- United Kingdom

- /

- Food

- /

- AIM:ANP

Discovering Anpario And 2 Other Top UK Penny Stocks

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting the interconnectedness of global economies. Amid these broader market fluctuations, investors often seek opportunities in less conventional areas such as penny stocks. Although considered niche and somewhat outdated, penny stocks can still present growth potential, particularly when they are backed by strong financial health. In this article, we explore three UK penny stocks that might offer hidden value and long-term potential for investors willing to navigate this unique segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.794 | £1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.418 | £45.23M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.871 | £322.08M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.55 | £127.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £177.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.835 | £11.5M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.24 | £69.27M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.265 | £854.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Anpario (AIM:ANP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anpario plc, along with its subsidiaries, manufactures natural sustainable feed additives for animal health, nutrition, and biosecurity, with a market cap of £87.91 million.

Operations: The company's revenue primarily comes from its Vitamins & Nutrition Products segment, totaling £38.20 million.

Market Cap: £87.91M

Anpario plc, with a market cap of £87.91 million, stands out in the penny stock segment due to its solid financial position and absence of debt. The company has £27.2 million in short-term assets, comfortably covering both short-term (£8.2M) and long-term liabilities (£2.6M). Despite a 6.3% annual decline in earnings over the past five years, recent performance shows an impressive 62.7% growth over the last year, surpassing industry averages and improving net profit margins from 8.2% to 10.8%. However, its dividend track record remains unstable despite a recent increase approved at their AGM on June 19, 2025.

- Jump into the full analysis health report here for a deeper understanding of Anpario.

- Gain insights into Anpario's future direction by reviewing our growth report.

Corero Network Security (AIM:CNS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Corero Network Security plc offers distributed denial of service (DDoS) protection solutions globally and has a market cap of £75.54 million.

Operations: The company generates revenue of $24.56 million through its DDoS protection solutions offered worldwide.

Market Cap: £75.54M

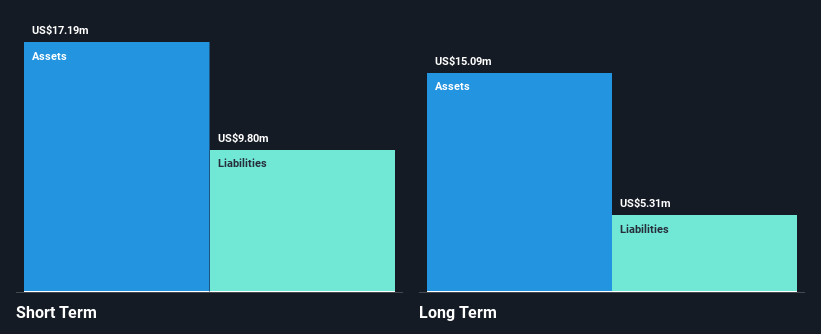

Corero Network Security, with a market cap of £75.54 million, has recently become profitable and is gaining traction in the cybersecurity space with its DDoS protection solutions. The company has no debt, ensuring financial stability while its short-term assets of $17 million exceed both short-term and long-term liabilities. Recent strategic partnerships, including agreements with Cooper University Health Care and TierPoint, highlight Corero's expansion into healthcare and cloud security markets. These collaborations showcase Corero's innovative CORE platform capabilities like Zero Trust Access Control (ZTAC) and Layer 7 DDoS protection, reinforcing its role in addressing evolving cyber threats globally.

- Click here and access our complete financial health analysis report to understand the dynamics of Corero Network Security.

- Learn about Corero Network Security's future growth trajectory here.

TPXimpact Holdings (AIM:TPX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPXimpact Holdings plc, with a market cap of £21.43 million, offers digital native technology services across the United Kingdom and several international markets including Norway, Switzerland, Germany, the United States, and Malaysia.

Operations: No specific revenue segments are reported for TPXimpact Holdings.

Market Cap: £21.43M

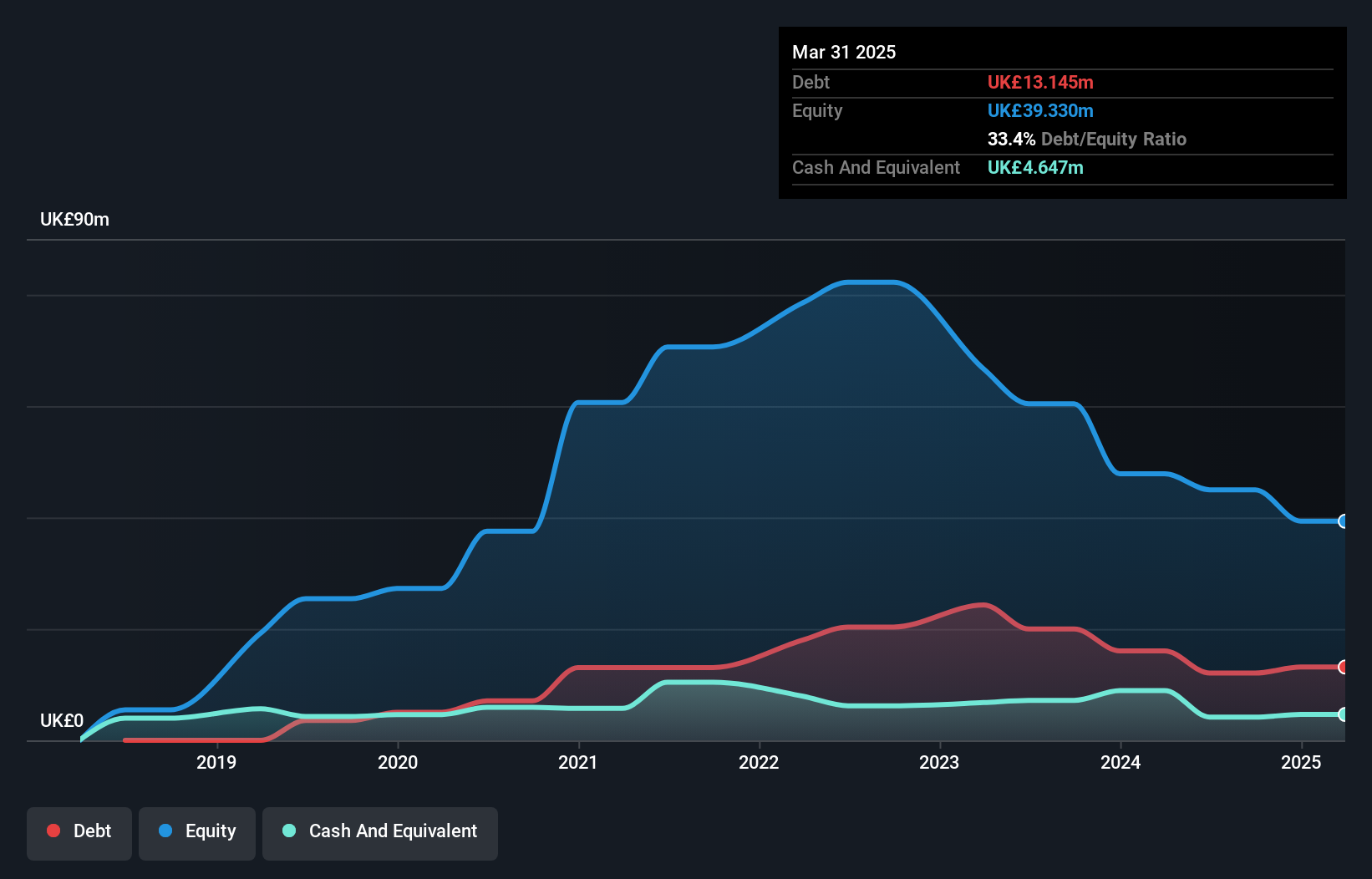

TPXimpact Holdings, with a market cap of £21.43 million, is navigating financial challenges despite its role in digital services across several markets. The company remains unprofitable with a net loss of £9.16 million for the fiscal year ending March 31, 2025; however, it has reduced losses from the previous year and maintains a positive cash runway exceeding three years due to growing free cash flow. Recent contract wins with UK government departments underscore its capability in public sector transformation projects. Despite high volatility and negative return on equity, analysts anticipate significant stock price growth potential.

- Click to explore a detailed breakdown of our findings in TPXimpact Holdings' financial health report.

- Explore TPXimpact Holdings' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Dive into all 296 of the UK Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ANP

Anpario

Engages in the manufacturer of natural sustainable feed additives for animal health, nutrition, and biosecurity.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives