As Middle Eastern markets experience a rise in most Gulf bourses, buoyed by positive U.S. economic data and ongoing trade talks, investor confidence is on the upswing. In this environment of cautious optimism, dividend stocks stand out as attractive options for those seeking steady income and potential capital appreciation amidst fluctuating market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.40% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.02% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.43% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.99% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.93% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.87% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.63% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 5.70% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.13% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.35% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Dubai Refreshment (P.J.S.C.) (DFM:DRC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Refreshment (P.J.S.C.) is involved in bottling and selling Pepsi Cola International products both within the United Arab Emirates and internationally, with a market cap of AED1.76 billion.

Operations: Dubai Refreshment (P.J.S.C.) generates revenue of AED828.69 million from its activities in canning, bottling, distribution, and trading of soft drinks and related beverage products.

Dividend Yield: 5.1%

Dubai Refreshment (P.J.S.C.) demonstrates a mixed dividend profile. While its dividend payments have increased over the past decade, they remain volatile and unreliable. The dividends are well-covered by earnings and cash flows, with payout ratios of 66.6% and 42.1%, respectively. Despite trading significantly below estimated fair value, the dividend yield of 5.13% is lower than top-tier payers in the region. Recent Q1 earnings show improved sales at AED 178.15 million and net income at AED 30.17 million, indicating potential for future stability.

- Navigate through the intricacies of Dubai Refreshment (P.J.S.C.) with our comprehensive dividend report here.

- Our expertly prepared valuation report Dubai Refreshment (P.J.S.C.) implies its share price may be lower than expected.

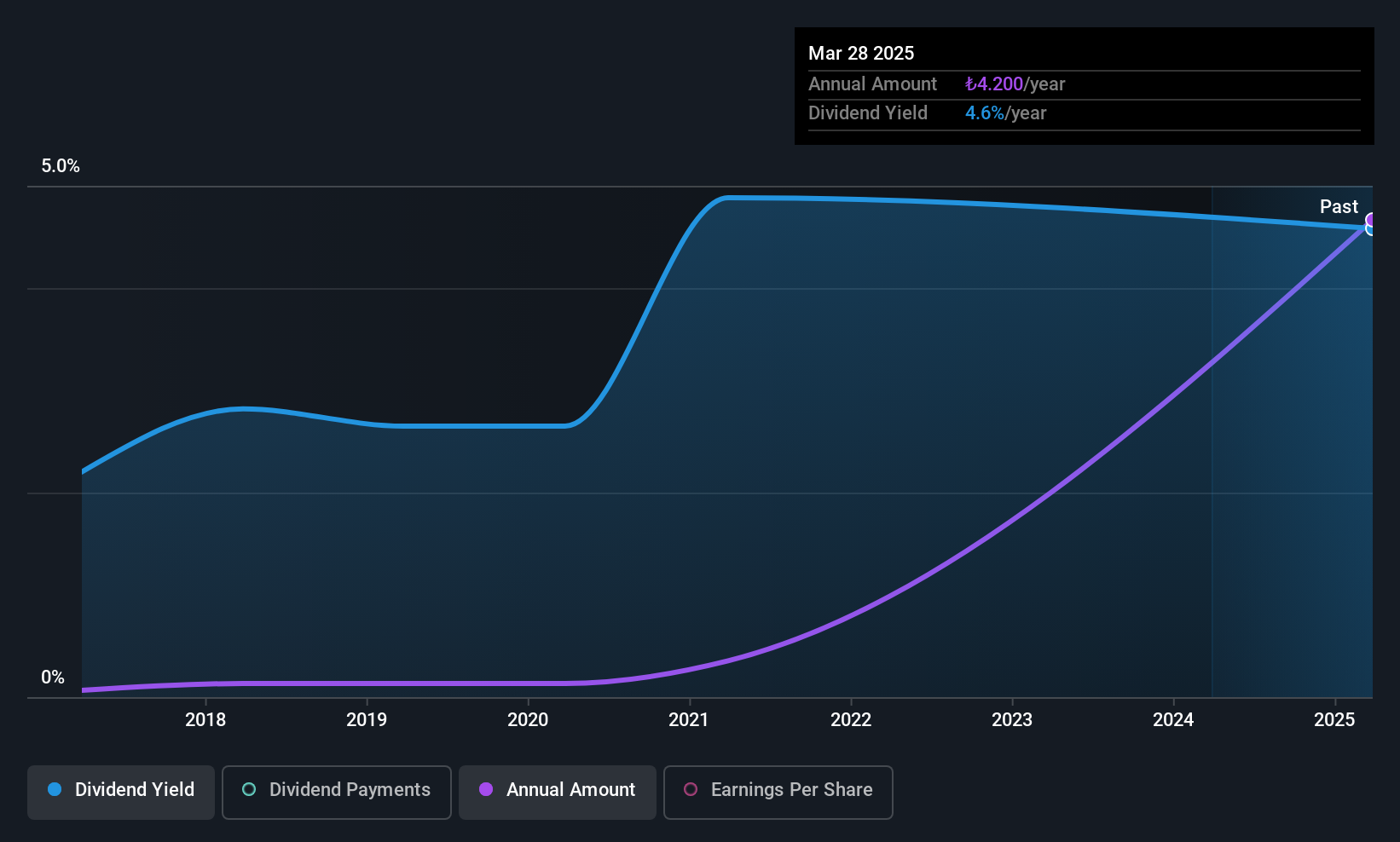

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY44.30 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue from several segments, including Motor Vehicles (TRY14.17 billion), Disease/Health (TRY10.38 billion), Motor Vehicles Liability (TRY9.16 billion), and Fire and Natural Disasters (TRY5.25 billion).

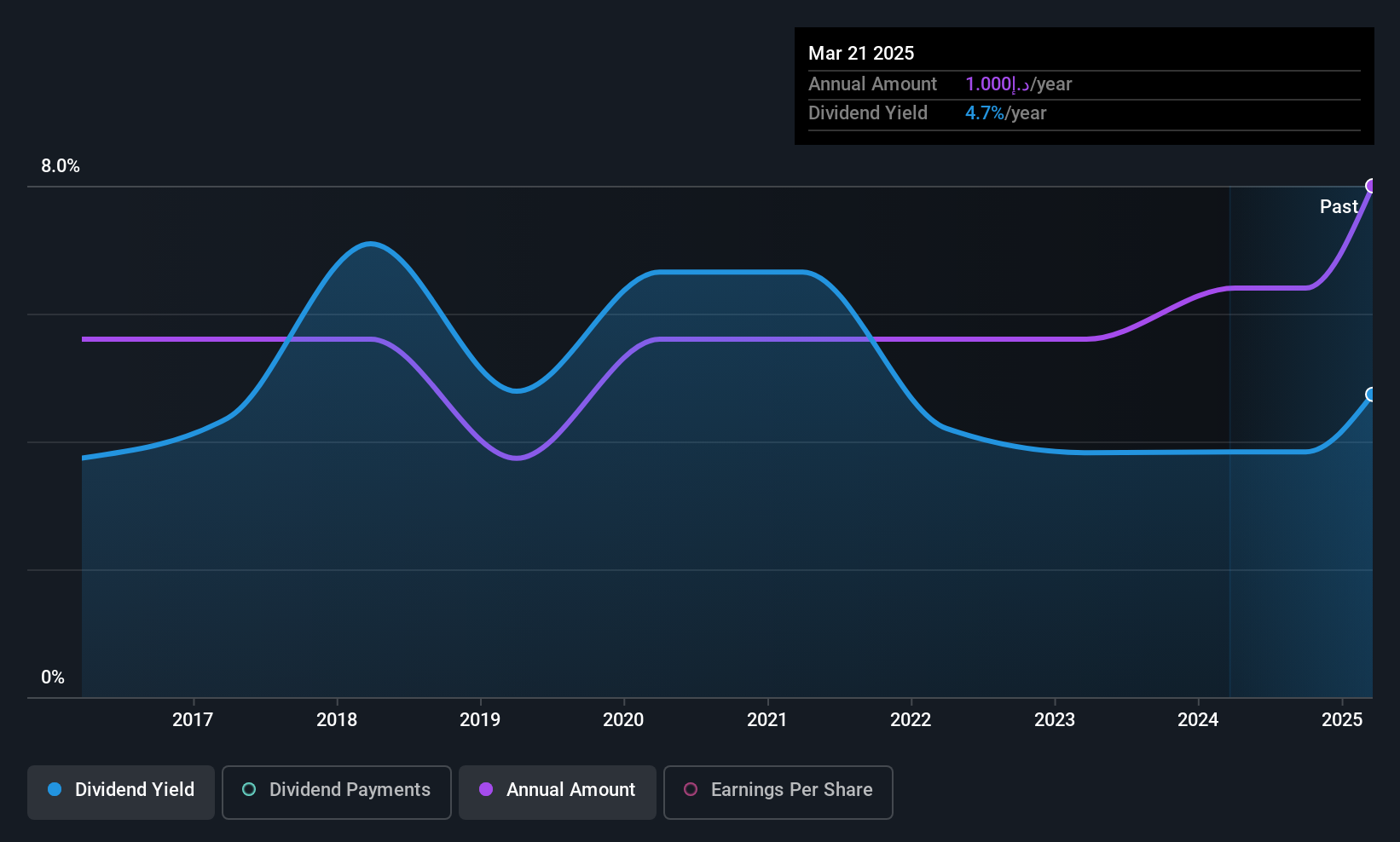

Dividend Yield: 4.7%

Anadolu Anonim Türk Sigorta Sirketi's dividend profile shows both strengths and weaknesses. The dividend yield of 4.74% places it among the top 25% in Turkey, supported by a low payout ratio of 19.7%. However, dividends have been volatile over the past decade despite overall growth. Recent Q1 earnings revealed a decline in net income to TRY 1.98 billion from TRY 2.87 billion last year, which may impact future stability and reliability of dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Anadolu Anonim Türk Sigorta Sirketi.

- In light of our recent valuation report, it seems possible that Anadolu Anonim Türk Sigorta Sirketi is trading behind its estimated value.

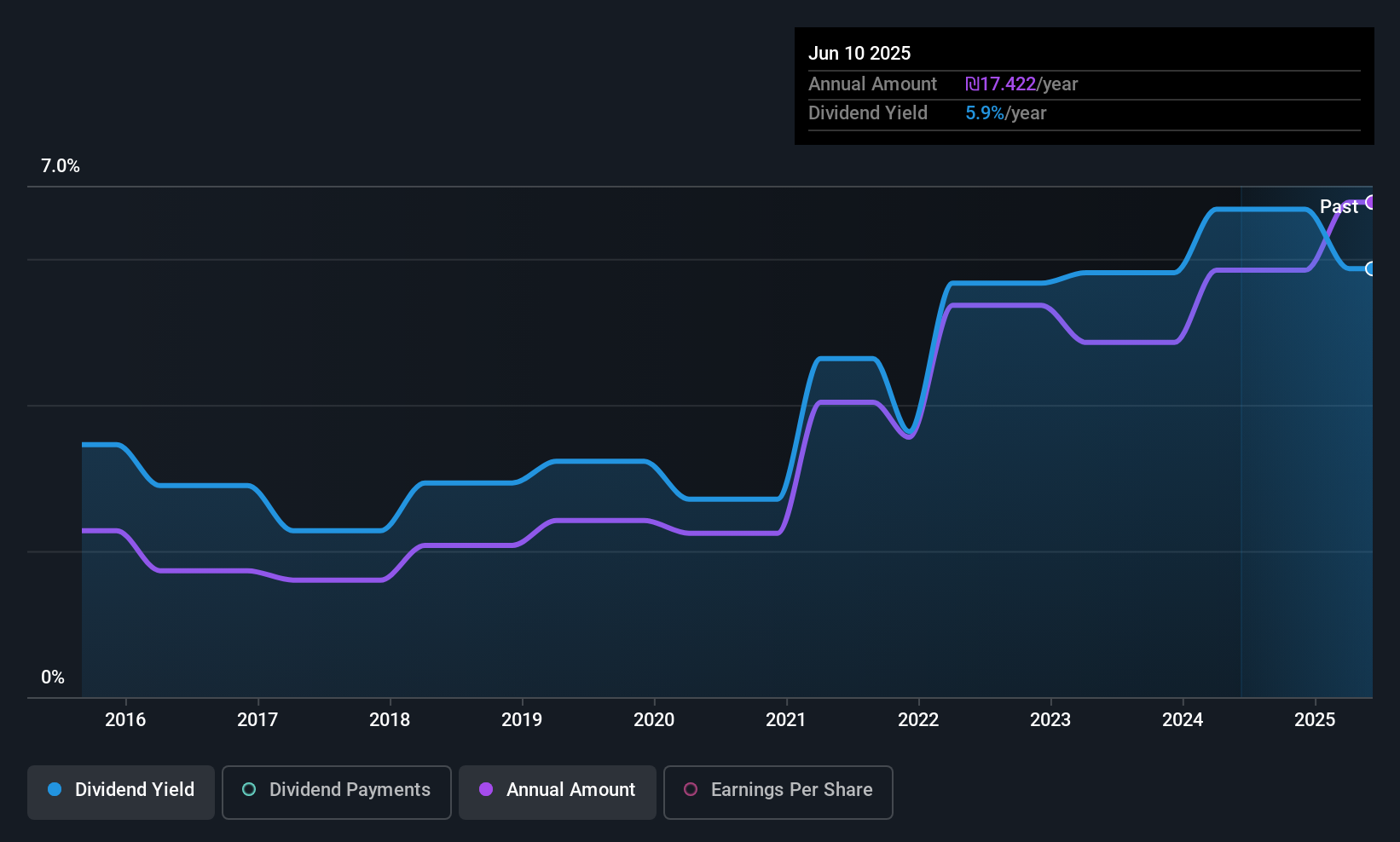

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market capitalization of ₪4.46 billion.

Operations: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd generates revenue primarily from its retail chains, which account for ₪6.64 billion, and Good Pharm Wholesale, contributing ₪455.07 million.

Dividend Yield: 5.4%

Rami Levi Chain Stores Hashikma Marketing 2006's dividend profile presents a mixed picture. While the stock trades at 59.3% below its estimated fair value, offering potential upside, its dividends have been volatile over the past decade. The payout ratio of 72.7% and cash payout ratio of 47.7% indicate dividends are covered by earnings and cash flows, respectively. Recent Q1 results showed a decrease in net income to ILS 50.96 million from ILS 58.25 million year-on-year, which could affect future dividend reliability.

- Get an in-depth perspective on Rami Levi Chain Stores Hashikma Marketing 2006's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Rami Levi Chain Stores Hashikma Marketing 2006's share price might be too optimistic.

Key Takeaways

- Gain an insight into the universe of 72 Top Middle Eastern Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANSGR

Anadolu Anonim Türk Sigorta Sirketi

Offers non-life insurance products in Turkey.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives