- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (BX) Reports Strong Q2 Financials with US$3,712 Million Revenue and US$764 Million Net Income

Reviewed by Simply Wall St

Blackstone (BX) recently announced its strong second-quarter and six-month 2025 earnings, showing a significant rise in revenue and net income compared to the previous year. This robust financial performance likely supported the company's 28% price increase over the last quarter. Other relevant events, such as its $25 billion investment in Pennsylvania's infrastructure and various merger and acquisition discussions, may have added further weight to this move. The market has generally been rising, with a 1.7% increase over the past week and 18% over the past year, aligning moderately with Blackstone's upward trajectory.

The recent developments at Blackstone, including their strong second-quarter earnings and substantial infrastructure investments, align with a narrative indicating potential for future growth yet hint at challenges. Although Blackstone demonstrates expansion in revenue channels, such rapid growth could strain operations, potentially impacting future earnings. Over the past five years, Blackstone delivered a substantial total return of 271.13%, showing consistent long-term growth.

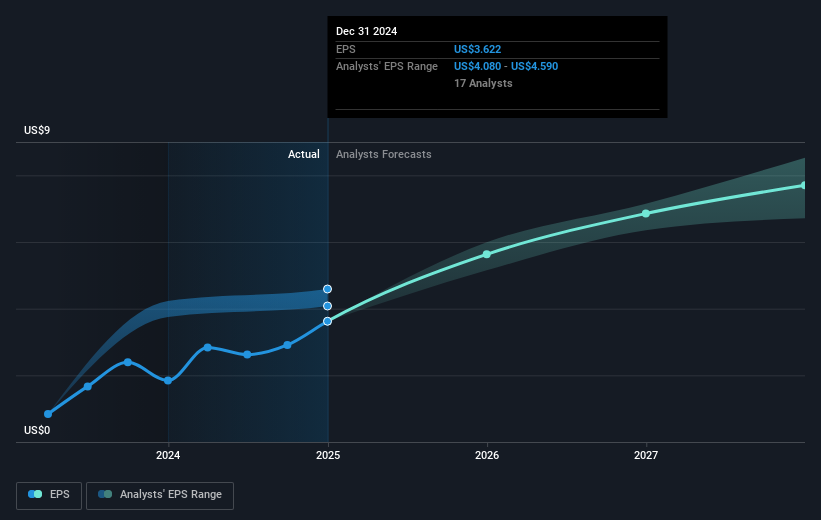

Comparatively, Blackstone's recent 28% share price increase over the last quarter reflects positively in the short-term, but the current price of $171.96 stands higher than the consensus price target of $160.60. This suggests market optimism might surpass analyst expectations. Examining the company's performance relative to the broader market over the past year, Blackstone slightly lagged behind the US Capital Markets industry which saw a higher return.

The recent positive financial performance could potentially elevate Blackstone's revenue and earnings forecasts. However, if operational inefficiencies emerge, as suggested in the narrative, they may counterbalance current momentum. This results in a careful market evaluation regarding the balance between short-term gains and long-term potential. The significant deviation between current share price and price target further underscores the necessity for investors to closely assess analyst forecasts in alignment with their expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives