- United Kingdom

- /

- Wireless Telecom

- /

- LSE:VOD

Vodafone Group (LSE:VOD) Completes €2.5B Note Buyback With Early Tender Results

Reviewed by Simply Wall St

Vodafone Group (LSE:VOD) has recently taken substantial steps in its debt management by increasing its tender offer to €2.5 billion, a move that reflects its focus on optimizing capital structure. This, along with other developments such as strategic alliances and executive changes, could have augmented the company's recent share price movement of 15% over the last quarter. Amid a relatively stable market with a focus on earnings and Federal Reserve updates, Vodafone's actions may have added weight to the broader market moves seen over the same period.

You should learn about the 2 risks we've spotted with Vodafone Group.

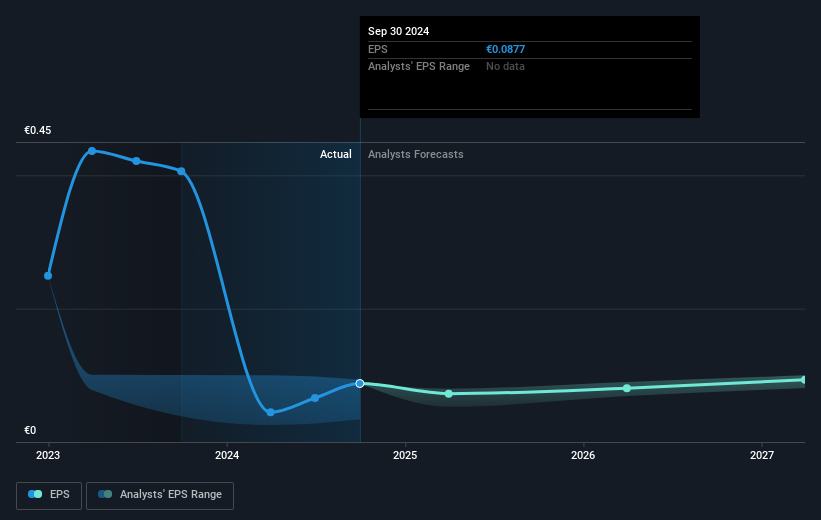

Vodafone's recent €2.5 billion debt management maneuver may significantly influence its operational narrative, particularly as it seeks to enhance revenue growth and financial flexibility through strategic partnerships and asset sales. These efforts could play a key role in mitigating weaker performances in markets like Germany, potentially affecting revenue and future earnings. While the company's shares have shown a 22.69% total return over the past year, it underperformed the broader UK Wireless Telecom industry, which achieved a return of 22.8% over the same period. Such performance metrics could be viewed in light of Vodafone's ongoing restructuring challenges and efforts to bolster digital services.

The current share price of £0.81 reflects a 6.57% discount to the consensus price target of £0.85, indicating a possible undervaluation according to analysts. The company's long-term initiatives, particularly digital partnerships and asset optimization, may influence future revenue and earnings forecasts, though these are tempered by operational challenges and restructuring risks. Vodafone's focus on digital growth and B2B services may not be sufficient to fully counterbalance pressures in traditional connectivity, impacting analyst expectations. Thus, while the price target suggests potential upside, investor caution is warranted given current valuation and market conditions.

Our valuation report here indicates Vodafone Group may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VOD

Vodafone Group

Provides telecommunication services in Germany, the United Kingdom, rest of Europe, Turkey, and South Africa.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives