- United States

- /

- Oil and Gas

- /

- NYSE:EQT

EQT (EQT) Secures Major Partnership To Power New 4.4 Gigawatt Facility

Reviewed by Simply Wall St

EQT Corporation (EQT) recently became the exclusive partner for sourcing and supplying natural gas to the Homer City Energy Campus, a major development project that marks a transformation of Pennsylvania's largest coal-burning power plant into an advanced energy and data hub. This news comes amid a generally positive setting in the stock market where indices experienced only slight fluctuations. Over the last quarter, EQT’s share price increased by 15%, likely buoyed by strong quarterly earnings, strategic developments, and a large-scale share buyback. The market’s overall stability and positive sentiment likely complemented EQT’s notable price movement.

Be aware that EQT is showing 3 risks in our investment analysis and 1 of those is a bit unpleasant.

The partnership with the Homer City Energy Campus could further enhance EQT Corporation's market presence and operational scope, potentially impacting future revenue streams. By supplying natural gas to a significant transformation project from coal to advanced energy, EQT aligns itself with the ongoing energy transition trends, which may bolster future revenue and earnings forecasts. This strategic development complements the company's existing endeavors, like the acquisition of Olympus Energy assets, to integrate upstream and midstream operations, thus generating operational synergies that are expected to enhance free cash flow and revenue.

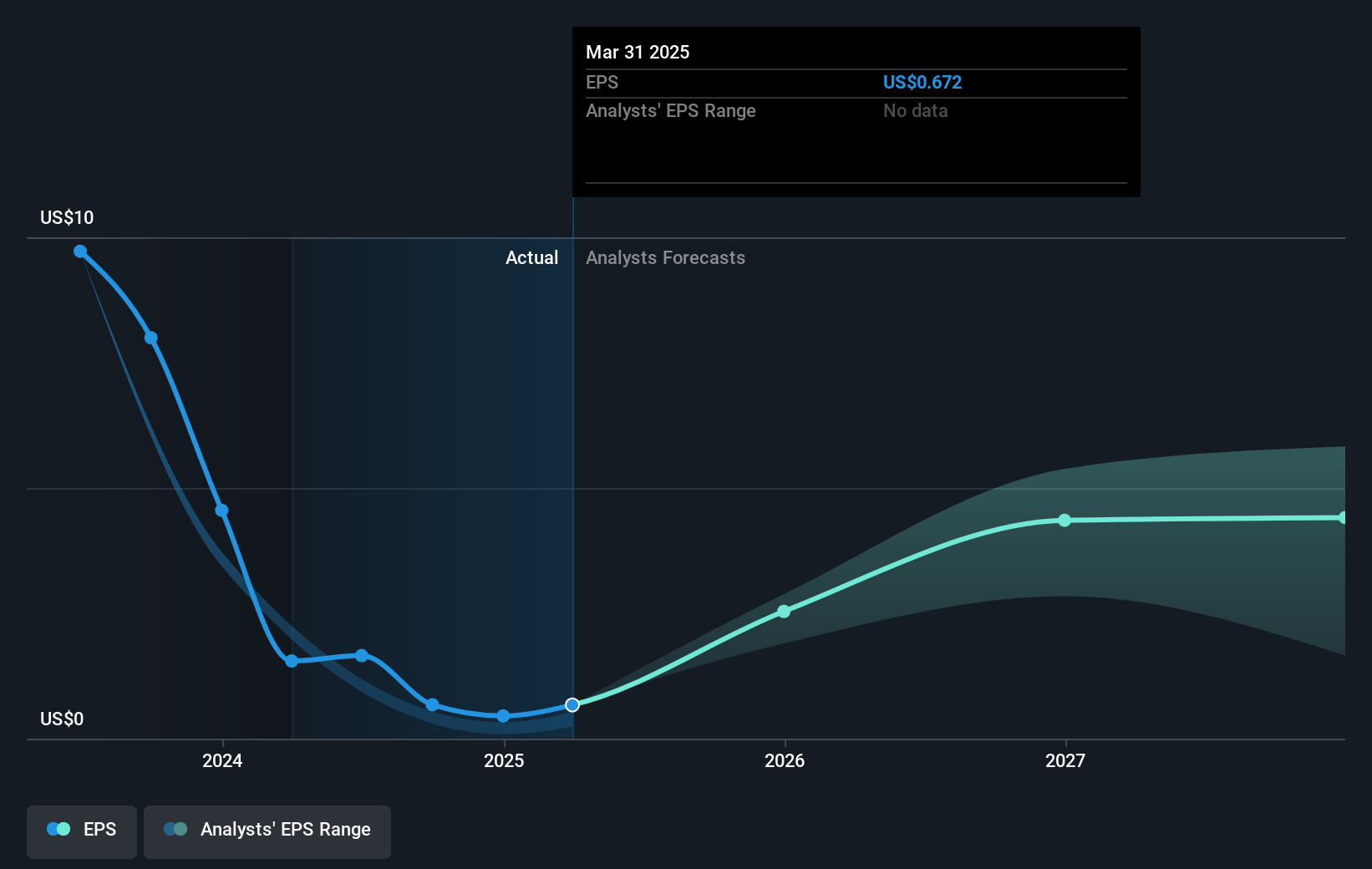

Over the past five years, EQT's total shareholder return, including dividends, was an impressive 361.26%, illustrating the company's robust performance during this period. Recently, over the past year, EQT has outperformed the US Oil and Gas industry which experienced a 3.1% decline, indicating its resilience in a volatile market climate. The current share price of US$58.24 is slightly below the consensus analyst price target of US$61.30, suggesting that the market sees potential for a moderate upside. The price target reflects an anticipation of future improved financial performance, contingent on successfully capturing the expected synergies and maintaining favorable market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives