As of July 2025, the Asian markets are navigating a complex landscape marked by trade negotiations and economic data that reflect both challenges and opportunities. For investors looking to explore beyond established giants, penny stocks—though an older term—remain a relevant area for potential growth. These smaller or newer companies can offer surprising value when backed by solid financial foundations, and this article will highlight three such stocks that demonstrate financial strength in today's market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.36 | HK$858.09M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.17 | HK$1.81B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.13 | HK$1.89B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.93 | THB1.37B | ✅ 2 ⚠️ 2 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.30 | SGD905.36M | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.53 | HK$13.7B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 988 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Uju Holding (SEHK:1948)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Uju Holding Limited is an investment holding company that offers digital marketing services and live-streaming e-commerce in the People’s Republic of China, with a market capitalization of approximately HK$2.19 billion.

Operations: The company generated CN¥9.15 billion from its All-In-One Online Marketing Solutions Services segment.

Market Cap: HK$2.19B

Uju Holding Limited, with a market capitalization of approximately HK$2.19 billion, has experienced significant volatility in its share price recently. The company generated CN¥9.15 billion from its All-In-One Online Marketing Solutions Services segment, indicating substantial revenue streams. However, earnings have declined by 15.9% annually over the past five years, though recent growth of 3.7% outpaces industry averages. Recent leadership changes include Mr. Cheng Yu and Ms. Ma Xiaoxia assuming key roles; they also acquired a controlling stake in the company for HKD 210 million and are pursuing additional shares to consolidate ownership further.

- Click to explore a detailed breakdown of our findings in Uju Holding's financial health report.

- Gain insights into Uju Holding's historical outcomes by reviewing our past performance report.

Sihuan Pharmaceutical Holdings Group (SEHK:460)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sihuan Pharmaceutical Holdings Group Ltd. is an investment holding company involved in the research, development, manufacture, and sale of pharmaceutical and medical aesthetic products in China, with a market cap of approximately HK$10.41 billion.

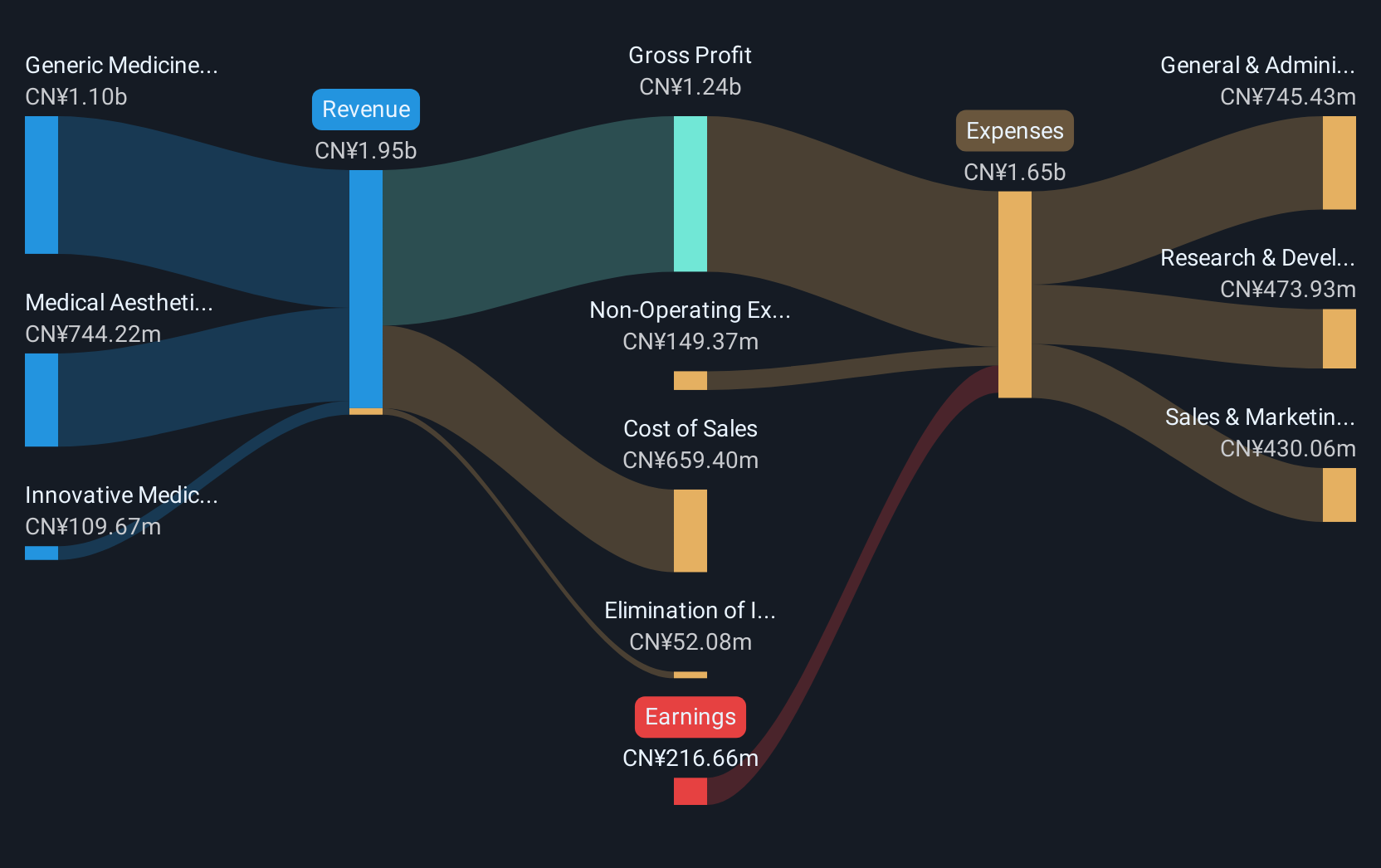

Operations: The company's revenue is primarily derived from its Generic Medicine segment, generating CN¥1.10 billion, followed by Medical Aesthetic Products at CN¥744.22 million and Innovative Medicine and Other Medicine contributing CN¥109.67 million.

Market Cap: HK$10.41B

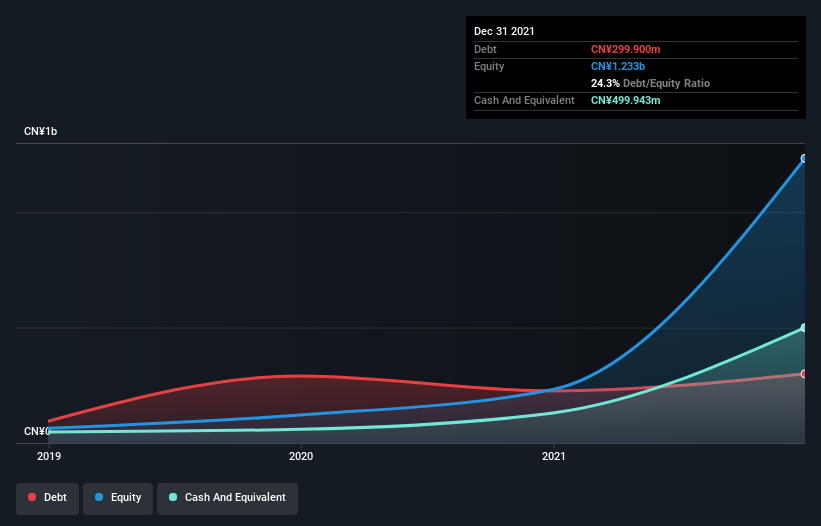

Sihuan Pharmaceutical Holdings Group, with a market cap of HK$10.41 billion, primarily generates revenue from its Generic Medicine segment (CN¥1.10 billion). Despite being unprofitable, the company has reduced losses by 5.3% annually over five years and maintains a strong cash position exceeding its total debt. Recent developments include the acceptance of a new drug application for Bireociclib Tablets targeting breast cancer and approval for Dapagliflozin Tablets in diabetes treatment, underscoring robust R&D capabilities. The company's medical aesthetic segment is poised for growth following regulatory approvals for innovative PLLA fillers in China’s burgeoning market.

- Take a closer look at Sihuan Pharmaceutical Holdings Group's potential here in our financial health report.

- Explore historical data to track Sihuan Pharmaceutical Holdings Group's performance over time in our past results report.

AGTech Holdings (SEHK:8279)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AGTech Holdings Limited is an integrated technology and services company operating in the People's Republic of China and Macau, with a market cap of HK$2.65 billion.

Operations: The company's revenue is derived from three main segments: Electronic Payment and Related Services (HK$307.26 million), Lottery Operation (HK$239.95 million), and Banking Business (HK$67.76 million).

Market Cap: HK$2.65B

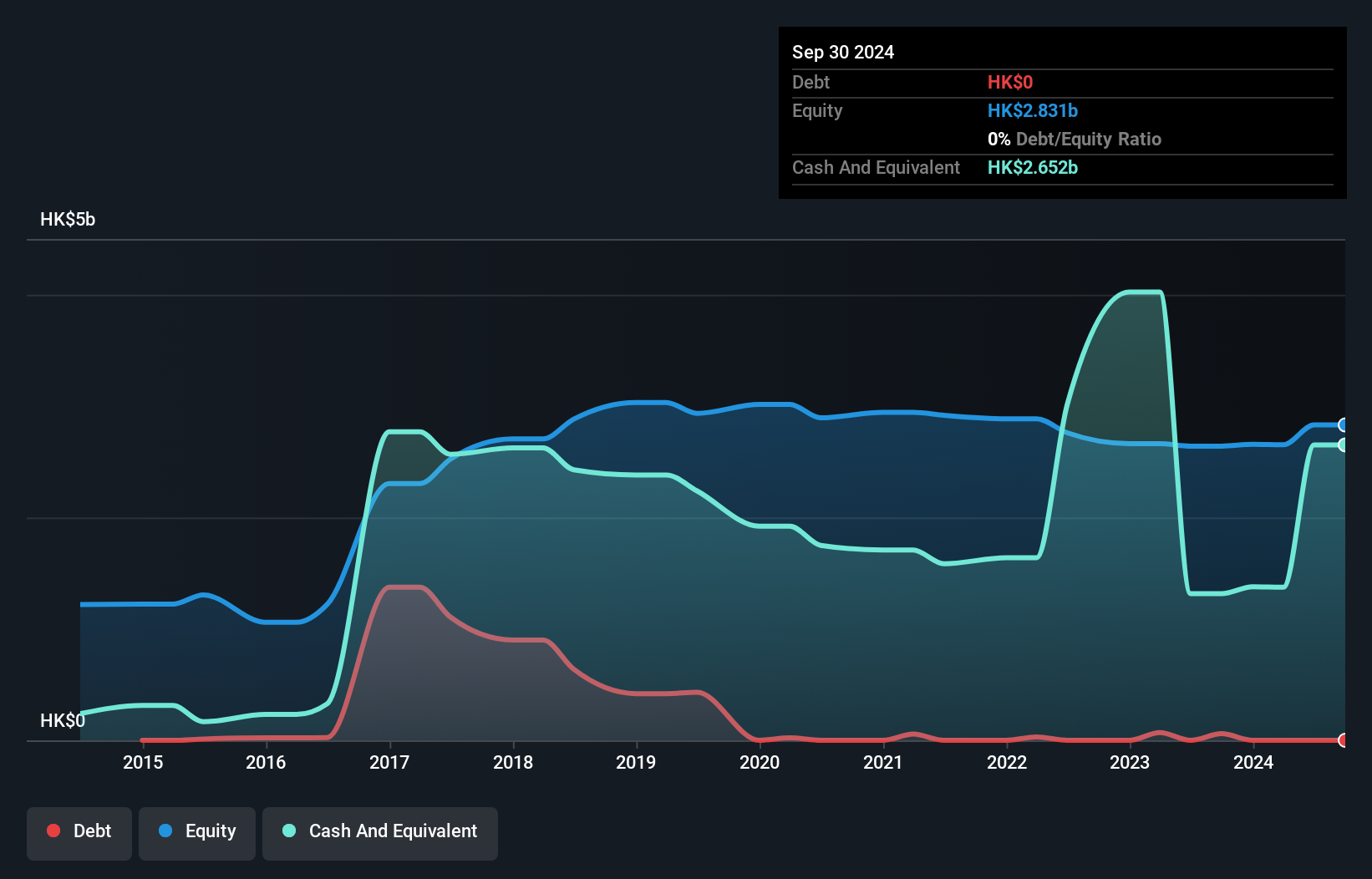

AGTech Holdings, with a market cap of HK$2.65 billion, operates across electronic payments, lottery operations, and banking in China and Macau. Despite being unprofitable, the company has reduced its losses by 39.3% annually over five years and remains debt-free with short-term assets (HK$4.2 billion) covering both short- and long-term liabilities. Recent earnings reported sales of HK$614.97 million for FY2025 but a net loss of HK$90.43 million due to factors like fair value losses on joint venture loans and decreased revenue from digital payments amid lower tourist spending in Macau post-COVID subsidies ending in 2023.

- Dive into the specifics of AGTech Holdings here with our thorough balance sheet health report.

- Understand AGTech Holdings' track record by examining our performance history report.

Key Takeaways

- Get an in-depth perspective on all 988 Asian Penny Stocks by using our screener here.

- Ready For A Different Approach? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:460

Sihuan Pharmaceutical Holdings Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical and medical aesthetic products in the People’s Republic of China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives