- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (GS) Reports Increased Q2 Net Income of US$3,723 Million

Reviewed by Simply Wall St

Goldman Sachs Group (GS) recently reported strong financial results for the second quarter and the first half of 2025, with net income and earnings per share showing significant year-on-year growth. This robust performance aligns with a 39% rise in its share price over the last quarter. The company's inclusion in the Russell Top 50 Index and high-profile executive appointments, such as Raghav Maliah's new role in investment banking, further reflect strategic refinements aimed at enhancing its market position. Meanwhile, broader market trends, including record highs for major indices, provided a favorable backdrop for this price movement.

Goldman Sachs Group's recent financial results and strategic developments reflect a concerted effort to enhance its market position, with a strong 39% rise in its share price over the last quarter. This aligns with a longer-term total shareholder return of 287.95% over the past five years, underscoring a robust performance trajectory. Against a backdrop of broader market gains, GS not only outpaced the Capital Markets industry, which returned 32% over the past year, but also exceeded the general US market return of 12.4%.

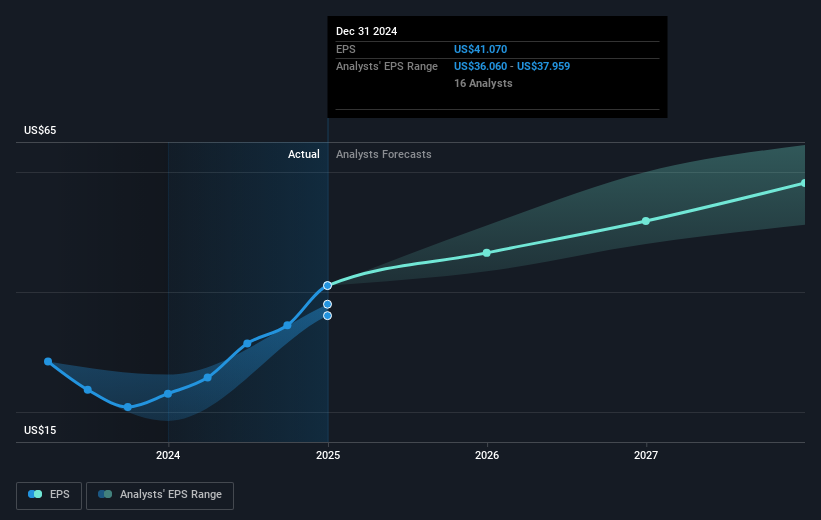

The company's continued growth in advisory and asset management—bolstered by M&A activity and high client demand—is poised to shift revenues toward more stable, high-margin streams. Strategic adoption of AI and digital transformation projects are expected to further enhance efficiency and drive earnings higher. These initiatives could augment the revenue and earnings forecasts, which currently project revenues at US$53 billion and earnings at US$14.13 billion. However, potential risks such as geopolitical uncertainties and regulatory changes could impact these projections.

Despite the current share price of US$708.82, which is above the analyst consensus target of US$670.4, the slight price target discount indicates the expectation of moderate returns aligned with the fair valuation analysis. Investors are encouraged to assess these targets in line with their expectations of future performance, considering that GS is trading below industry price-to-earnings ratios, suggesting it may offer good relative value.

Dive into the specifics of Goldman Sachs Group here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives