- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market concerns, penny stocks remain an intriguing investment area for those seeking potential growth opportunities. While traditionally associated with smaller or newer companies, these stocks can offer significant value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.215 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.25 | £53.93M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.05 | £314.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.45 | £124.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £193.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.19 | £67.66M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.14 | £808.09M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Iofina (AIM:IOF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iofina plc explores, develops, and produces iodine and halogen-based specialty chemical derivatives from oil and gas operations across North America, Asia, South America, Europe, and internationally with a market cap of £52.28 million.

Operations: The company's revenue is primarily derived from its Halogen Derivatives and Iodine segment, which generated $54.47 million.

Market Cap: £52.28M

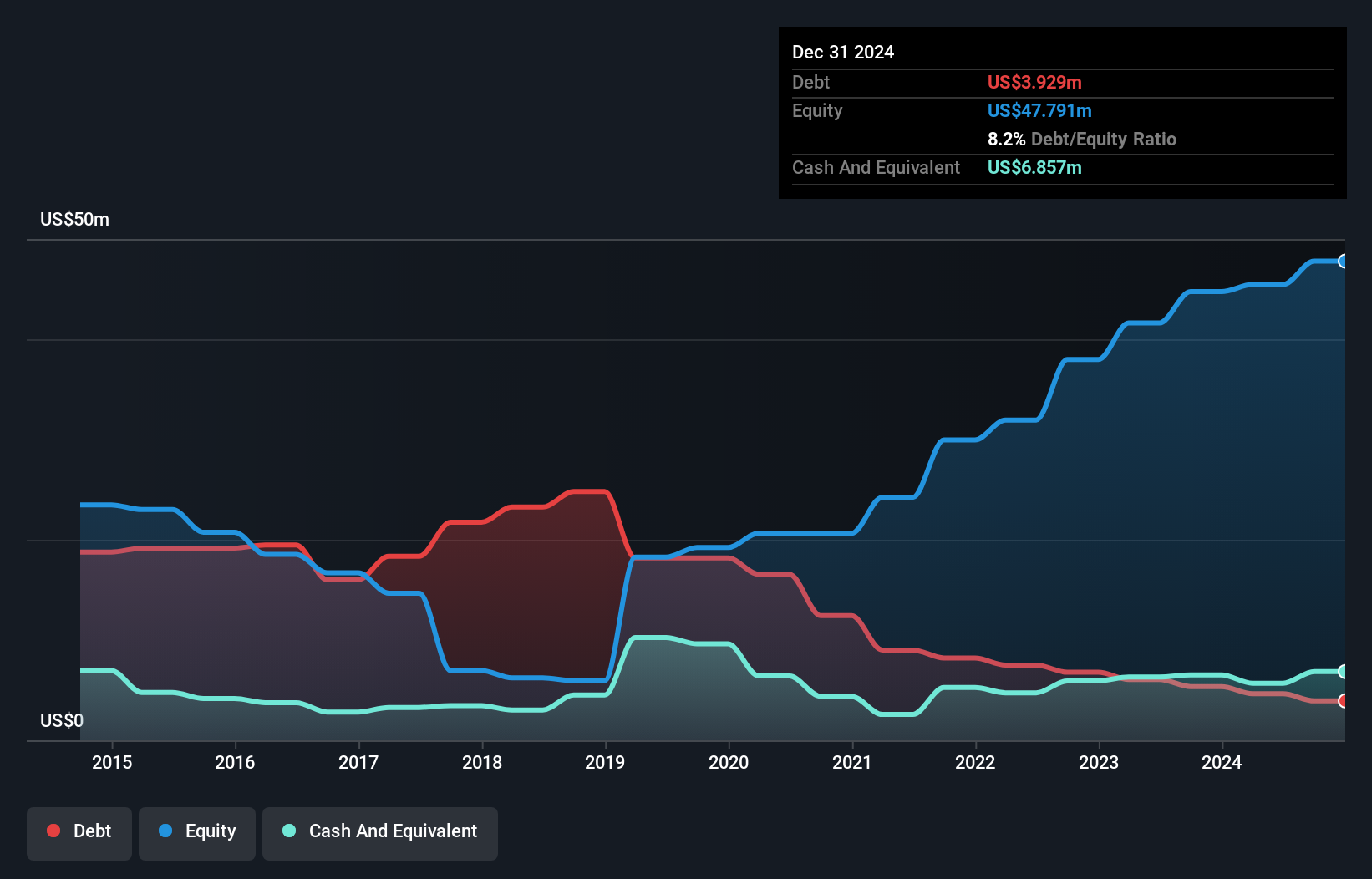

Iofina plc, with a market cap of £52.28 million, has demonstrated financial resilience despite recent challenges. The company reported US$54.47 million in revenue for 2024, although net income decreased to US$2.92 million from the previous year’s US$6.56 million, reflecting a drop in profit margins to 5.4%. Despite this decline, Iofina's debt situation is favorable with more cash than total debt and well-covered interest payments by EBIT (31.4x). The management team and board are experienced, contributing to stable operations amidst volatile earnings growth (-55.5% last year), yet revenue is projected to grow annually by 12.68%.

- Navigate through the intricacies of Iofina with our comprehensive balance sheet health report here.

- Learn about Iofina's future growth trajectory here.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is involved in the ownership, manufacturing, and distribution of batteries, lighting, vaping products, sports nutrition and wellness items, and branded household consumer goods across the UK, Ireland, the Netherlands, France, Europe at large and internationally with a market cap of £213.52 million.

Operations: Supreme generates its revenue from three main segments: Vaping (£128.95 million), Electricals (£53.37 million), and Drinks & Wellness (£48.76 million).

Market Cap: £213.52M

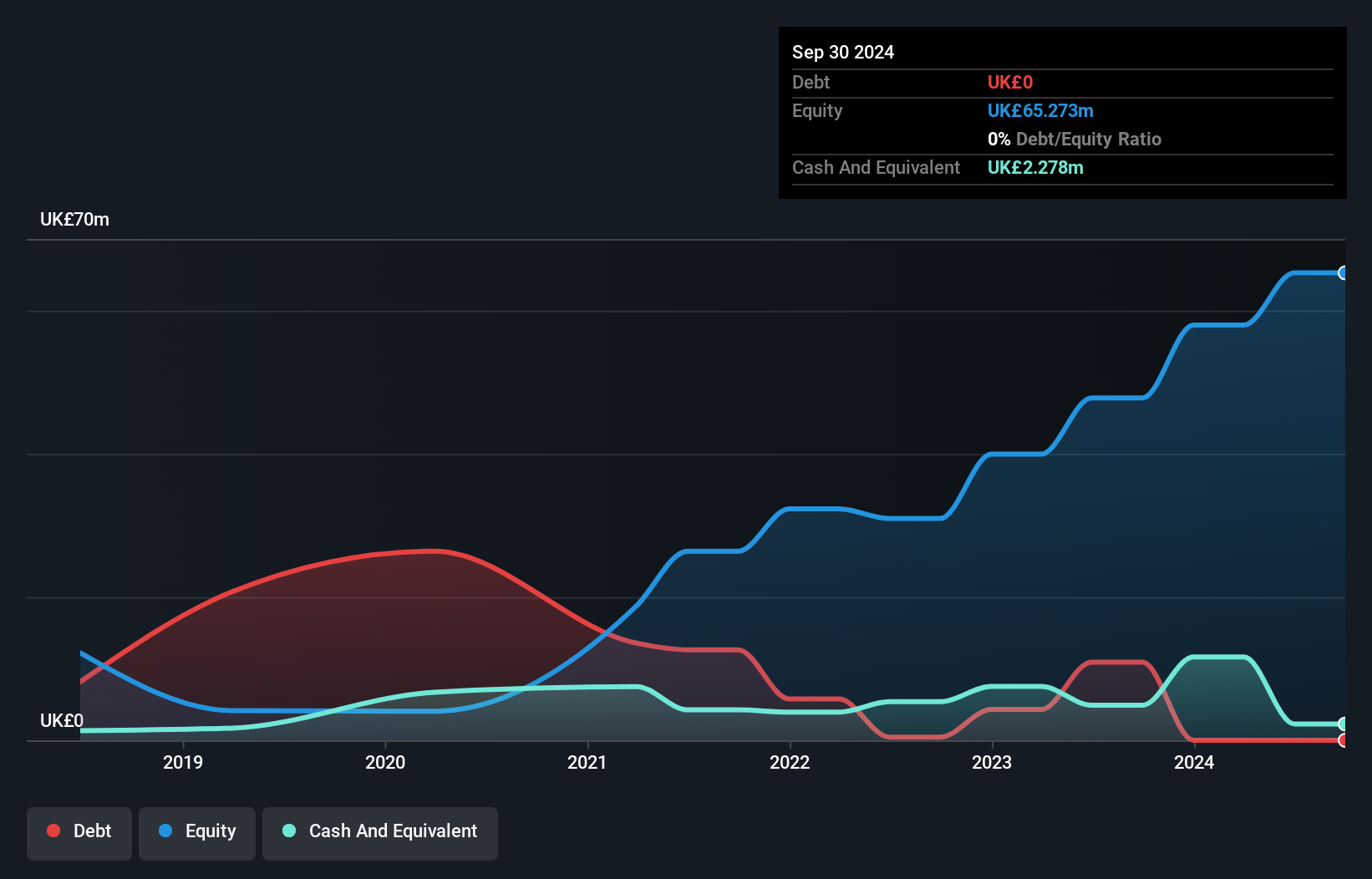

Supreme Plc, with a market cap of £213.52 million, reported solid financial performance with revenue of £231.08 million and net income of £23.46 million for the year ended March 31, 2025. The company is trading at a significant discount to its estimated fair value and maintains strong financial health with more cash than total debt and well-covered interest payments by EBIT (25.3x). Despite recent earnings growth slowing to 4.6%, Supreme's historical profit growth has been robust at an average of 21.8% annually over five years, although future earnings are forecasted to decline by an average of 5.9% per year over the next three years.

- Dive into the specifics of Supreme here with our thorough balance sheet health report.

- Understand Supreme's earnings outlook by examining our growth report.

Genel Energy (LSE:GENL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of £179.52 million.

Operations: Genel Energy's revenue primarily comes from its production segment, generating $74.7 million.

Market Cap: £179.52M

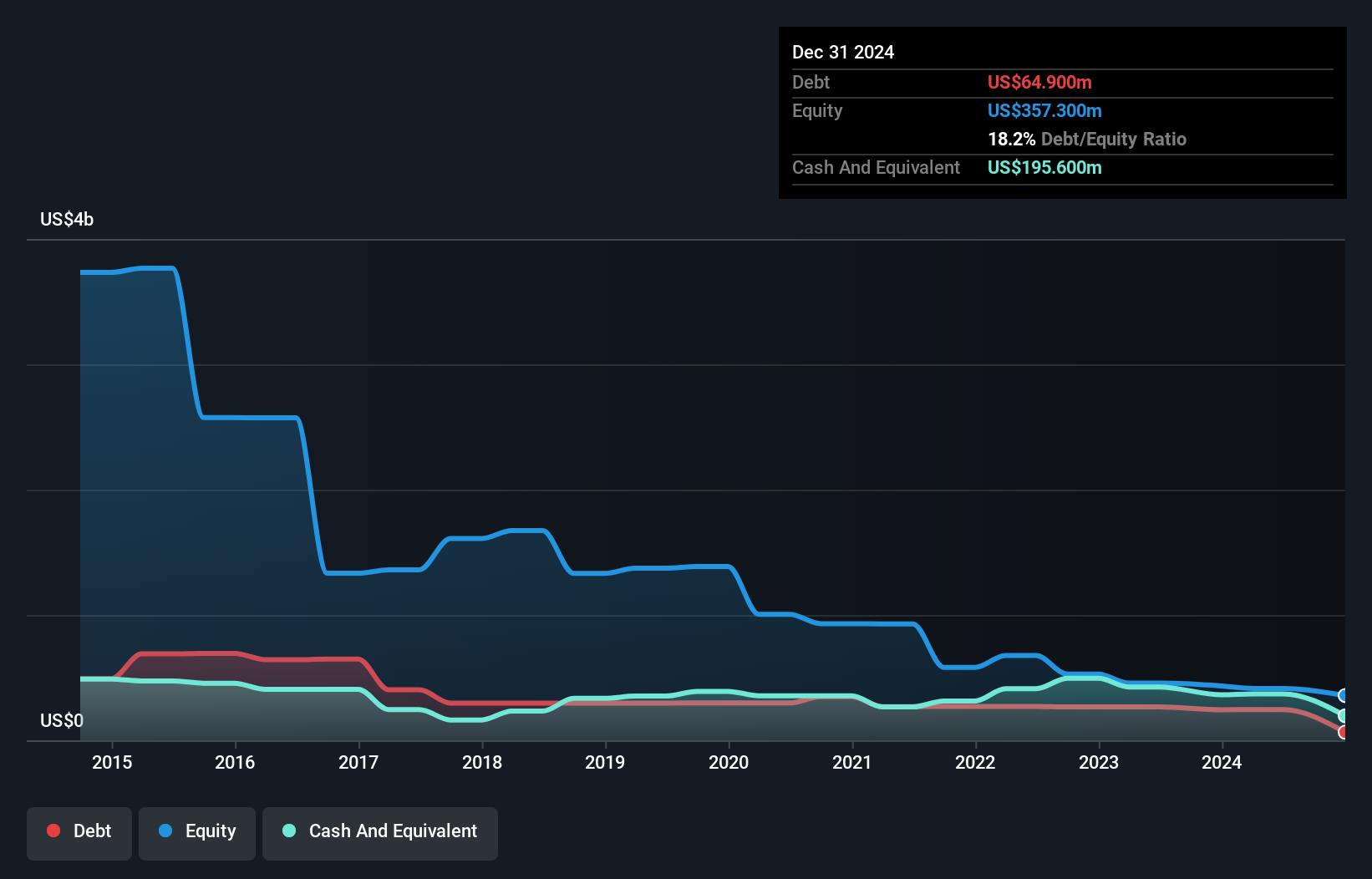

Genel Energy, with a market cap of £179.52 million, is experiencing robust production growth, reporting 82,081 bopd in Q1 2025. Despite being unprofitable and not expected to turn profitable in the next three years, the company maintains financial stability with short-term assets exceeding liabilities and more cash than total debt. Its share price has been highly volatile recently but trades significantly below estimated fair value. Genel's management and board are experienced, while its cash runway extends beyond three years even as free cash flow shrinks by 14% annually. The company has also reduced its debt-to-equity ratio over five years.

- Take a closer look at Genel Energy's potential here in our financial health report.

- Review our growth performance report to gain insights into Genel Energy's future.

Next Steps

- Get an in-depth perspective on all 295 UK Penny Stocks by using our screener here.

- Contemplating Other Strategies? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Operates as an independent oil and gas exploration and production company.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives