- United States

- /

- Beverage

- /

- NYSE:ZVIA

Beam Global Leads The Charge With 3 Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations with major indices like the S&P 500 retreating from record highs, investors are keenly observing potential opportunities amid strong corporate earnings and economic data. Penny stocks, often associated with smaller or newer companies, present a unique investment avenue that remains relevant despite their somewhat outdated label. By focusing on those with robust financial health, these stocks can offer a compelling chance for growth at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.70 | $524.41M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.46 | $249.3M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9714 | $159.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.37 | $234.25M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $100.29M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.13 | $414.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.83 | $6.01M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.68 | $99.74M | ✅ 3 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.96 | $43.75M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 417 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Beam Global (BEEM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beam Global is a clean-technology innovation company that designs, develops, engineers, manufactures, and sells renewably energized infrastructure products and battery solutions in the United States and Romania with a market cap of $31.62 million.

Operations: Beam Global generates revenue from its Solar Products and Proprietary Technology Solutions segment, which amounted to $41.10 million.

Market Cap: $31.62M

Beam Global, a clean-technology company, has faced challenges with declining sales and increased net losses in recent quarters. Despite these setbacks, the company is actively pursuing growth through strategic alliances, such as its joint venture with Platinum Group LLC to expand into the Middle East and Africa. This partnership aims to leverage regional relationships for market penetration. Beam Global's financial position shows short-term assets exceeding liabilities and a cash runway of over a year based on current free cash flow. However, high volatility and unprofitability remain concerns for investors considering this penny stock opportunity.

- Navigate through the intricacies of Beam Global with our comprehensive balance sheet health report here.

- Gain insights into Beam Global's future direction by reviewing our growth report.

Hyperfine (HYPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hyperfine, Inc. is a health technology company focused on producing, supplying, servicing, and commercializing MRI products with a market cap of $62.27 million.

Operations: The company generates revenue from its Medical Imaging Systems segment, totaling $11.73 million.

Market Cap: $62.27M

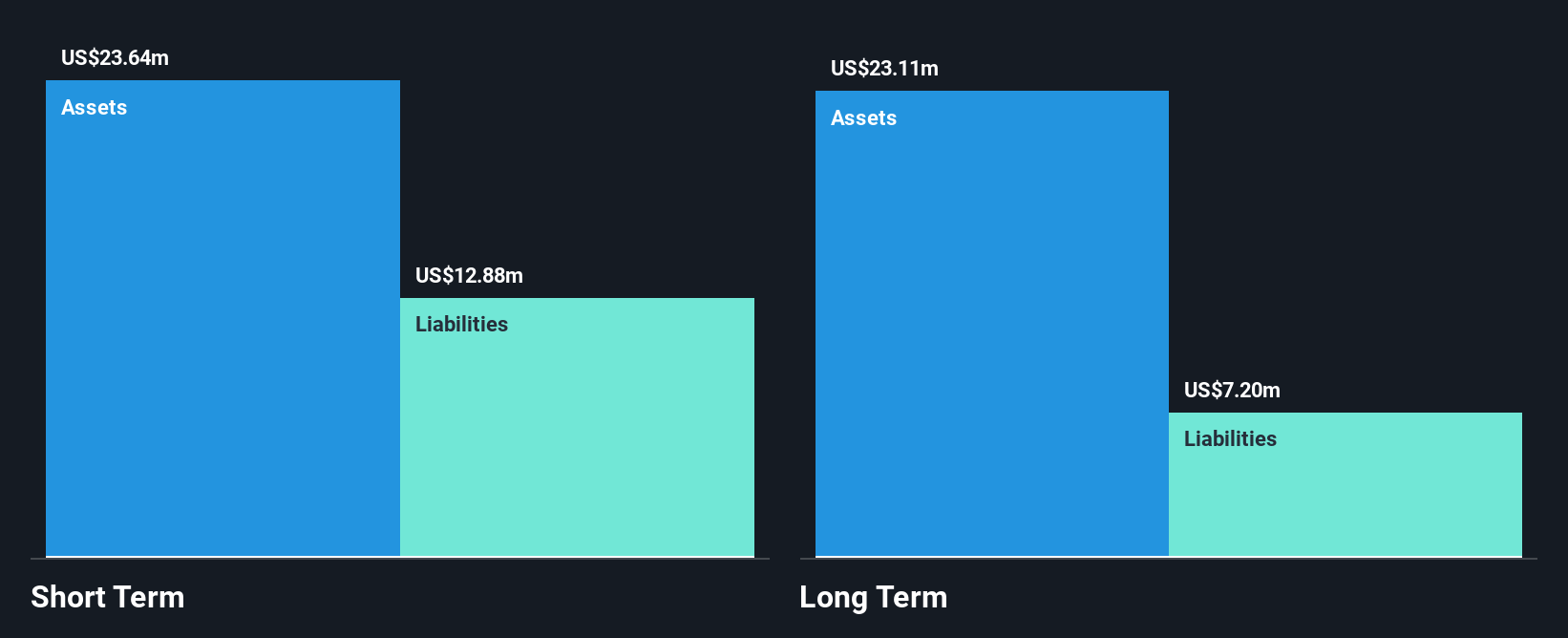

Hyperfine, Inc. is navigating the penny stock landscape with a focus on its next-generation Swoop® MRI system, recently achieving FDA clearance and commercial sales to top-tier hospitals. Despite generating US$11.73 million in revenue from its Medical Imaging Systems segment, the company remains unprofitable with a market cap of US$62.27 million and less than a year of cash runway. Hyperfine's financial stability is bolstered by short-term assets exceeding liabilities and being debt-free, yet challenges persist with high share price volatility and potential Nasdaq delisting due to non-compliance with minimum bid price requirements.

- Click here and access our complete financial health analysis report to understand the dynamics of Hyperfine.

- Gain insights into Hyperfine's outlook and expected performance with our report on the company's earnings estimates.

Zevia PBC (ZVIA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zevia PBC develops, markets, sells, and distributes zero sugar beverages in the United States and Canada with a market cap of $221.16 million.

Operations: The company's revenue is primarily generated from its non-alcoholic beverages segment, totaling $154.27 million.

Market Cap: $221.16M

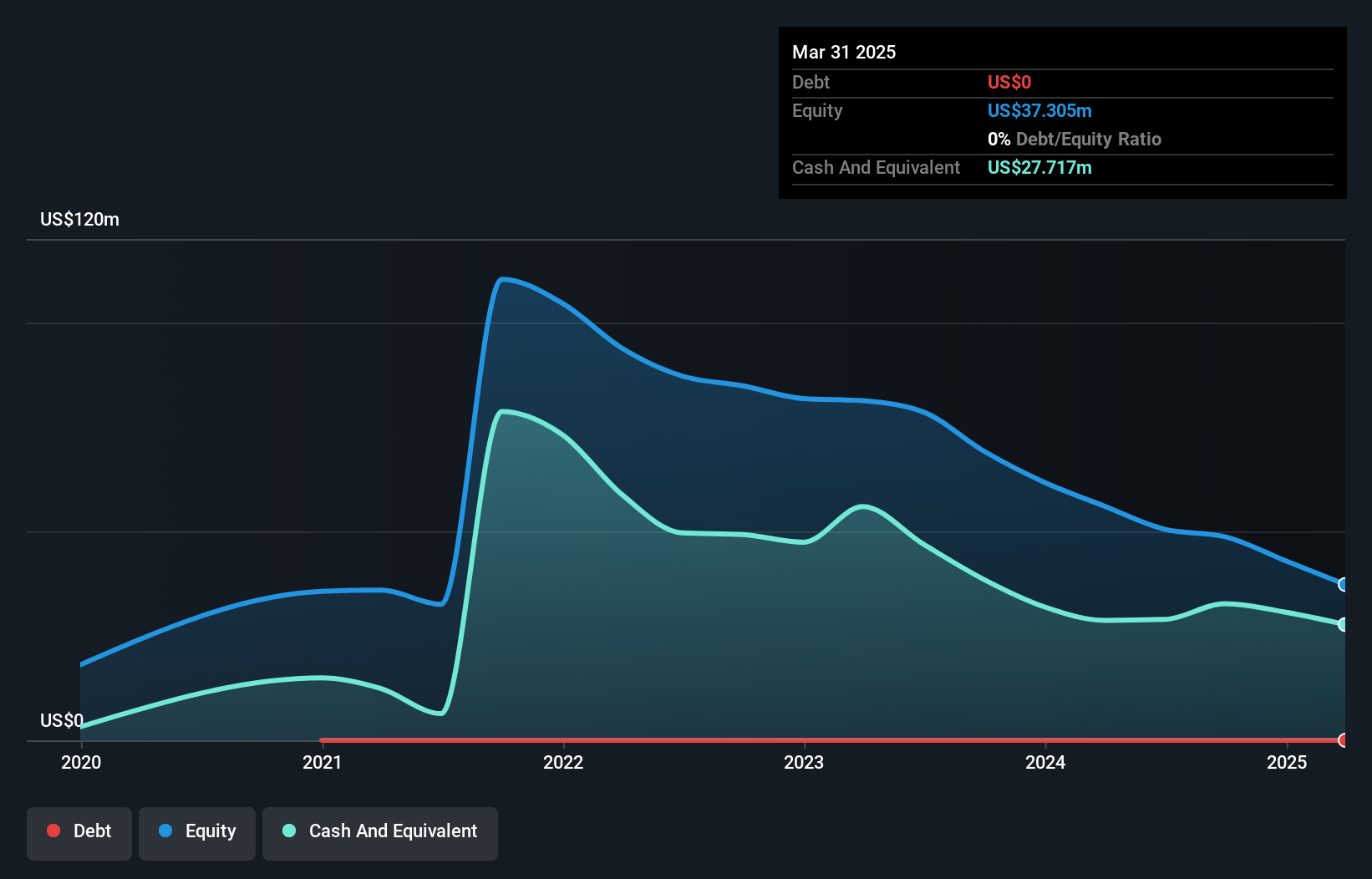

Zevia PBC, with a market cap of US$221.16 million, is navigating the penny stock arena by focusing on zero sugar beverages, generating US$154.27 million in revenue primarily from this segment. The company remains unprofitable with increasing losses over five years and no forecasted profitability in the near term. Despite a seasoned board and being debt-free for five years, challenges include significant insider selling and high share price volatility. Recent inclusion in multiple Russell Growth Indexes may enhance visibility among investors while maintaining a stable cash runway exceeding three years provides some financial stability amidst ongoing operational challenges.

- Unlock comprehensive insights into our analysis of Zevia PBC stock in this financial health report.

- Review our growth performance report to gain insights into Zevia PBC's future.

Taking Advantage

- Gain an insight into the universe of 417 US Penny Stocks by clicking here.

- Seeking Other Investments? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevia PBC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZVIA

Zevia PBC

Develops, markets, sells, and distributes zero sugar beverages in the United States and Canada.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives