- United States

- /

- Banks

- /

- NYSE:CFG

Discovering 3 Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

With the Dow Jones Industrial Average, S&P 500, and Nasdaq recently reaching new all-time highs following a cooler-than-expected inflation report, investors are keenly observing market dynamics as the Federal Reserve considers its next interest rate move. In such an environment, identifying stocks that may be priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.04 | $13.53 | 48% |

| TowneBank (TOWN) | $32.80 | $62.93 | 47.9% |

| SLM (SLM) | $26.73 | $53.09 | 49.6% |

| MoneyHero (MNY) | $1.31 | $2.53 | 48.3% |

| Hess Midstream (HESM) | $33.74 | $66.78 | 49.5% |

| GeneDx Holdings (WGS) | $125.07 | $248.76 | 49.7% |

| Flux Power Holdings (FLUX) | $6.61 | $13.19 | 49.9% |

| First Busey (BUSE) | $23.18 | $45.91 | 49.5% |

| Corpay (CPAY) | $284.45 | $546.77 | 48% |

| Compass (COMP) | $7.67 | $15.26 | 49.7% |

Let's uncover some gems from our specialized screener.

Brunswick (BC)

Overview: Brunswick Corporation designs, manufactures, and markets recreation products globally with a market cap of approximately $4.25 billion.

Operations: Brunswick's revenue segments include $5.68 billion from Propulsion, $2.21 billion from Parts & Accessories, and $1.76 billion from Boat sales.

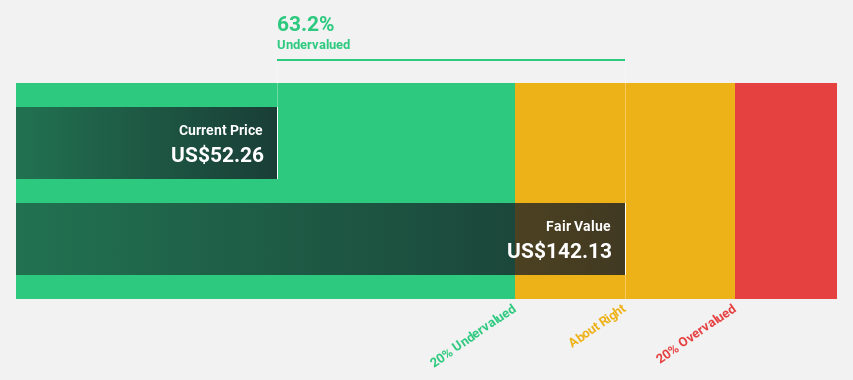

Estimated Discount To Fair Value: 40.8%

Brunswick Corporation is trading at US$70.63, significantly below its estimated fair value of US$119.27, making it an undervalued stock based on cash flows. Despite a challenging third quarter with a net loss of US$235.5 million, earnings are expected to grow 27.3% annually over the next three years, outpacing the broader U.S. market's growth rate of 15.5%. However, interest payments and dividends are not well covered by current earnings levels.

- Our expertly prepared growth report on Brunswick implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Brunswick's balance sheet by reading our health report here.

Citizens Financial Group (CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company offering retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States with a market cap of $21.84 billion.

Operations: The company generates revenue through its Consumer Banking segment, which accounts for $5.79 billion, and its Commercial Banking segment, contributing $2.43 billion.

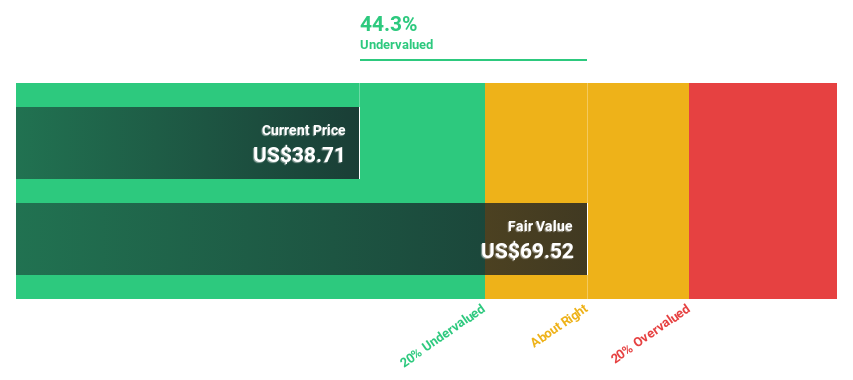

Estimated Discount To Fair Value: 37.6%

Citizens Financial Group is priced at US$50.96, notably below its estimated fair value of US$81.68, highlighting its undervaluation based on cash flows. The company reported third-quarter net income of US$494 million, up from US$382 million a year ago. Earnings are projected to grow 21.3% annually over the next three years, surpassing the U.S. market's growth rate of 15.5%, while maintaining a reliable dividend yield of 3.3%.

- Upon reviewing our latest growth report, Citizens Financial Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Citizens Financial Group stock in this financial health report.

KeyCorp (KEY)

Overview: KeyCorp is the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services in the United States, with a market cap of $19.44 billion.

Operations: KeyBank National Association generates revenue through its diverse portfolio of retail and commercial banking products and services across the United States.

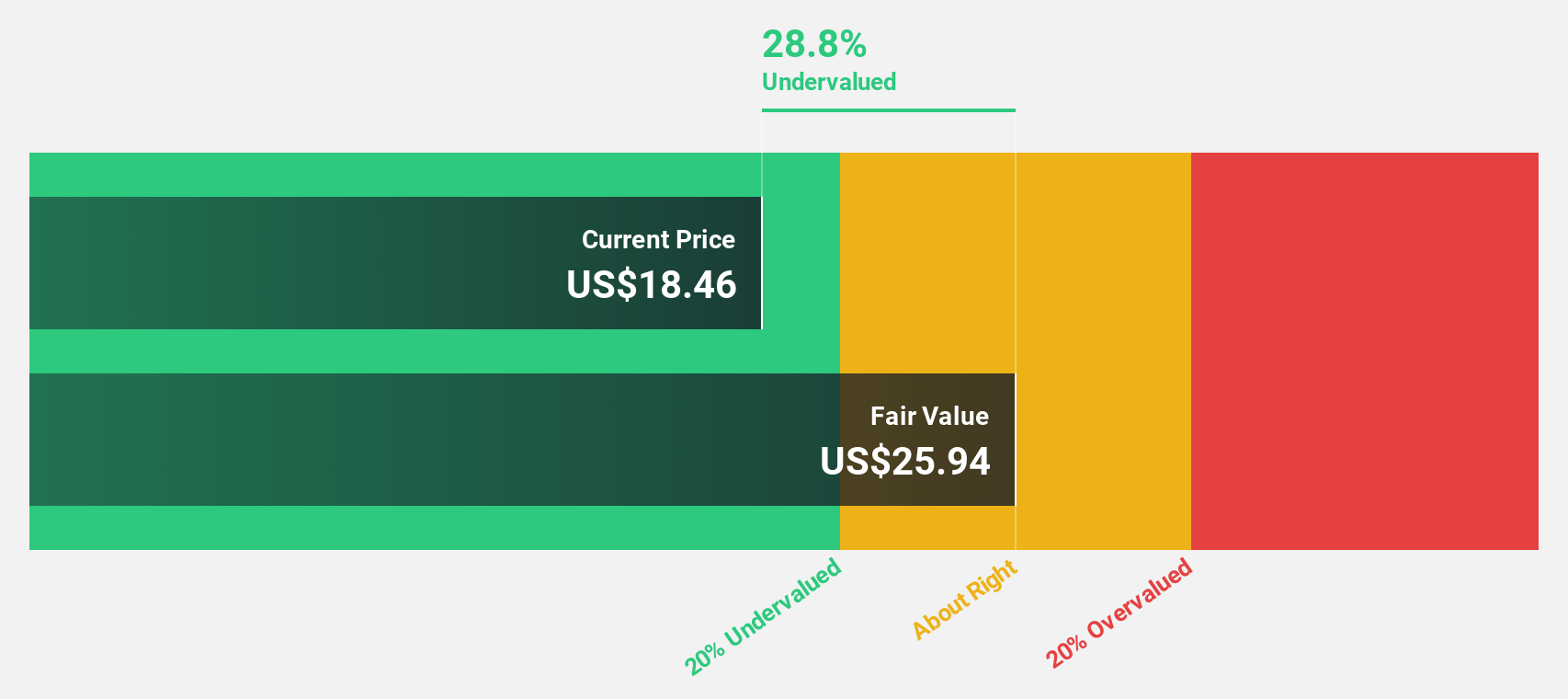

Estimated Discount To Fair Value: 45.8%

KeyCorp, trading at US$17.52, is significantly undervalued with an estimated fair value of US$32.32 based on discounted cash flows. Despite recent insider selling, earnings are forecast to grow 28.7% annually over the next three years, outpacing the U.S. market's growth rate of 15.5%. Recent third-quarter results showed net income of US$489 million compared to a loss last year, although the dividend remains under pressure due to coverage concerns.

- Our comprehensive growth report raises the possibility that KeyCorp is poised for substantial financial growth.

- Click here to discover the nuances of KeyCorp with our detailed financial health report.

Summing It All Up

- Discover the full array of 179 Undervalued US Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives