- United Kingdom

- /

- Food

- /

- LSE:BAKK

Venture Life Group And 2 Other UK Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. In such times, investors often seek opportunities in smaller companies that offer potential growth and value. Penny stocks, though an older term, continue to represent these possibilities by focusing on firms with strong financials and promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.802 | £1.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.435 | £47.07M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.88 | £325.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.65 | £131.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.17 | £67.23M | ✅ 3 ⚠️ 5 View Analysis > |

| ME Group International (LSE:MEGP) | £2.24 | £845.53M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Venture Life Group (AIM:VLG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Venture Life Group plc develops and commercializes healthcare products across various international markets, with a market capitalization of £77.47 million.

Operations: The company's revenue is primarily generated from the United Kingdom (£16.17 million), followed by contributions from the Rest of Europe (£2.27 million), Ireland (£1.28 million), and other international markets including Rest of The World, Sweden, Denmark, Netherlands, Lithuania, Canada, USA, France, Brazil, and Germany.

Market Cap: £77.47M

Venture Life Group plc, with a market cap of £77.47 million, is trading at 47.3% below its estimated fair value, presenting potential value for investors. Despite being unprofitable and reporting a net loss of £0.314 million for 2024, the company has seen revenue growth from £22.37 million to £26.59 million year-over-year and forecasts suggest continued revenue growth at 16.4% annually. Its short-term assets (£71.8M) comfortably cover both short-term (£19.3M) and long-term liabilities (£29.8M). The board's average tenure of 5.2 years indicates experienced leadership amidst stable weekly volatility (7%).

- Take a closer look at Venture Life Group's potential here in our financial health report.

- Learn about Venture Life Group's future growth trajectory here.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market cap of £1.25 billion.

Operations: The company's revenue is primarily derived from the United Kingdom with £1.95 billion, followed by the United States at £227.7 million and China at £116.5 million.

Market Cap: £1.25B

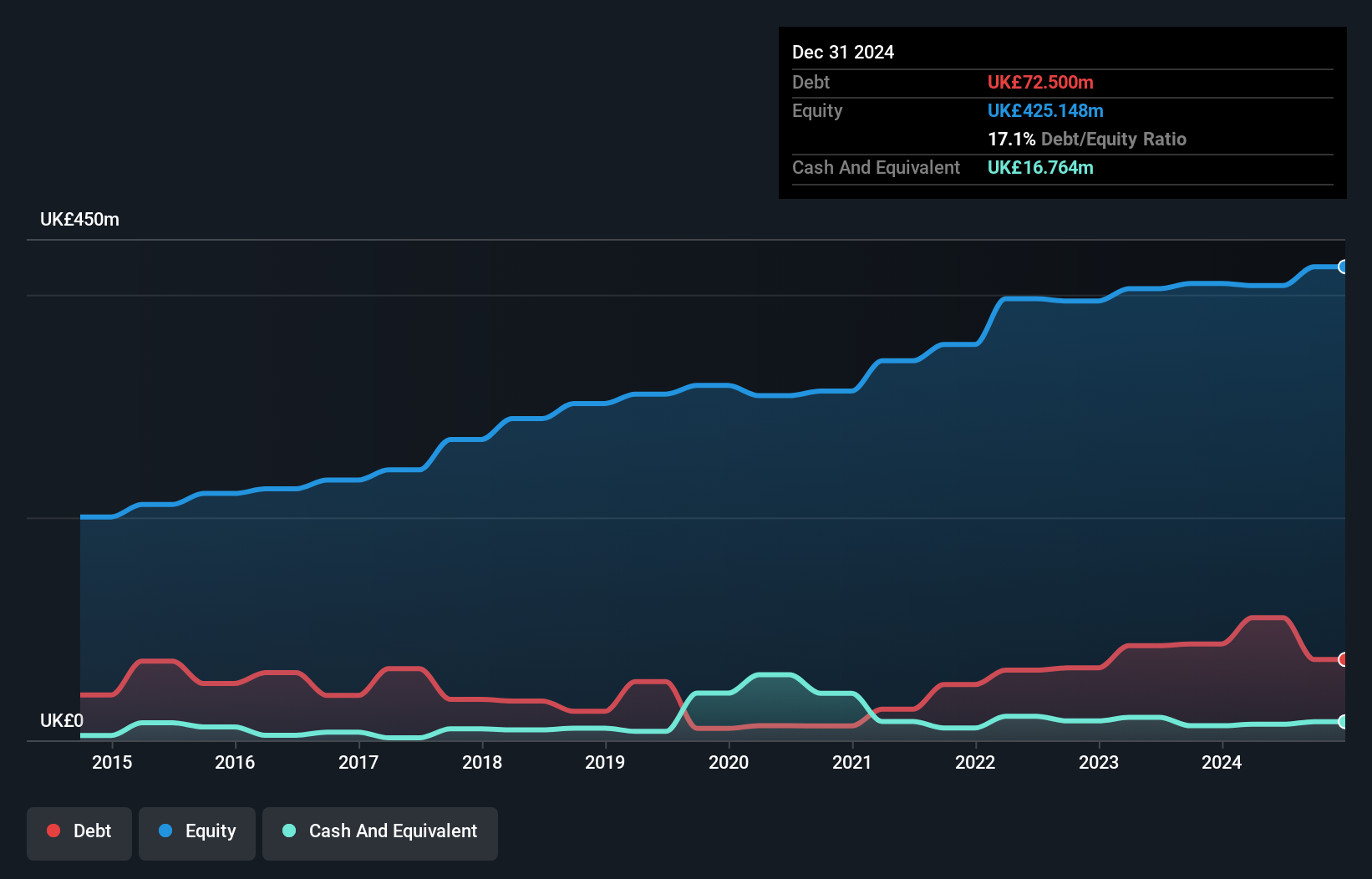

Bakkavor Group, with a market cap of £1.25 billion, is trading at 15.3% below its estimated fair value, suggesting potential undervaluation. Despite a significant one-off loss impacting recent results, the company has demonstrated consistent earnings growth of 7.7% per year over five years and forecasts indicate further growth at 12.69% annually. The management team and board are experienced, with average tenures of 4.3 and 4.8 years respectively, while debt levels are well-managed with a net debt to equity ratio of 31.1%. Recent revenue for the first quarter reached £559.3 million alongside an increased dividend declaration.

- Click to explore a detailed breakdown of our findings in Bakkavor Group's financial health report.

- Review our growth performance report to gain insights into Bakkavor Group's future.

Henry Boot (LSE:BOOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Henry Boot PLC operates in the United Kingdom, focusing on property investment and development, land promotion, and construction activities, with a market cap of £317.01 million.

Operations: The company's revenue segments include £81.18 million from construction, £78.04 million from land promotion, and £170.33 million from property investment and development.

Market Cap: £317.01M

Henry Boot PLC, with a market cap of £317.01 million, operates in property investment and development, land promotion, and construction. Recent changes include the upcoming departure of Nick Duckworth from Hallam Land. Despite an unqualified auditor's report expressing going concern doubts, the company maintains a satisfactory net debt to equity ratio of 13.1% and has well-covered interest payments by EBIT (7x). However, earnings have declined by 5.3% annually over five years with negative growth last year (-11.3%). The Price-To-Earnings ratio is favorable at 13.6x compared to the UK market average of 16.3x.

- Click here and access our complete financial health analysis report to understand the dynamics of Henry Boot.

- Explore Henry Boot's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 295 companies within our UK Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bakkavor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAKK

Bakkavor Group

Engages in the preparation and marketing of fresh prepared foods in the United Kingdom, the United States, and China.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives