- India

- /

- Personal Products

- /

- NSEI:PGHH

Procter & Gamble Hygiene and Health Care Limited's (NSE:PGHH) Popularity With Investors Is Under Threat From Overpricing

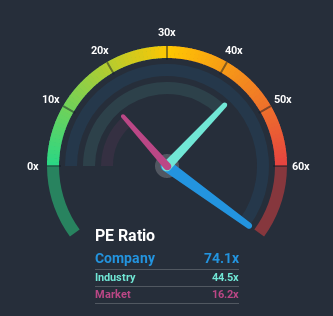

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 16x, you may consider Procter & Gamble Hygiene and Health Care Limited (NSE:PGHH) as a stock to avoid entirely with its 74.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for Procter & Gamble Hygiene and Health Care, which is generally not a bad outcome. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Procter & Gamble Hygiene and Health Care

How Is Procter & Gamble Hygiene and Health Care's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Procter & Gamble Hygiene and Health Care's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 3.4%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that Procter & Gamble Hygiene and Health Care's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Procter & Gamble Hygiene and Health Care's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Procter & Gamble Hygiene and Health Care revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Procter & Gamble Hygiene and Health Care that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

When trading Procter & Gamble Hygiene and Health Care or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PGHH

Procter & Gamble Hygiene and Health Care

Engages in the manufacture and sale of branded packaged fast-moving consumer goods in the feminine care and healthcare businesses in India and internationally.

Excellent balance sheet with acceptable track record.