Turkish market, and its payout ratio of 18.4% indicates dividends are well covered by earnings. However, its dividend history has been volatile over the past decade, making it less reliable for consistent income. Recent earnings show growth with net interest income and net income rising significantly year-over-year, suggesting potential for future stability despite a high level of non-performing loans at 2.6%.

- Navigate through the intricacies of Turkiye Garanti Bankasi with our comprehensive dividend report here.

- Our valuation report unveils the possibility Turkiye Garanti Bankasi's shares may be trading at a discount.

Make It Happen

- Explore the 67 names from our Top Middle Eastern Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Profil Ticaret ve Sanayi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGPRO

Ege Profil Ticaret ve Sanayi Anonim Sirketi

Produces and sells plastic pipes, spare parts, and various profiles and plastic goods in Turkey an internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives