- Australia

- /

- Trade Distributors

- /

- ASX:EHL

ASX Penny Stock Gems With Market Caps Under A$500M

Reviewed by Simply Wall St

With the Reserve Bank of Australia keeping rates steady amidst a backdrop of sectoral fluctuations and market uncertainty, investors are keenly watching for opportunities that may arise. Penny stocks, though often seen as an outdated term, continue to offer intriguing possibilities by representing smaller or newer companies with potential for growth. These stocks can present a unique blend of affordability and opportunity when backed by strong fundamentals and financial health.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.43 | A$114.63M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.93 | A$451.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.70 | A$449.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.73 | A$847.84M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.485 | A$892.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.99 | A$189.33M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.79 | A$144.17M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 468 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Emeco Holdings (ASX:EHL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emeco Holdings Limited operates in Australia, offering surface and underground mining equipment rental, complementary equipment, and mining services with a market cap of A$434.74 million.

Operations: Emeco Holdings generates revenue from its Rental segment, which contributes A$579.43 million, and its Workshops segment, which adds A$292.97 million.

Market Cap: A$434.74M

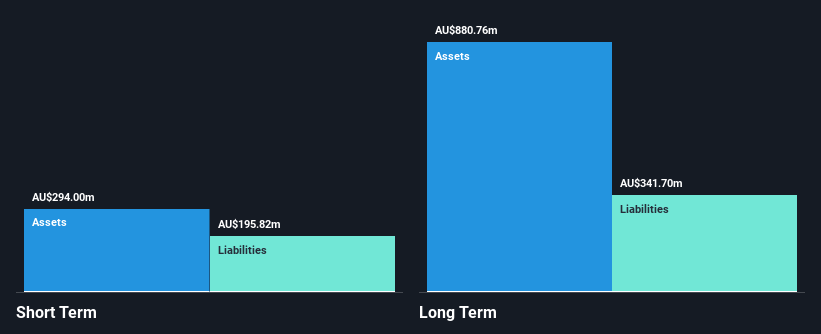

Emeco Holdings, with a market cap of A$434.74 million, shows potential within the penny stock space due to its strong financial management and growth prospects. The company's debt is well-covered by operating cash flow at 84.3%, and it has reduced its debt-to-equity ratio significantly over five years. Emeco trades at a substantial discount to fair value estimates and analysts anticipate further price appreciation. However, short-term assets fall short of covering long-term liabilities, and return on equity remains low at 9.9%. Recent conference presentations highlight ongoing engagement with investors and industry stakeholders.

- Click here and access our complete financial health analysis report to understand the dynamics of Emeco Holdings.

- Evaluate Emeco Holdings' prospects by accessing our earnings growth report.

Fleetwood (ASX:FWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fleetwood Limited, with a market cap of A$241.92 million, operates in Australia and New Zealand by designing, manufacturing, selling, and installing modular accommodation and buildings.

Operations: The company's revenue is primarily derived from Building Solutions at A$340.12 million, followed by RV Solutions at A$71.51 million and Community Solutions at A$50.02 million.

Market Cap: A$241.92M

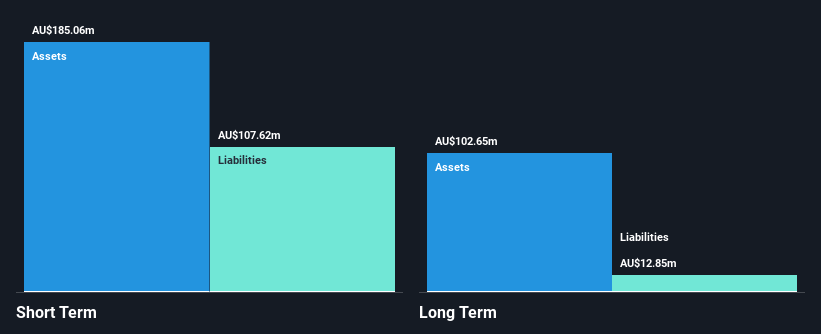

Fleetwood Limited, with a market cap of A$241.92 million, presents a mixed picture in the penny stock landscape. The company is trading significantly below its estimated fair value, which could indicate potential upside for investors. Fleetwood's financial health is solid with short-term assets exceeding both short and long-term liabilities, and it operates without debt. However, its recent earnings have been negatively impacted by a large one-off loss of A$6 million and declining profit margins from 1.6% to 1%. The company's dividend yield of 8.78% is not well-covered by earnings, raising sustainability concerns despite positive revenue forecasts.

- Click here to discover the nuances of Fleetwood with our detailed analytical financial health report.

- Gain insights into Fleetwood's future direction by reviewing our growth report.

Horizon Oil (ASX:HZN)

Simply Wall St Financial Health Rating: ★★★★★☆

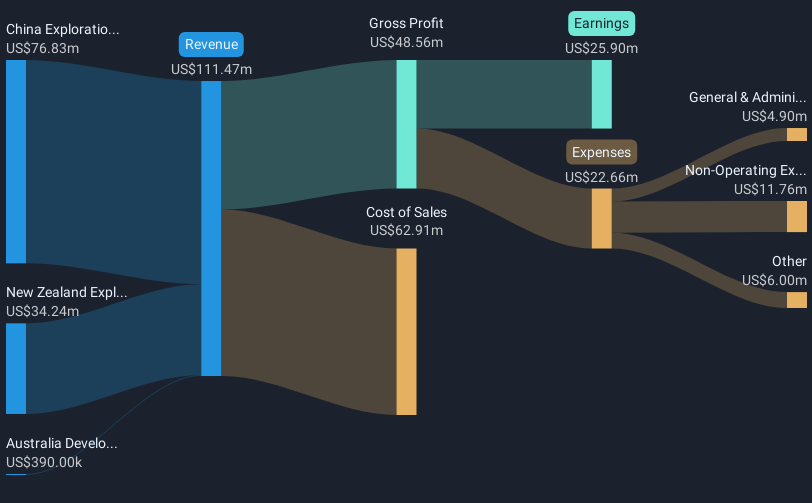

Overview: Horizon Oil Limited, along with its subsidiaries, is involved in the exploration, development, and production of oil and gas properties in China, New Zealand, and Australia with a market capitalization of A$325.06 million.

Operations: The company generates revenue primarily from its exploration and development activities, with $60.53 million from China and $34.26 million from New Zealand.

Market Cap: A$325.06M

Horizon Oil, with a market cap of A$325.06 million, offers an intriguing yet cautious opportunity in the penny stock arena. The company is trading at a discount to its estimated fair value, suggesting potential value for investors. Its financial stability is underscored by short-term assets exceeding short-term liabilities and operating cash flow covering debt well; however, long-term liabilities remain uncovered by current assets. Despite high-quality earnings and reduced debt levels over time, recent profit margins have declined significantly from 30.3% to 14.1%. Additionally, Horizon's dividend yield of 13.67% raises questions about sustainability given its coverage issues.

- Get an in-depth perspective on Horizon Oil's performance by reading our balance sheet health report here.

- Assess Horizon Oil's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 468 ASX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emeco Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EHL

Emeco Holdings

Provides surface and underground mining equipment rental, complementary equipment, and mining services in Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives