- United States

- /

- Banks

- /

- NYSE:BAC

Bank of America (BAC) Scheduled to Redeem US$2 Billion Senior Notes Ahead of 2026

Reviewed by Simply Wall St

Bank of America (BAC) saw its stock price rise by 24% over the last quarter, a period marked by notable financial maneuvers, including the redemption of $2 billion in senior notes. This strategic debt management may have influenced its market performance, although broader market trends also played a key role. The recent addition of Bank of America to various Russell growth benchmarks and its dividend increases further underpin investor confidence. However, while the company's actions spotlight its financial agility, the overall market context and ongoing investor sentiment towards financial stocks likely added depth to the share price movement.

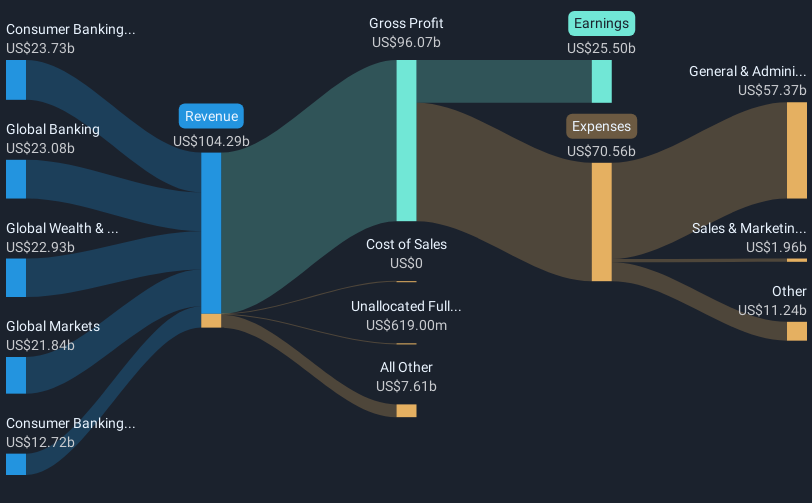

The recent financial maneuvers by Bank of America, including debt redemption and inclusion in growth benchmarks, underscore the company's efforts to enhance its market standing and potentially improve its financial metrics. While the short-term share price rose by 24% over the last quarter, the company's long-term performance paints a broader picture: over the past five years, Bank of America's total return, encompassing both share price and dividends, was 125.79%. Over the past year, however, BAC's performance aligned with the broader US market, albeit not keeping up with the 24.9% return achieved by the US Banks industry.

The news and corporate actions might positively impact Bank of America's revenue and earnings forecasts, particularly by supporting increased net interest income through effective interest rate management. Investments in digital engagement and AI could also bolster customer retention, potentially driving revenue growth. Currently trading at US$47.07, BAC is approximately 11.2% below its consensus price target of US$52.35, suggesting that the market might still perceive upside potential in the stock based on these forecast gains. However, continued monitoring of economic conditions and policy changes will be crucial as they could impact the expected financial outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAC

Bank of America

Through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives