As the Australian market navigates a period of cautious optimism, buoyed by recent positive developments in US-China trade relations and sector-specific movements, investors are keenly observing how these dynamics might influence dividend stocks on the ASX. In such an environment, selecting robust dividend stocks involves considering companies with stable earnings and strong cash flow potential to weather market fluctuations and capitalize on emerging opportunities.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.78% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.90% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.90% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.74% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.12% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.79% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.33% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.64% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.51% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dicker Data (ASX:DDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dicker Data Limited is a wholesale distributor of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand, with a market cap of A$1.88 billion.

Operations: Dicker Data Limited generates revenue primarily from the wholesale distribution of computer peripherals, totaling A$2.44 billion.

Dividend Yield: 4.2%

Dicker Data's dividend reliability is underscored by a decade of stable and growing payments, though its high payout ratio of 96.2% suggests dividends are not well covered by earnings. Despite a cash payout ratio of 83.2%, the dividend yield at 4.24% is below top-tier Australian payers. Recent earnings growth and revenue forecasts indicate potential for continued financial health, but significant insider selling and high debt levels warrant caution for investors prioritizing sustainability in dividends.

- Take a closer look at Dicker Data's potential here in our dividend report.

- Our valuation report unveils the possibility Dicker Data's shares may be trading at a discount.

Korvest (ASX:KOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korvest Ltd manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services in Australia with a market cap of A$156.19 million.

Operations: Korvest Ltd's revenue is primarily derived from its Industrial Products segment, contributing A$108.99 million, and its Production segment, which adds A$10.58 million.

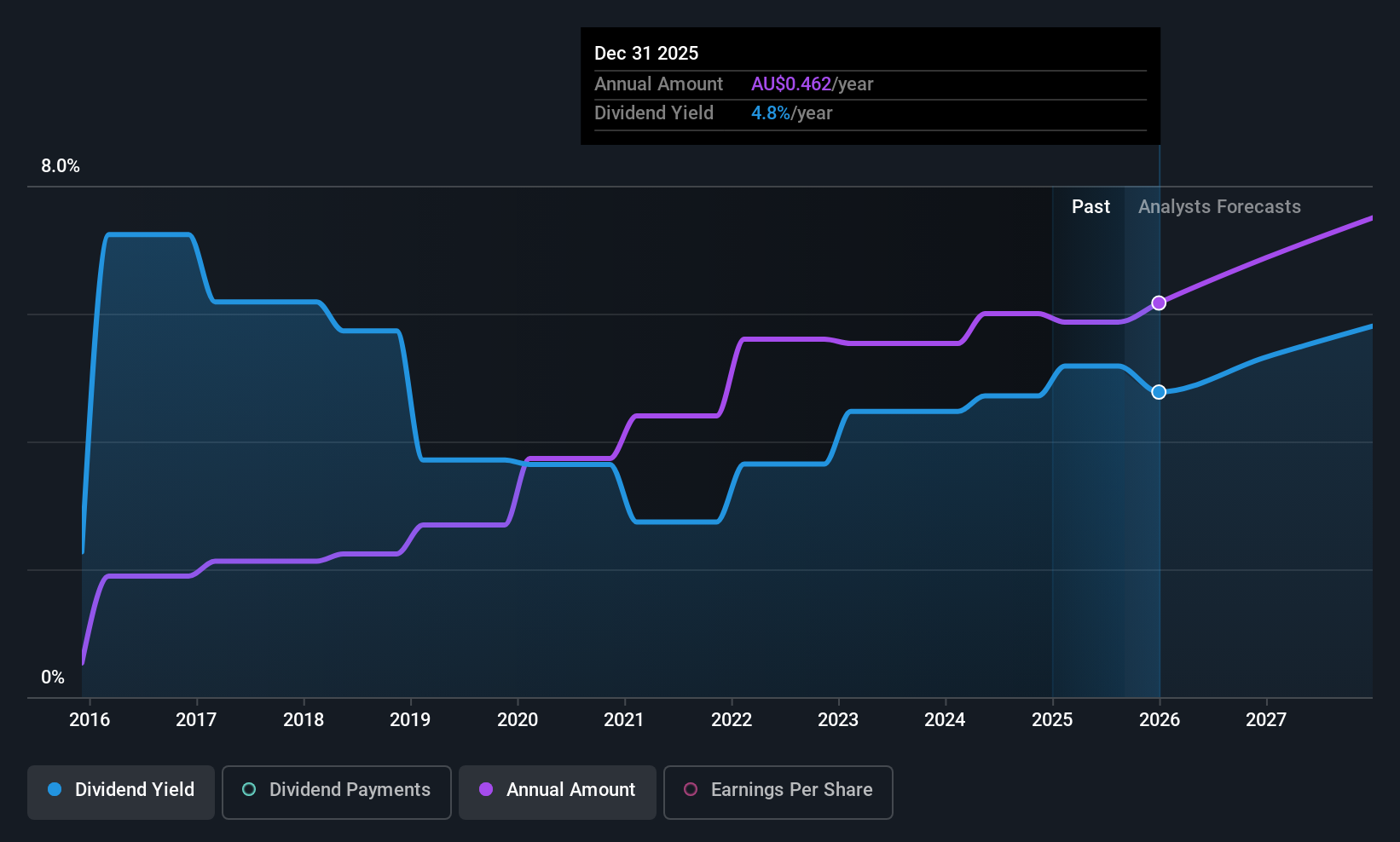

Dividend Yield: 4.9%

Korvest's dividend yield of 4.92% falls short of Australia's top-tier payers, and its dividends have been unreliable over the past decade due to volatility. However, a payout ratio of 58% indicates dividends are well-covered by earnings and cash flows, with recent earnings growth supporting this sustainability. Despite past volatility in payments, Korvest has increased its dividends over the last ten years. Investors should note upcoming financial results on November 4, 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Korvest.

- The valuation report we've compiled suggests that Korvest's current price could be inflated.

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited provides storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$351 million.

Operations: Sugar Terminals Limited generates revenue of A$118.51 million from the sugar industry segment in Australia.

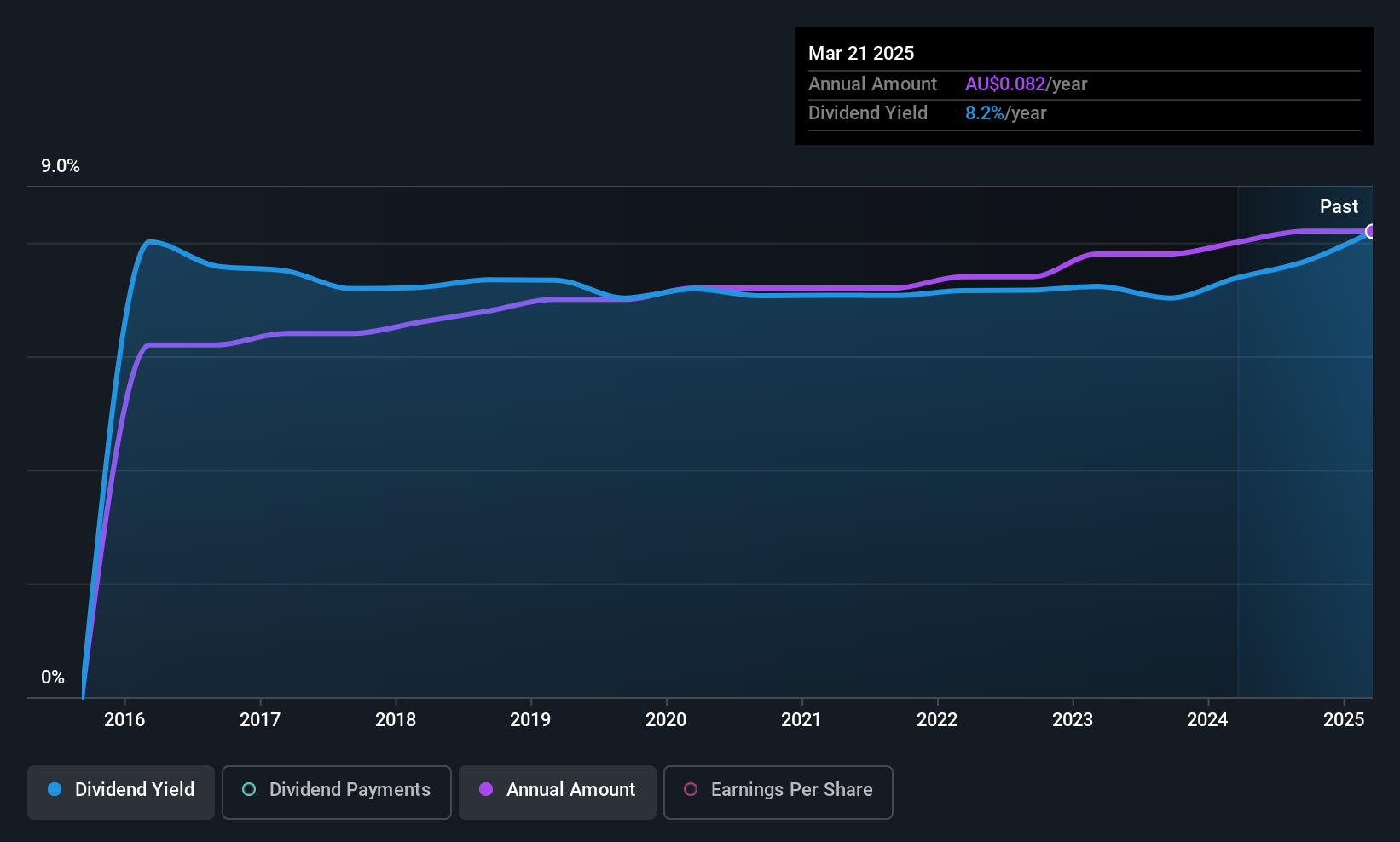

Dividend Yield: 7.9%

Sugar Terminals offers a dividend yield of 7.9%, ranking in the top 25% of Australian payers, but its dividends are not well covered by cash flows, evidenced by a high cash payout ratio of 100.5%. Despite a recent 4.9% dividend reduction to A$0.036 per share, payments have been stable over the past decade. Leadership changes with Peter Trimble as Chair may influence future strategic directions amidst ongoing insourcing initiatives planned for 2026.

- Dive into the specifics of Sugar Terminals here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Sugar Terminals is trading behind its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 25 Top ASX Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korvest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KOV

Korvest

Manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives