- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (RIVN) Expands Canadian Operations With New Quebec Service Centre

Reviewed by Simply Wall St

Rivian Automotive (RIVN) experienced a 6.81% price increase last quarter as it commenced the construction of a new service center in Quebec in collaboration with Montoni Group, targeting a key milestone in its Canadian expansion. The facility aims to support the future launch of its R2 model, integrate low-carbon materials, and promote community growth through job creation. Amidst a buoyant market where major indices such as the S&P 500 and Nasdaq reached record highs, Rivian’s actions highlighted its efforts to enhance its service network and operational capabilities, aligning with broader market positivity.

Be aware that Rivian Automotive is showing 2 risks in our investment analysis.

The recent news of Rivian Automotive's expansion in Quebec could significantly impact the company's overarching narrative by enhancing its service network and operational capabilities. As Rivian gears up for the R2 model's introduction, improvements in logistics and infrastructure are expected to bolster revenue forecasts by potentially increasing sales volumes in the region. The precise use of low-carbon materials and efforts to create jobs could also improve Rivian's brand reputation, which along with strategic alliances, might support revenue growth and, eventually, better margins.

Over the past year, Rivian's total shareholder return including share price and dividends was a decline of 27.92%. This performance seems to lag behind both the US market, which gained 12.4%, and the US Auto industry, which grew by 22.4% over the same period. This comparison emphasizes challenges Rivian faces in meeting market expectations and highlights the pressure to enhance operational results and market standing.

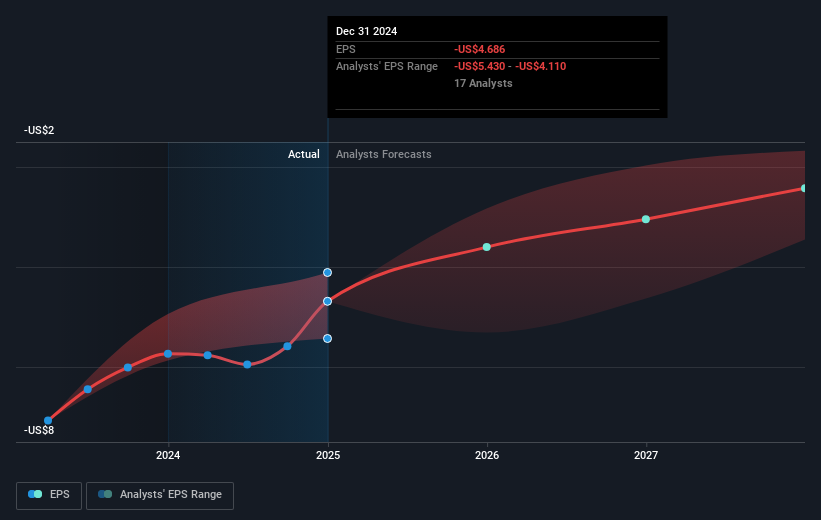

The recently announced initiatives in Quebec and future developments such as the R2 launch might contribute positively to Rivian's revenue and earnings outlook. Analysts forecast a robust revenue growth rate, even as they anticipate continued short-term unprofitability. With the current share price at US$12.39 and a consensus price target of approximately US$14.83, the market projects a potential 20% increase, reflecting cautious optimism regarding Rivian's future profitability potential and the successful execution of its strategic goals. Investors should weigh these prospects against inherent industry risks and the ongoing challenges outlined earlier.

Understand Rivian Automotive's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives