- United States

- /

- Communications

- /

- NYSE:CIEN

First Solar And 2 Additional Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

In the last week, the United States market has been flat, though it has risen by 10% over the past 12 months, with earnings forecast to grow by 15% annually. In this context, identifying stocks that may be priced below their estimated value can offer potential opportunities for investors looking to capitalize on undervaluation amidst stable market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $14.87 | $29.36 | 49.4% |

| Roku (ROKU) | $89.28 | $173.99 | 48.7% |

| Rapid7 (RPD) | $22.53 | $43.82 | 48.6% |

| MoneyHero (MNY) | $1.23 | $2.40 | 48.8% |

| Ligand Pharmaceuticals (LGND) | $124.30 | $240.64 | 48.3% |

| Hess Midstream (HESM) | $38.08 | $73.49 | 48.2% |

| Definitive Healthcare (DH) | $3.95 | $7.83 | 49.6% |

| Carter Bankshares (CARE) | $17.89 | $35.50 | 49.6% |

| Bridgewater Bancshares (BWB) | $16.05 | $30.95 | 48.1% |

| ACNB (ACNB) | $42.35 | $84.33 | 49.8% |

Here's a peek at a few of the choices from the screener.

First Solar (FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic solar energy solutions across the United States, France, India, Chile, and other international markets with a market capitalization of approximately $17.25 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of CdTe solar modules, totaling approximately $4.25 billion.

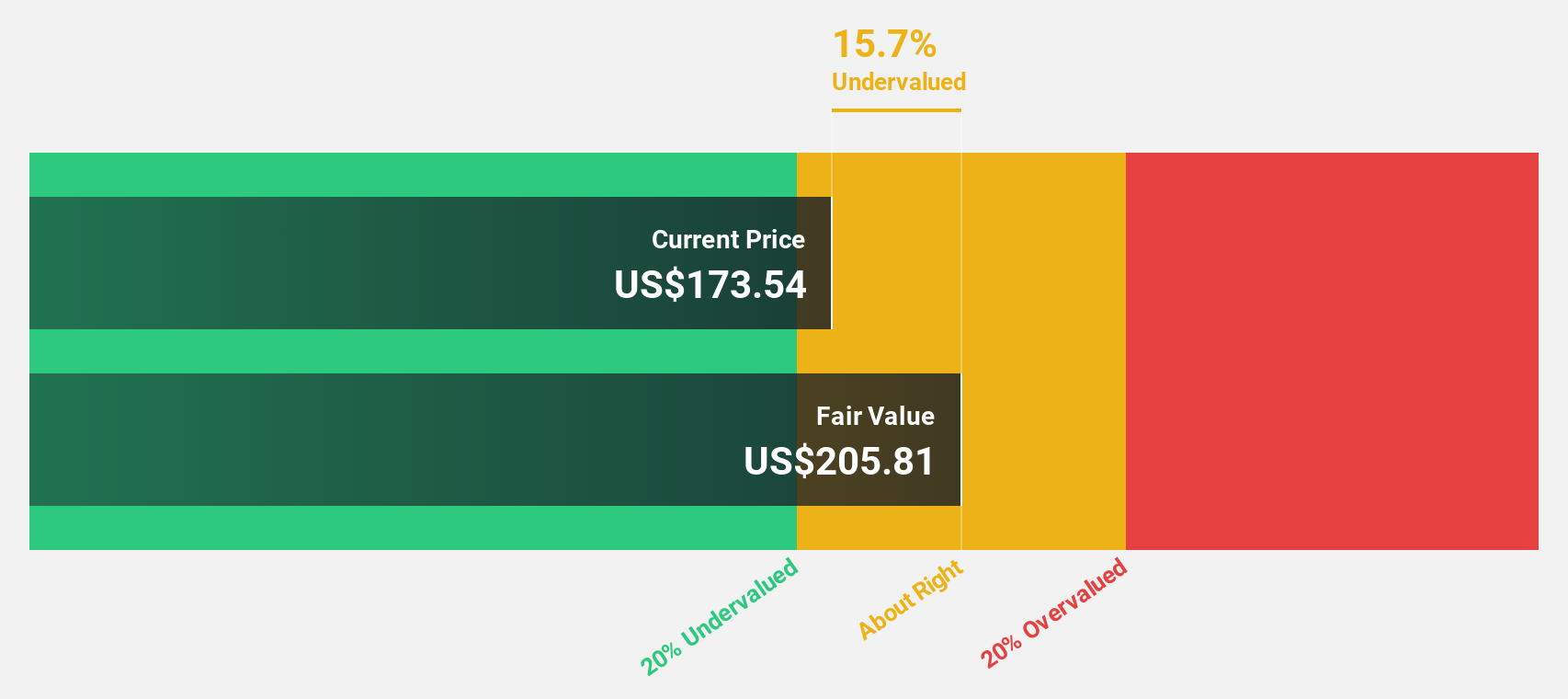

Estimated Discount To Fair Value: 26%

First Solar is trading at US$171.93, approximately 26% below its estimated fair value of US$232.47, indicating it may be undervalued based on discounted cash flow analysis. Despite recent volatility and lowered earnings guidance for 2025, the company's earnings are forecast to grow significantly at over 20% annually, outpacing the broader U.S. market. A new agreement with UbiQD could enhance product efficiency and support revenue growth projections of 12.3% per year.

- Our comprehensive growth report raises the possibility that First Solar is poised for substantial financial growth.

- Dive into the specifics of First Solar here with our thorough financial health report.

Ciena (CIEN)

Overview: Ciena Corporation is a network technology company that offers hardware, software, and services to network operators globally, with a market cap of approximately $11.51 billion.

Operations: Ciena's revenue is derived from four main segments: Networking Platforms at $3.25 billion, Global Services at $551.93 million, Platform Software and Services at $363.38 million, and Blue Planet Automation Software and Services at $103.23 million.

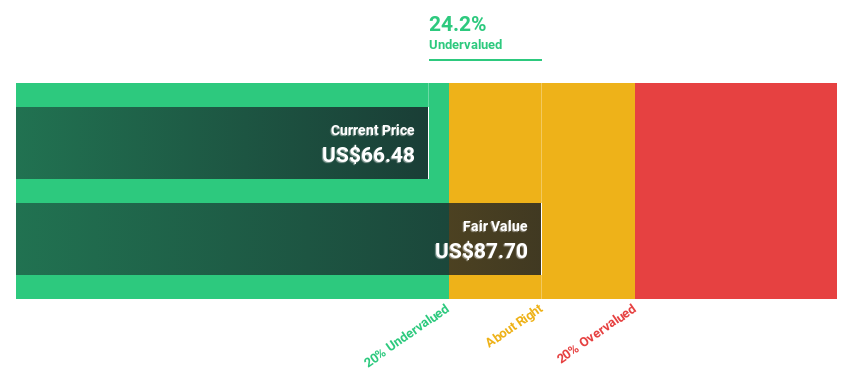

Estimated Discount To Fair Value: 27.9%

Ciena, priced at US$82.61, trades 27.9% below its estimated fair value of US$114.62, highlighting potential undervaluation based on cash flows. While profit margins have dipped to 2.5% from last year's 3.7%, earnings are projected to grow significantly at over 35% annually, surpassing U.S. market expectations. Recent strategic partnerships and technological advancements like the WaveLogic 6 Extreme enhance Ciena's capabilities in high-bandwidth applications, potentially boosting future revenue and operational efficiency despite current challenges.

- The growth report we've compiled suggests that Ciena's future prospects could be on the up.

- Get an in-depth perspective on Ciena's balance sheet by reading our health report here.

Turning Point Brands (TPB)

Overview: Turning Point Brands, Inc. manufactures, markets, and distributes branded consumer products in the United States and Canada with a market capitalization of approximately $1.34 billion.

Operations: The company's revenue is primarily derived from its Zig-Zag Products segment, which contributes $192.96 million, and its Stoker’s Products segment, which accounts for $191.07 million.

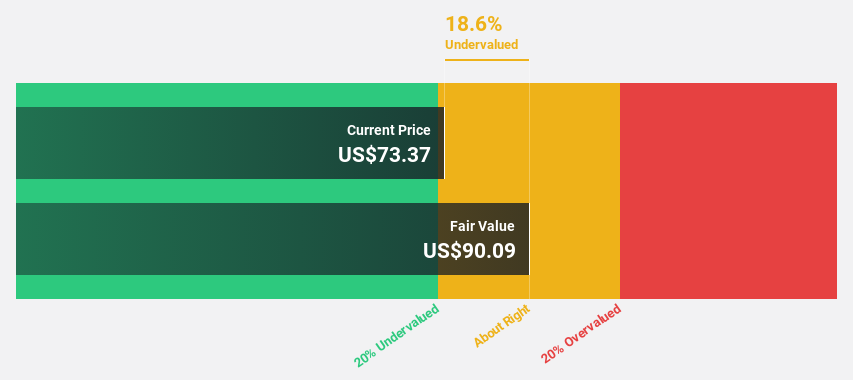

Estimated Discount To Fair Value: 12.7%

Turning Point Brands, at US$78.39, trades 12.7% below its fair value estimate of US$89.78, indicating potential undervaluation based on cash flows despite a high debt level and recent insider selling. Earnings grew by 15.2% last year and are forecast to grow annually at 15.8%, outpacing the U.S. market's growth rate of 14.8%. Revenue is expected to increase by 22.3% per year, exceeding the broader market's growth forecast of 8.8%.

- According our earnings growth report, there's an indication that Turning Point Brands might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Turning Point Brands.

Taking Advantage

- Investigate our full lineup of 173 Undervalued US Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives