- New Zealand

- /

- Software

- /

- NZSE:VGL

Vista Group International Leads The Charge Among 3 Global Penny Stocks

Reviewed by Simply Wall St

Global markets have been navigating a period of muted responses to new U.S. tariffs and mixed economic data, with the Nasdaq Composite Index showing resilience among major indices. In such a landscape, investors often look beyond the well-trodden paths of large-cap stocks to explore opportunities in less conventional areas like penny stocks. Despite being an outdated term, penny stocks still represent intriguing possibilities for growth, especially when they are backed by robust balance sheets and sound fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.21 | A$102.37M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.39 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.535 | MYR316.53M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.36 | SGD9.29B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.44 | SEK2.34B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.93 | MYR7.17B | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,824 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Vista Group International (NZSE:VGL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions for the film industry, with a market capitalization of NZ$859.80 million.

Operations: The company's revenue is derived from its Cinema Business, which generates NZ$119.8 million, and its Film Business, contributing NZ$30.2 million.

Market Cap: NZ$859.8M

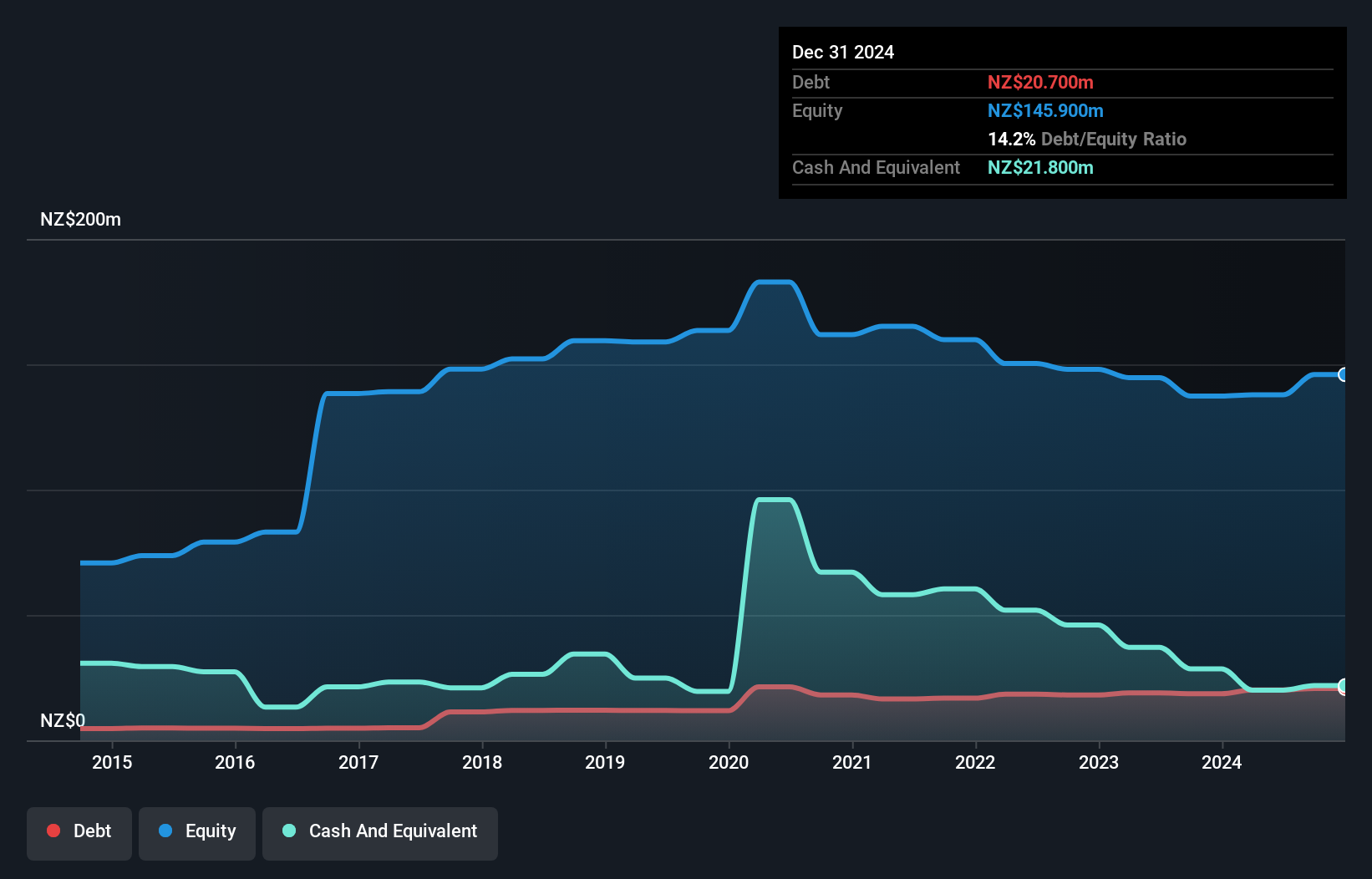

Vista Group International, with a market cap of NZ$859.80 million, is focused on software and data analytics for the film industry. Despite being unprofitable, it has reduced losses by 19.5% annually over five years and maintains more cash than debt. Its Cinema Business generates NZ$119.8 million in revenue, complemented by NZ$30.2 million from its Film Business. With short-term assets exceeding liabilities and a cash runway extending beyond three years, Vista's financial stability is notable amid its volatility stability at 6%. Recent client announcements include Picturehouse Cinemas adopting Vista Cloud across 25 UK sites in early 2025.

- Click here to discover the nuances of Vista Group International with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Vista Group International's future.

Elec-Tech International (SZSE:002005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Elec-Tech International Co., Ltd. manufactures and sells small household appliances and LED products both in China and internationally, with a market cap of CN¥4.33 billion.

Operations: Elec-Tech International Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥4.33B

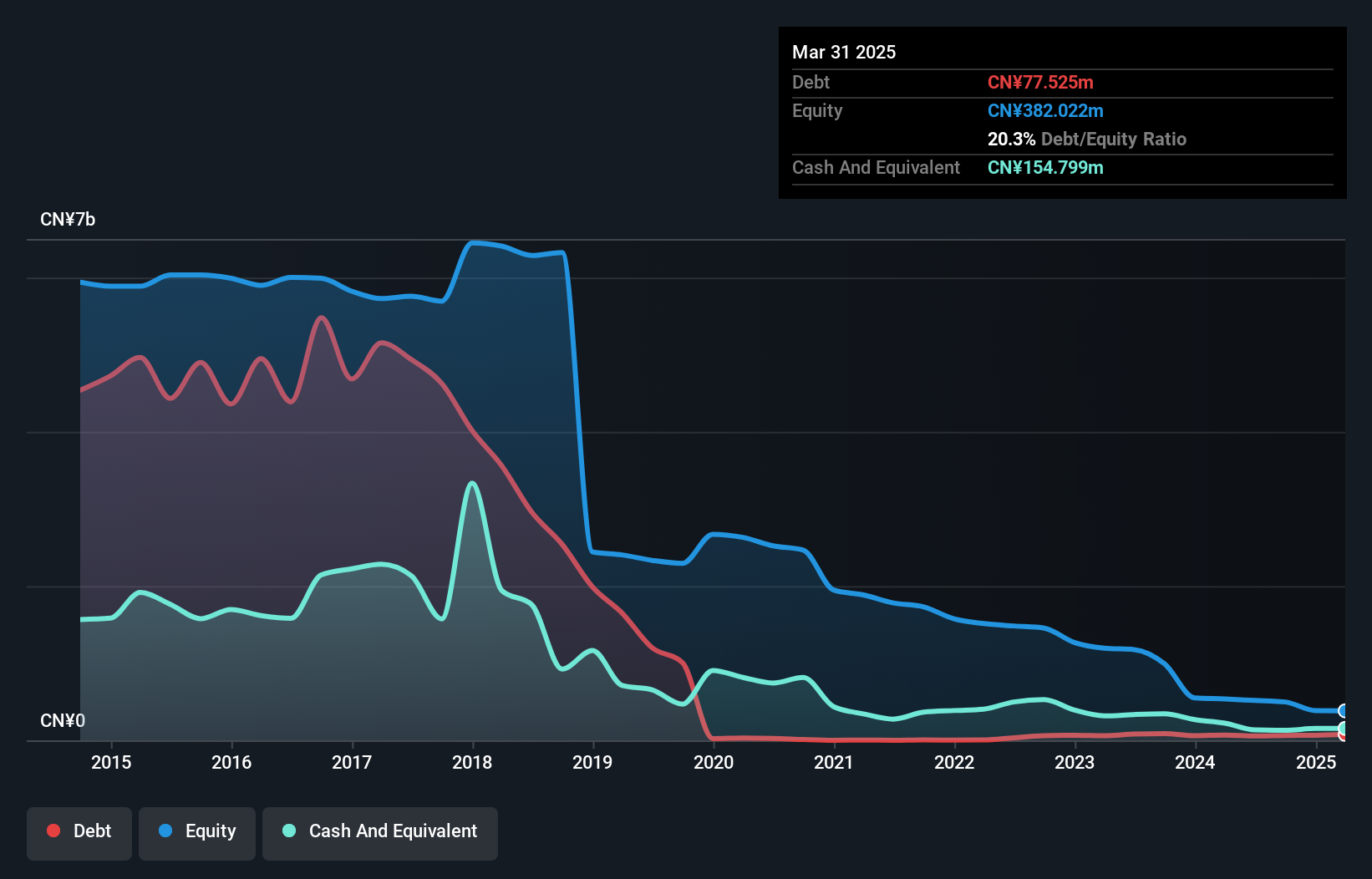

Elec-Tech International, with a market cap of CN¥4.33 billion, reported first-quarter sales of CN¥150.2 million, slightly down from the previous year. Despite having more cash than debt and a sufficient cash runway for over a year, the company faces challenges with short-term liabilities exceeding assets and an auditor expressing doubts about its going concern status. The board's inexperience is evident with an average tenure of 0.8 years, while profitability remains elusive as losses have increased by 1% annually over five years. Recent earnings calls highlight ongoing financial struggles amidst stable weekly volatility at 6%.

- Dive into the specifics of Elec-Tech International here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Elec-Tech International's track record.

Cubic Digital TechnologyLtd (SZSE:300344)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cubic Digital Technology Co., Ltd. manufactures and sells steel frame foamed cement composite boards in China, with a market cap of CN¥2.56 billion.

Operations: Cubic Digital Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.56B

Cubic Digital Technology Co., Ltd., with a market cap of CN¥2.56 billion, has shown a significant increase in first-quarter sales to CN¥43.63 million from CN¥17.35 million the previous year, though it remains unprofitable with a net loss of CN¥17.33 million. The company benefits from more cash than debt and sufficient short-term assets covering liabilities, alongside an experienced board averaging 4.2 years in tenure. Its share price has been highly volatile recently, but no meaningful shareholder dilution occurred over the past year as it continues to trade significantly below its estimated fair value while reducing losses annually by 17.2%.

- Click to explore a detailed breakdown of our findings in Cubic Digital TechnologyLtd's financial health report.

- Learn about Cubic Digital TechnologyLtd's historical performance here.

Where To Now?

- Get an in-depth perspective on all 3,824 Global Penny Stocks by using our screener here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:VGL

Vista Group International

Provides software and data analytics solutions to the film industry.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives