- Sweden

- /

- Interactive Media and Services

- /

- OM:BUSER

European Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

As European markets experienced a mixed week, with the pan-European STOXX Europe 600 Index seeing gains amid trade deal hopes before turning lower due to tariff concerns, investors are keenly observing potential opportunities. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €0.95 | €14.11M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.48 | €46.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.484 | RON16.23M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.89 | €60.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €5.00 | €18.7M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.40 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.41 | SEK2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.15 | €296.84M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €33.05M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 332 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

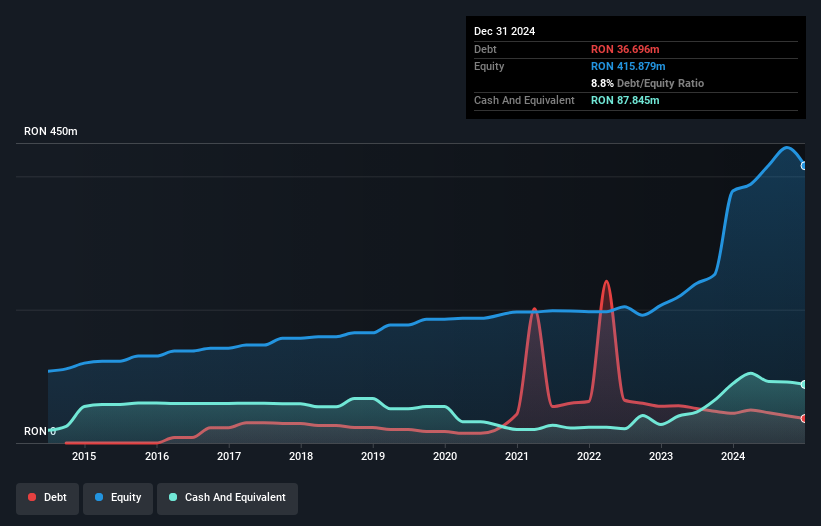

SOCEP (BVB:SOCP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOCEP S.A., along with its subsidiary SOCEFIN S.R.L., offers cargo handling services in the ports of Constanta and Agigea, Romania, with a market cap of RON988.38 million.

Operations: SOCEP S.A. does not report specific revenue segments, focusing instead on providing cargo handling services in the Romanian ports of Constanta and Agigea.

Market Cap: RON988.38M

SOCEP S.A., a cargo handling service provider in Romania, has shown stable financial performance with recent first-quarter sales of RON 53.38 million and net income of RON 18.48 million. The company's debt management is satisfactory, with a net debt to equity ratio of 1.9% and strong interest coverage by profits. Despite high non-cash earnings, SOCEP faces challenges such as negative earnings growth over the past year and unsustainable dividend coverage by free cash flows. However, its price-to-earnings ratio suggests good value compared to the broader Romanian market, complemented by a high return on equity at 21.3%.

- Click here to discover the nuances of SOCEP with our detailed analytical financial health report.

- Understand SOCEP's track record by examining our performance history report.

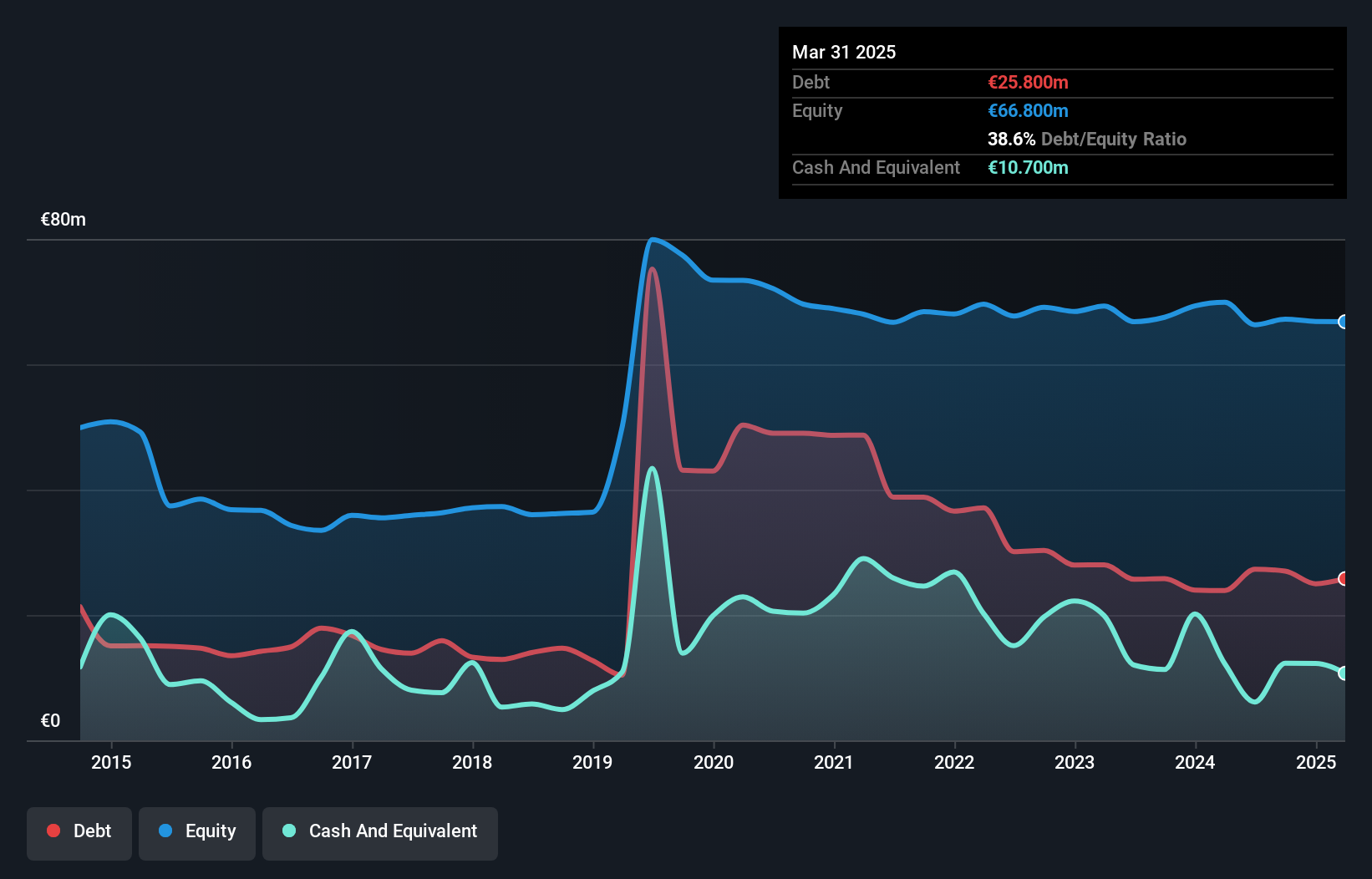

Glaston Oyj Abp (HLSE:GLA1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glaston Oyj Abp manufactures and sells glass processing machines across various regions including Finland, Europe, the Middle East, Africa, the Americas, China, and the rest of Asia Pacific with a market cap of €56.74 million.

Operations: The company's revenue is primarily derived from its Architecture segment, which contributes €165.46 million, and its Mobility, Display & Solar segment, which generates €47.82 million.

Market Cap: €56.74M

Glaston Oyj Abp, with a market cap of €56.74 million, has faced challenges in maintaining profitability, as evidenced by its recent first-quarter net income of €0.2 million compared to €0.8 million the previous year. The company's debt management shows improvement, with a reduced debt-to-equity ratio from 68.5% to 38.6% over five years and satisfactory interest coverage by EBIT at 3.4x. However, short-term liabilities exceed short-term assets slightly (€86.7M vs €83.3M). Recent executive changes may influence strategic direction positively but the management team is relatively new with an average tenure of 0.3 years.

- Click to explore a detailed breakdown of our findings in Glaston Oyj Abp's financial health report.

- Learn about Glaston Oyj Abp's future growth trajectory here.

Bambuser (OM:BUSER)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bambuser AB (publ) operates a cloud-based video commerce platform and has a market cap of SEK155.89 million.

Operations: The company generates revenue from its Internet Telephone segment, totaling SEK99.27 million.

Market Cap: SEK155.89M

Bambuser, with a market cap of SEK155.89 million, operates in the video commerce space and is currently unprofitable, reporting a net loss of SEK35.23 million for Q1 2025. Despite financial challenges, the company remains debt-free and has sufficient cash runway for over a year. Recent strategic partnerships with Alibaba Cloud and Dentsu Japan International Brands aim to expand Bambuser's presence in China and Japan's e-commerce markets, leveraging its innovative shoppable video solutions to enhance customer engagement. These collaborations could position Bambuser favorably within rapidly growing Asian social commerce sectors despite current earnings volatility.

- Unlock comprehensive insights into our analysis of Bambuser stock in this financial health report.

- Evaluate Bambuser's historical performance by accessing our past performance report.

Where To Now?

- Unlock more gems! Our European Penny Stocks screener has unearthed 329 more companies for you to explore.Click here to unveil our expertly curated list of 332 European Penny Stocks.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bambuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BUSER

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives