Global Stocks That May Be Priced Below Their Estimated Value In November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances in major indices and shifting monetary policies, investors are closely watching for opportunities amid these fluctuations. The recent rate cuts by the Federal Reserve and the temporary trade truce between the U.S. and China have added layers of complexity to market dynamics, prompting a focus on stocks that may be undervalued relative to their estimated intrinsic value. In this environment, identifying undervalued stocks requires careful consideration of factors such as earnings potential, market position, and broader economic conditions. With these elements in mind, we explore three global stocks that might be priced below their estimated value as of November 2025.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$179.00 | NT$354.81 | 49.6% |

| Ülker Bisküvi Sanayi (IBSE:ULKER) | TRY108.10 | TRY214.73 | 49.7% |

| Tibet Tianlu (SHSE:600326) | CN¥12.46 | CN¥24.70 | 49.6% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.54 | CN¥74.87 | 49.9% |

| TESEC (TSE:6337) | ¥2101.00 | ¥4157.22 | 49.5% |

| STEICO (XTRA:ST5) | €20.40 | €40.71 | 49.9% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.00 | NOK59.91 | 49.9% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥64.24 | CN¥128.02 | 49.8% |

| Andes Technology (TWSE:6533) | NT$267.00 | NT$528.46 | 49.5% |

| Absolent Air Care Group (OM:ABSO) | SEK238.00 | SEK472.84 | 49.7% |

Let's dive into some prime choices out of the screener.

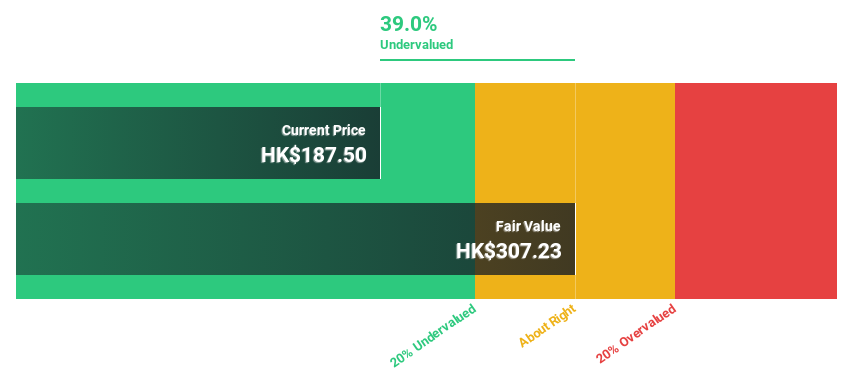

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology both in China and internationally, with a market cap of approximately HK$104.47 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, amounting to CN¥1.50 billion.

Estimated Discount To Fair Value: 31.4%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$448, significantly below its estimated fair value of HK$652.83, suggesting potential undervaluation based on cash flows. The company's revenue is forecast to grow at 35.2% annually, outpacing the broader Hong Kong market's growth rate of 8.7%. Recent positive clinical trial results and product approvals bolster its pipeline strength, potentially enhancing future cash flows and supporting its valuation prospects amidst a challenging earnings environment.

- According our earnings growth report, there's an indication that Sichuan Kelun-Biotech Biopharmaceutical might be ready to expand.

- Click to explore a detailed breakdown of our findings in Sichuan Kelun-Biotech Biopharmaceutical's balance sheet health report.

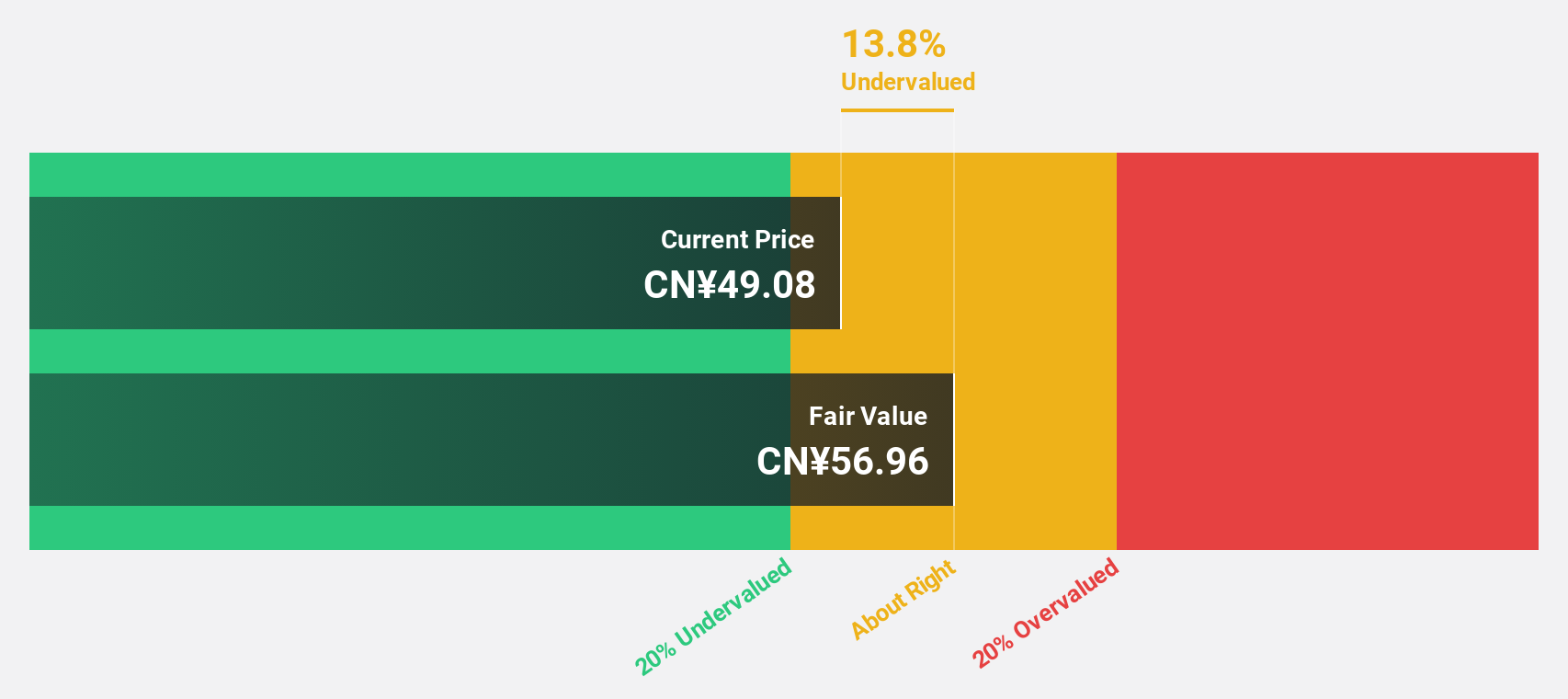

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China and has a market cap of CN¥9.06 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates revenue through its specialized engineering technical services in China.

Estimated Discount To Fair Value: 18.9%

L&K Engineering (Suzhou) Ltd. is trading at CNY 46.71, below its estimated fair value of CNY 57.61, indicating potential undervaluation based on cash flows. Despite a volatile share price recently, earnings grew by 28.5% over the past year with revenue forecast to grow at 20.7% annually, surpassing the broader Chinese market's growth rate of 14.3%. However, profit growth is expected to be moderate and dividends remain unstable.

- Our expertly prepared growth report on L&K Engineering (Suzhou)Ltd implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of L&K Engineering (Suzhou)Ltd.

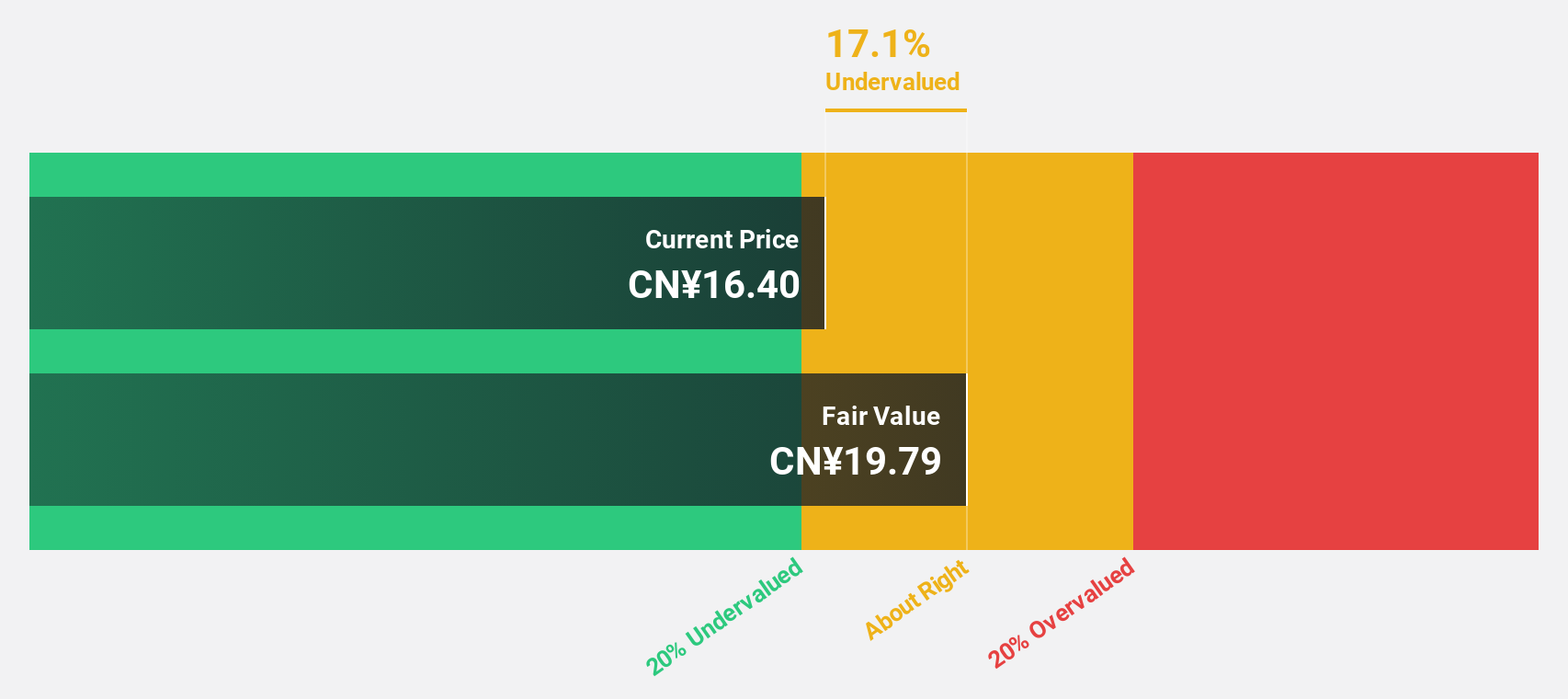

Xizi Clean Energy Equipment Manufacturing (SZSE:002534)

Overview: Xizi Clean Energy Equipment Manufacturing Co., Ltd. and its subsidiaries manufacture and sell waste heat recovery boilers both in China and internationally, with a market cap of CN¥13.39 billion.

Operations: Xizi Clean Energy Equipment Manufacturing Co., Ltd. generates revenue through the production and distribution of waste heat recovery boilers domestically and abroad.

Estimated Discount To Fair Value: 12.1%

Xizi Clean Energy Equipment Manufacturing is trading at CN¥17.39, slightly below its estimated fair value of CN¥19.79, suggesting it could be undervalued on a cash flow basis. Despite earnings forecasts showing significant growth potential at 34.7% annually, recent financial results reveal declining net income and reduced profit margins compared to last year. The company has experienced share price volatility and an unstable dividend history, which may concern some investors looking for stability in returns.

- The analysis detailed in our Xizi Clean Energy Equipment Manufacturing growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Xizi Clean Energy Equipment Manufacturing.

Turning Ideas Into Actions

- Embark on your investment journey to our 502 Undervalued Global Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives