- United States

- /

- Oil and Gas

- /

- NYSE:OKE

ONEOK (OKE) Declares Consistent Quarterly Dividend of US$1.03 Per Share

Reviewed by Simply Wall St

ONEOK (OKE) recently announced the affirmation of its quarterly dividend of $1.03 per share, providing a stable annualized dividend of $4.12. Despite this positive development, the company's shares experienced a 2% decline over the past week. This movement contrasts with a generally positive market backdrop, where major indexes such as the S&P 500 and Nasdaq were nearing record highs, buoyed by strong earnings reports from several companies. While the dividend announcement underscores ONEOK's financial stability, it couldn't prevent the stock from slightly countering the broader market trend of positive returns.

We've spotted 1 warning sign for ONEOK you should be aware of.

Despite the recent announcement of a stable dividend of US$1.03 per share, ONEOK's stock experienced a 2% decline over the past week. This comes amid broader market movements, where major indexes like S&P 500 and Nasdaq are nearing record highs. Over the longer term, the company's total return, including share price appreciation and dividends, achieved a significant 272.28% increase over five years. However, its performance over the past year lagged behind the US Oil and Gas industry and the broader US market. ONEOK returned less than both sector and market averages during this period.

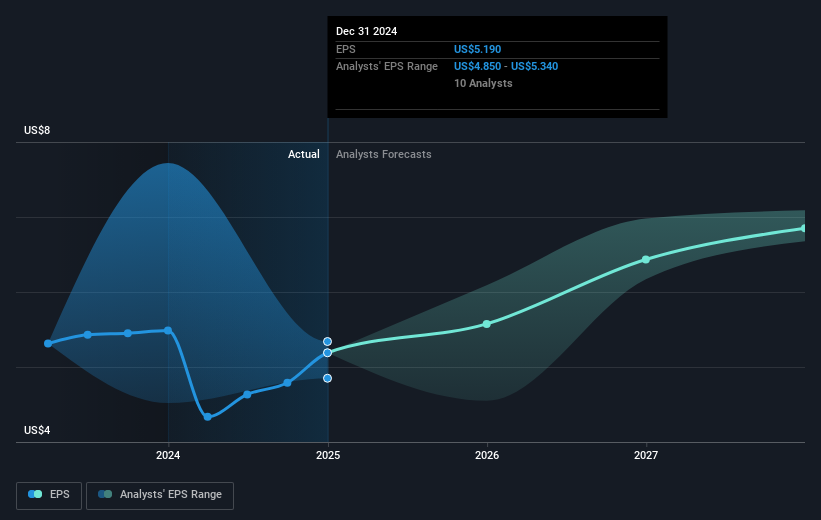

The dividend affirmation signals financial consistency, which may positively affect revenue and earnings forecasts by maintaining investor confidence. The strong balance sheet and expansion projects, such as the Easton Energy connection, support future growth. Analysts project revenue growth of 8.6% annually over the next three years, potentially boosting earnings to US$4.5 billion by May 2028. The stock price of US$79.17 presents a discount against the analyst price target of US$103.08, suggesting room for potential appreciation. Continued execution of expansion and acquisition strategies will be essential for aligning actual performance with these forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives