- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (CTAS) Reports US$10 Billion Revenue, Confirms Guidance, Completes Buyback

Reviewed by Simply Wall St

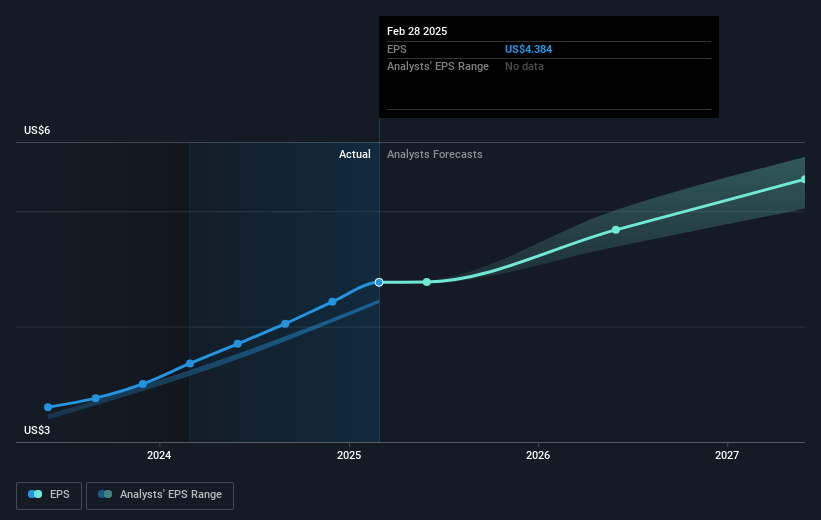

Cintas (CTAS) has recently provided updated earnings guidance for fiscal year 2026, with revenue expected between $11 billion and $11.15 billion and diluted EPS forecasted at $4.71 to $4.85. Over the last quarter, Cintas's stock price moved 4%, a shift that was aligned with broader market trends, as major indexes like the S&P 500 and Nasdaq reached record highs. The company's strong earnings results for Q4 2025, with revenue and net income seeing year-over-year increases, likely supported this upward momentum. Share buyback activities further reinforced investor confidence, despite the overall market facing some tariff concerns recently.

We've discovered 1 risk for Cintas that you should be aware of before investing here.

The recent earnings guidance update from Cintas, projecting fiscal 2026 revenue between $11 billion and $11.15 billion, and diluted EPS at $4.71 to $4.85, aligns with ongoing operational enhancements and technology investments highlighted in the narrative. This outlook supports analysts' assumptions of continued growth, influenced by initiatives such as SAP and SmartTruck investments which aim to improve efficiency and margins. However, barriers like tariffs and foreign exchange fluctuations may affect growth and profitability projections.

Over the past five years, Cintas's total shareholder return, including share price and dividends, surged 211.60%, showcasing the company's resilience and strong market presence. In comparison, recent performance exceeded the US Commercial Services industry, which returned 5.7% over the past year, emphasizing Cintas's capacity to outperform its sector peers in the short term.

The alignment of the current share price at US$214.02 with the consensus analyst price target of US$215.63 suggests a minor discount of approximately 0.75%. This indicates analysts' consensus that Cintas is fairly valued, reflecting expected earnings growth and market conditions. The company's robust financial metrics, despite challenges, continue to bolster investor confidence, supporting forecasted revenue and earnings trajectories in line with the company's strategic initiatives.

Explore historical data to track Cintas' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives