- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A141080

Discover 3 Global Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets continue to experience robust performance, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In this environment of strong economic indicators and cautious optimism, identifying stocks that are considered undervalued can offer potential growth prospects amidst broader market strength.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$30.25 | HK$59.90 | 49.5% |

| Taiyo Yuden (TSE:6976) | ¥2577.00 | ¥5119.90 | 49.7% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.15 | CN¥46.03 | 49.7% |

| Medley (TSE:4480) | ¥3320.00 | ¥6624.28 | 49.9% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.30 | €110.26 | 49.8% |

| JRCLtd (TSE:6224) | ¥1161.00 | ¥2302.88 | 49.6% |

| Jiangxi Rimag Group (SEHK:2522) | HK$13.62 | HK$27.23 | 50% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.94 | 49.6% |

| ATEME (ENXTPA:ATEME) | €5.20 | €10.34 | 49.7% |

| Astroscale Holdings (TSE:186A) | ¥672.00 | ¥1343.25 | 50% |

Below we spotlight a couple of our favorites from our exclusive screener.

LigaChem Biosciences (KOSDAQ:A141080)

Overview: LigaChem Biosciences Inc. is a clinical stage biopharmaceutical company focused on discovering and developing medicines for unmet medical needs, with a market cap of approximately ₩4.40 trillion.

Operations: The company generates revenue from its Pharmaceutical Business segment, amounting to ₩20.86 billion, and New Drug Research and Development segment, totaling ₩125.56 billion.

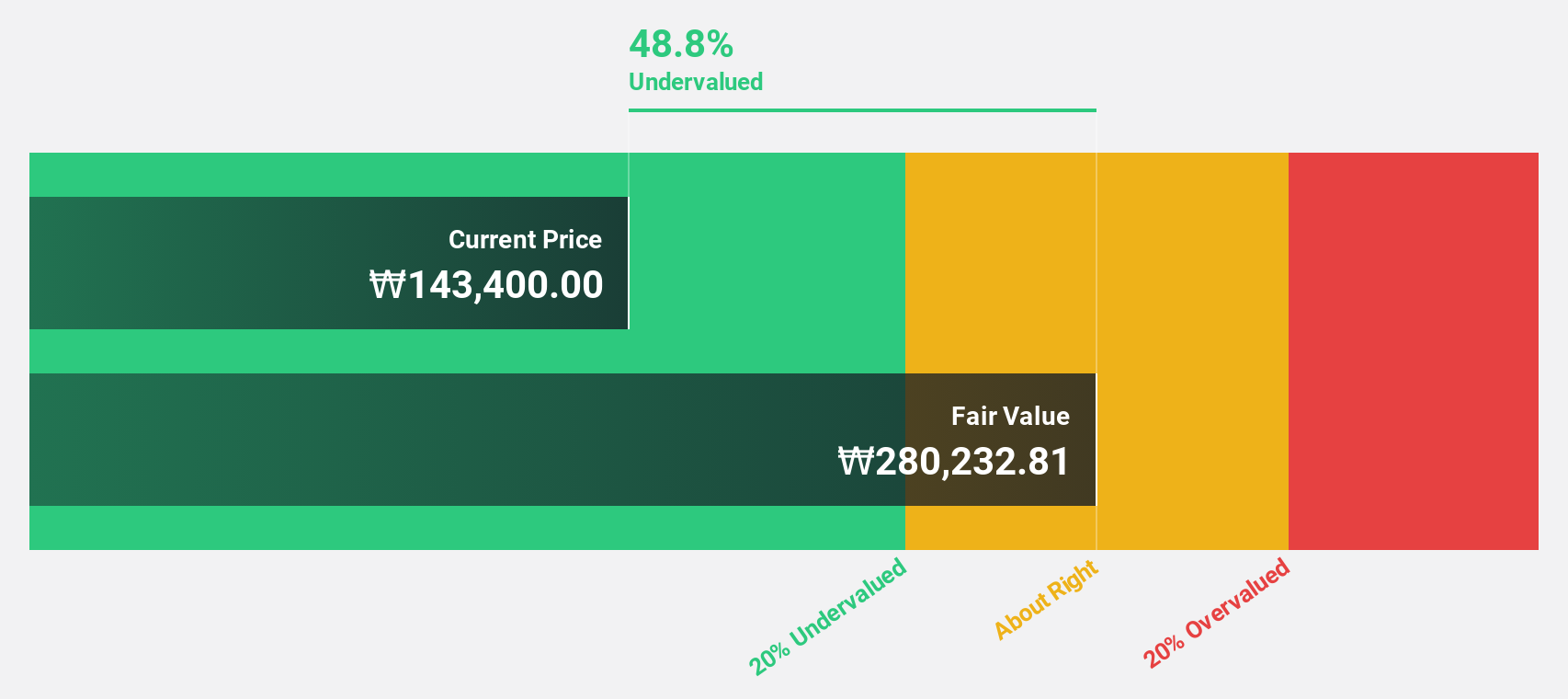

Estimated Discount To Fair Value: 49.1%

LigaChem Biosciences appears undervalued, trading 49.1% below its estimated fair value of ₩278,636.18. Despite a drop in sales to KRW 0.00016 million in Q1 2025, net income rose significantly to KRW 26,472.89 million due to large one-off items. Earnings are forecasted to grow at a robust rate of over 50% annually for the next three years, outpacing the Korean market's average growth rate and indicating strong cash flow potential despite low return on equity forecasts.

- In light of our recent growth report, it seems possible that LigaChem Biosciences' financial performance will exceed current levels.

- Dive into the specifics of LigaChem Biosciences here with our thorough financial health report.

China Southern Power Grid TechnologyLtd (SHSE:688248)

Overview: China Southern Power Grid Technology Co., Ltd. (SHSE:688248) operates in the energy sector, focusing on power grid technology solutions, with a market cap of CN¥18.96 billion.

Operations: I'm sorry, but the revenue segment information for China Southern Power Grid Technology Co., Ltd. is missing from the provided text. If you can provide that data, I would be happy to help summarize it for you.

Estimated Discount To Fair Value: 21.3%

China Southern Power Grid Technology Ltd. is trading at CN¥33.99, 21.3% below its estimated fair value of CN¥43.17, highlighting potential undervaluation based on discounted cash flows. The company's earnings grew by 29.8% last year and are expected to continue growing significantly at 29.72% annually, surpassing the Chinese market's average growth rate of 23.4%. Despite a low forecasted return on equity of 17.8%, revenue growth remains robust and above market expectations at 28.8% per year.

- Insights from our recent growth report point to a promising forecast for China Southern Power Grid TechnologyLtd's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of China Southern Power Grid TechnologyLtd.

Accton Technology (TWSE:2345)

Overview: Accton Technology Corporation is engaged in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and other international markets with a market cap of NT$444.89 billion.

Operations: The company's revenue from its computer networks segment is NT$134.33 billion.

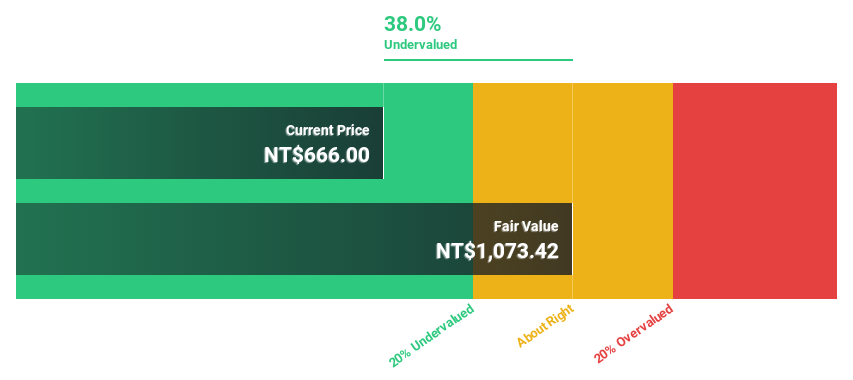

Estimated Discount To Fair Value: 49.2%

Accton Technology is trading at NT$813, significantly below its estimated fair value of NT$1600.07, indicating potential undervaluation based on discounted cash flows. The company's earnings grew by 63.1% over the past year and are forecasted to grow significantly at 23.3% annually, outpacing the Taiwanese market's average growth rate of 13.9%. Recent business expansions in Vietnam with a projected investment of US$94.03 million could further enhance future cash flow prospects.

- The growth report we've compiled suggests that Accton Technology's future prospects could be on the up.

- Take a closer look at Accton Technology's balance sheet health here in our report.

Make It Happen

- Discover the full array of 479 Undervalued Global Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A141080

LigaChem Biosciences

A clinical stage biopharmaceutical company, engages in the discovery and development of medicines for unmet medical needs.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives